Answered step by step

Verified Expert Solution

Question

1 Approved Answer

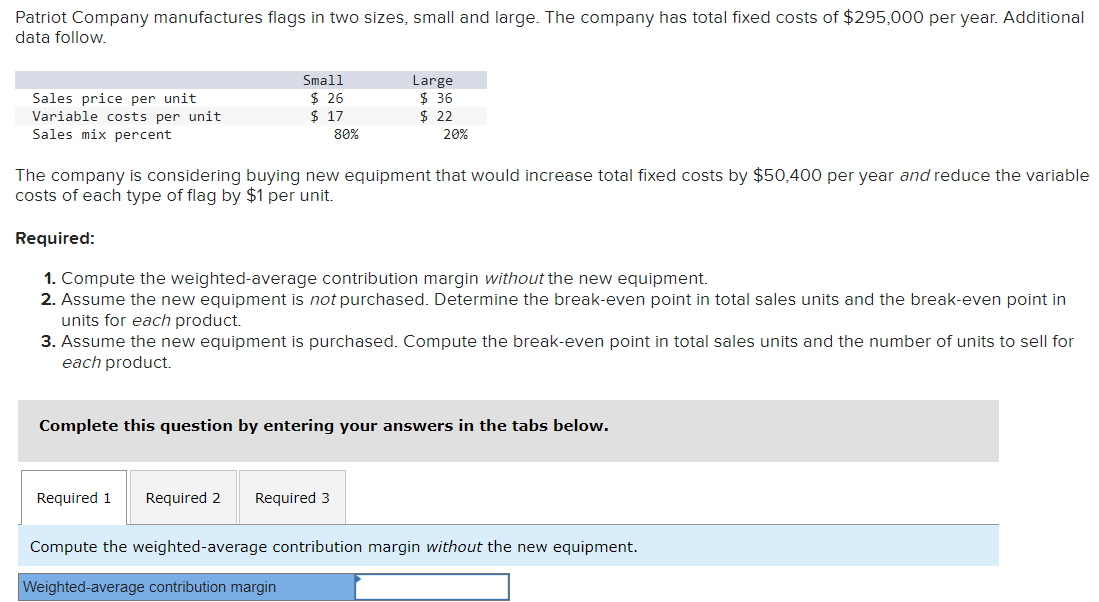

Patriot Company manufactures flags in two sizes, small and large. The company has total fixed costs of $295,000 per year. Additional data follow. Sales

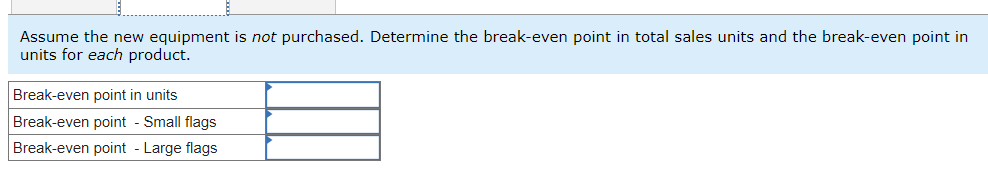

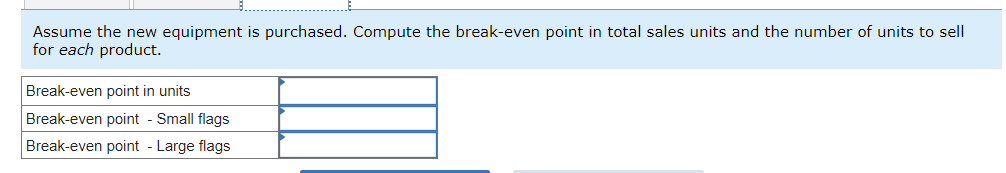

Patriot Company manufactures flags in two sizes, small and large. The company has total fixed costs of $295,000 per year. Additional data follow. Sales price per unit Small $ 26 Large $ 36 Variable costs per unit $ 17 $ 22 Sales mix percent 80% 20% The company is considering buying new equipment that would increase total fixed costs by $50,400 per year and reduce the variable costs of each type of flag by $1 per unit. Required: 1. Compute the weighted-average contribution margin without the new equipment. 2. Assume the new equipment is not purchased. Determine the break-even point in total sales units and the break-even point in units for each product. 3. Assume the new equipment is purchased. Compute the break-even point in total sales units and the number of units to sell for each product. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the weighted-average contribution margin without the new equipment. Weighted-average contribution margin Assume the new equipment is not purchased. Determine the break-even point in total sales units and the break-even point in units for each product. Break-even point in units Break-even point - Small flags Break-even point - Large flags Assume the new equipment is purchased. Compute the break-even point in total sales units and the number of units to sell for each product. Break-even point in units Break-even point - Small flags Break-even point - Large flags

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started