Answered step by step

Verified Expert Solution

Question

1 Approved Answer

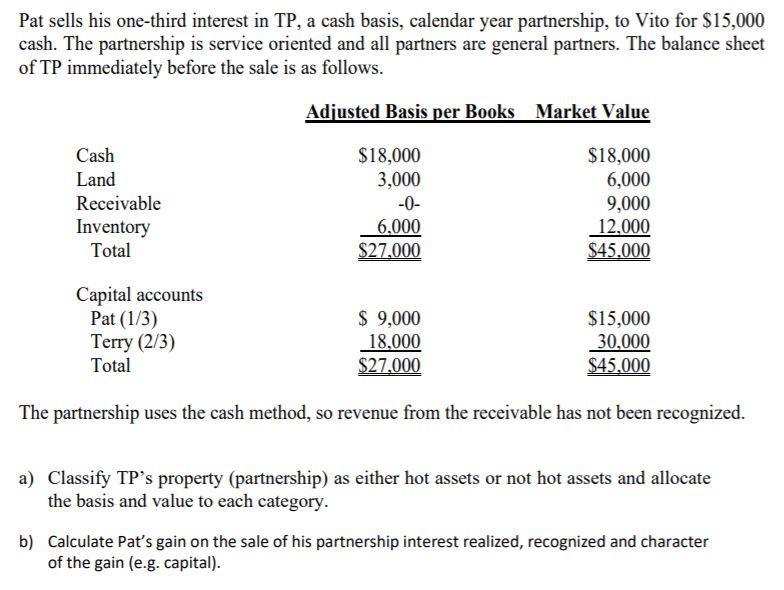

Pat sells his one-third interest in TP, a cash basis, calendar year partnership, to Vito for $15,000 cash. The partnership is service oriented and

Pat sells his one-third interest in TP, a cash basis, calendar year partnership, to Vito for $15,000 cash. The partnership is service oriented and all partners are general partners. The balance sheet of TP immediately before the sale is as follows. Adjusted Basis per Books Market Value $18,000 3,000 -0- $18,000 6,000 9,000 12.000 $45.000 Cash Land Receivable Inventory Total 6.000 $27.000 Capital accounts Pat (1/3) Terry (2/3) Total $ 9,000 18.000 $27,000 $15,000 30.000 $45.000 The partnership uses the cash method, so revenue from the receivable has not been recognized. a) Classify TP's property (partnership) as either hot assets or not hot assets and allocate the basis and value to each category. b) Calculate Pat's gain on the sale of his partnership interest realized, recognized and character of the gain (e.g. capital).

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Definition of Hot Assets Hot Assets are those assets that give rise to ordinary gain or loss in the event of sale of an interest in partnership Duri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started