Answered step by step

Verified Expert Solution

Question

1 Approved Answer

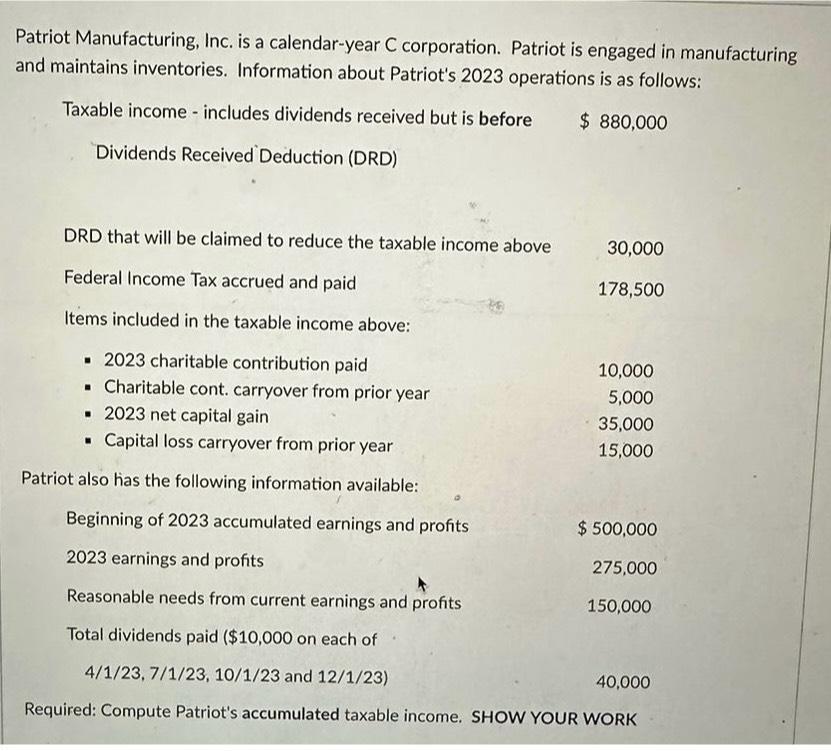

Patriot Manufacturing, Inc. is a calendar-year C corporation. Patriot is engaged in manufacturing and maintains inventories. Information about Patriot's 2023 operations is as follows:

Patriot Manufacturing, Inc. is a calendar-year C corporation. Patriot is engaged in manufacturing and maintains inventories. Information about Patriot's 2023 operations is as follows: Taxable income includes dividends received but is before $ 880,000 Dividends Received Deduction (DRD) DRD that will be claimed to reduce the taxable income above Federal Income Tax accrued and paid Items included in the taxable income above: 2023 charitable contribution paid . Charitable cont. carryover from prior year 2023 net capital gain . Capital loss carryover from prior year Patriot also has the following information available: 30,000 178,500 10,000 5,000 35,000 15,000 Beginning of 2023 accumulated earnings and profits 2023 earnings and profits Reasonable needs from current earnings and profits Total dividends paid ($10,000 on each of 4/1/23,7/1/23, 10/1/23 and 12/1/23) 40,000 Required: Compute Patriot's accumulated taxable income. SHOW YOUR WORK $ 500,000 275,000 150,000

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To compute Patriots accumulated taxable income we need to consider the following factors Beginning o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started