Answered step by step

Verified Expert Solution

Question

1 Approved Answer

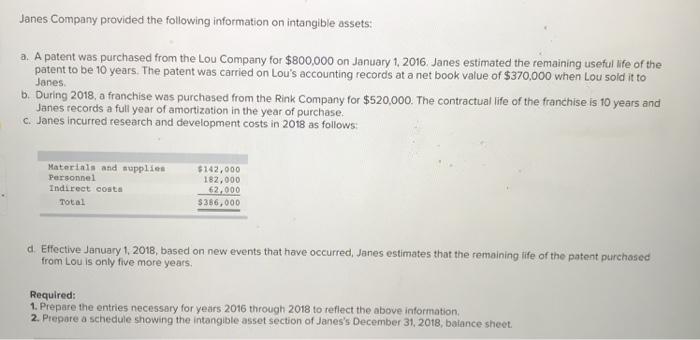

Janes Company provided the following information on intangible assets: a. A patent was purchased from the Lou Company for $800,000 on January 1, 2016.

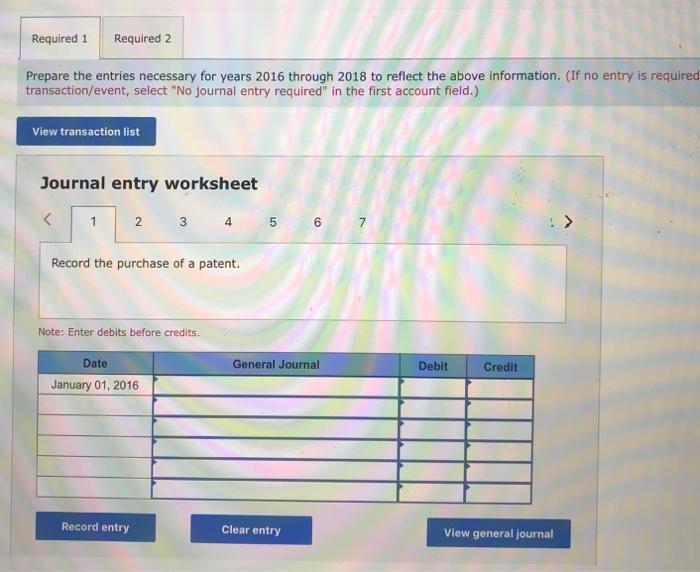

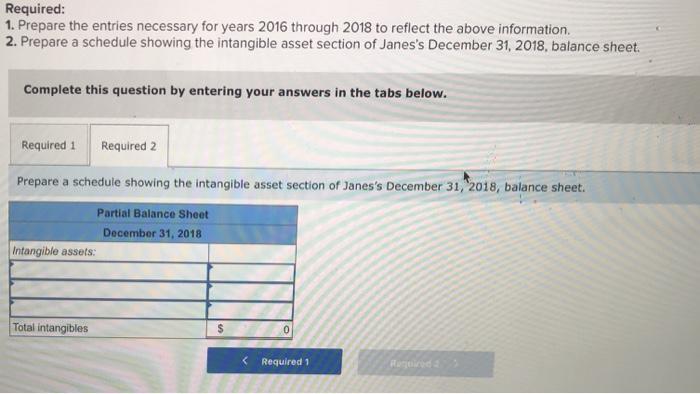

Janes Company provided the following information on intangible assets: a. A patent was purchased from the Lou Company for $800,000 on January 1, 2016. Janes estimated the remaining useful life of the patent to be 10 years. The patent was carried on Lou's accounting records at a net book value of $370,000 when Lou soid it to Janes. b. During 2018, a franchise was purchased from the Rink Company for $520,000. The contractual life of the franchise is 10 years and Janes records a full year of amortization in the year of purchase. c. Janes incurred research and development costs in 2018 as follows: Materials and supplies Personnel Indirect costa $142,000 182,000 62,000 $386,000 Total d. Effective January 1, 2018, based on new events that have occurred, Janes estimates that the remaining ife of the patent purchased from Lou is only five more years. Required: 1. Prepare the entries necessary for years 2016 through 2018 to reflect the above information, 2. Prepare a schedule showing the intangible asset section of Janes's December 31, 2018, balance sheet. Required 1 Required 2 Prepare the entries necessary for years 2016 through 2018 to reflect the above information. (If no entry is required transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 4 5 6 7 Record the purchase of a patent. Note: Enter debits before credits. Date General Journal Debit Credit January 01, 2016 Record entry Clear entry View general journal Required: 1. Prepare the entries necessary for years 2016 through 2018 to reflect the above information. 2. Prepare a schedule showing the intangible asset section of Janes's December 31, 2018, balance sheet. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule showing the intangible asset section of Janes's December 31, 2018, balance sheet. Partial Balance Sheet December 31, 2018 Intangible assets: Total intangibles < Required 1 Ranired

Step by Step Solution

★★★★★

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Journal Entry S No Date Particulars Dr Amt Cr Amt a 1Jan16 Patent 80000000 Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started