Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Patricia was evaluating the profitability of her bike shop, which sells bicycles, skateboards, and frisbee golf items. Since the frisbee golf segment was new,

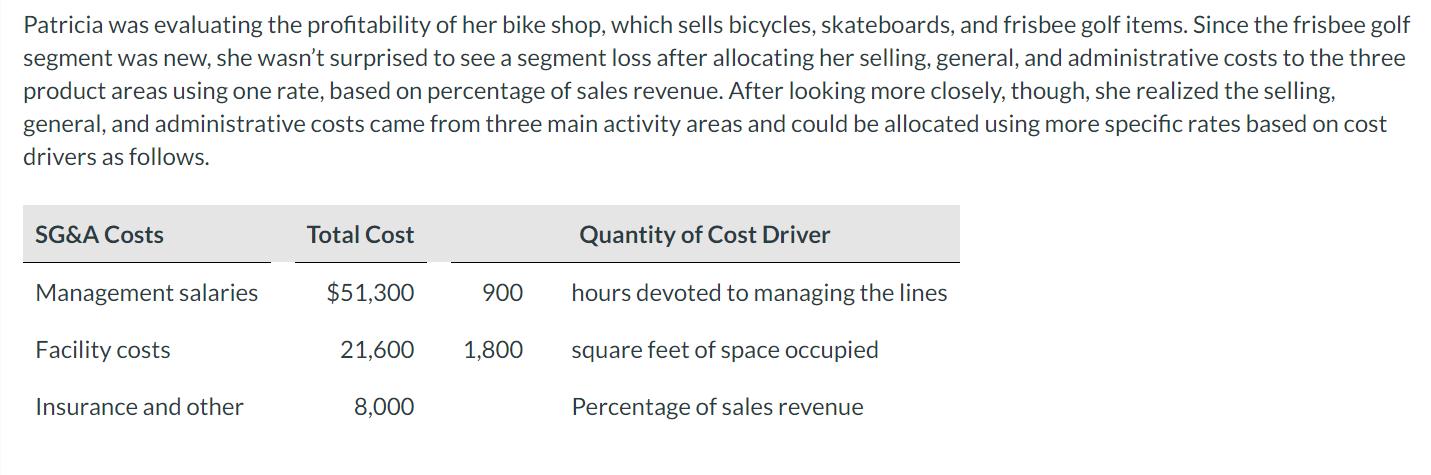

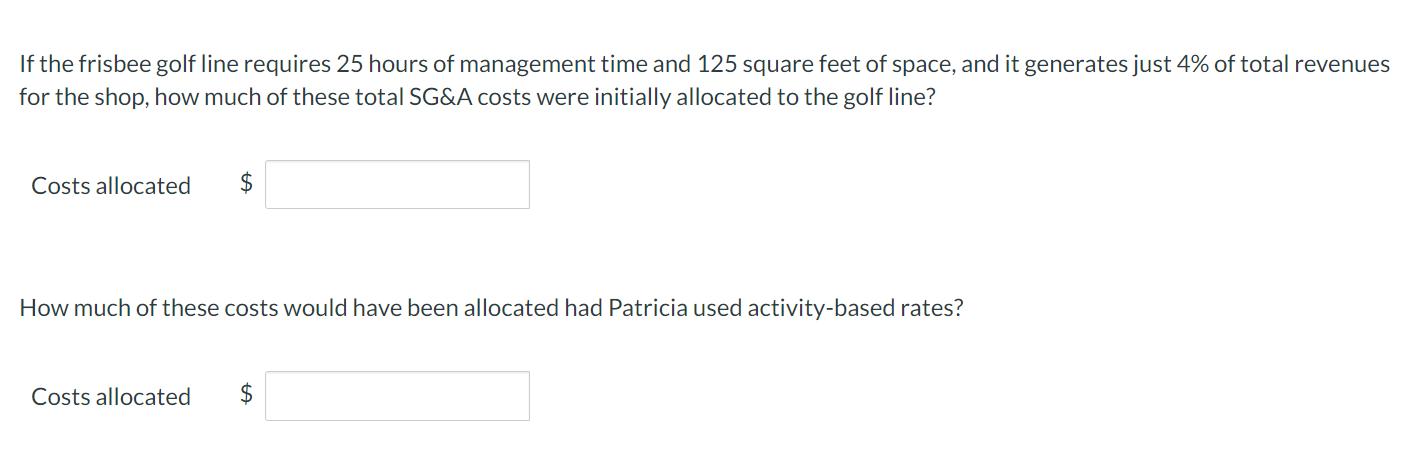

Patricia was evaluating the profitability of her bike shop, which sells bicycles, skateboards, and frisbee golf items. Since the frisbee golf segment was new, she wasn't surprised to see a segment loss after allocating her selling, general, and administrative costs to the three product areas using one rate, based on percentage of sales revenue. After looking more closely, though, she realized the selling, general, and administrative costs came from three main activity areas and could be allocated using more specific rates based on cost drivers as follows. SG&A Costs Management salaries Facility costs Insurance and other Total Cost $51,300 21,600 8,000 900 1,800 Quantity of Cost Driver hours devoted to managing the lines square feet of space occupied Percentage of sales revenue If the frisbee golf line requires 25 hours of management time and 125 square feet of space, and it generates just 4% of total revenues for the shop, how much of these total SG&A costs were initially allocated to the golf line? Costs allocated $ How much of these costs would have been allocated had Patricia used activity-based rates? Costs allocated LA $

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the SGA costs initially allocated to the frisbee golf line using activitybased rates we...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started