Question

Patriots Art, Inc. reported the following trend analysis to its bank as an attachment to a loan application. Fixed Charge Ratio Times Interest Earned

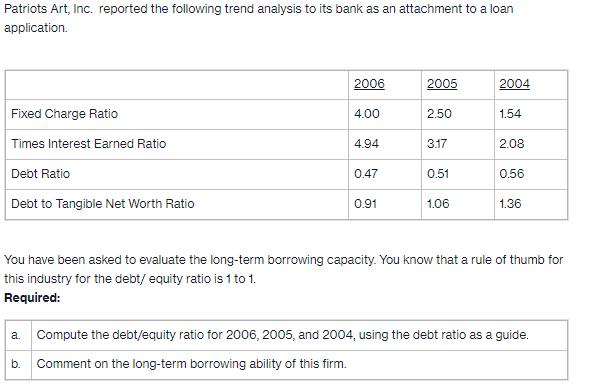

Patriots Art, Inc. reported the following trend analysis to its bank as an attachment to a loan application. Fixed Charge Ratio Times Interest Earned Ratio Debt Ratio Debt to Tangible Net Worth Ratio 2006 4.00 4.94 0.47 0.91 2005 2.50 3.17 0.51 1.06 2004 1.54 2.08 0.56 1.36 You have been asked to evaluate the long-term borrowing capacity. You know that a rule of thumb for this industry for the debt/ equity ratio is 1 to 1. Required: a. Compute the debt/equity ratio for 2006, 2005, and 2004, using the debt ratio as a guide. b. Comment on the long-term borrowing ability of this firm.

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the debtequity ratio for each year we can use the debt ratio as a guide Debt Ratio Tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis Using Financial Accounting Information

Authors: Charles H Gibson

12th Edition

1439080607, 978-1439080603

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App