Answered step by step

Verified Expert Solution

Question

1 Approved Answer

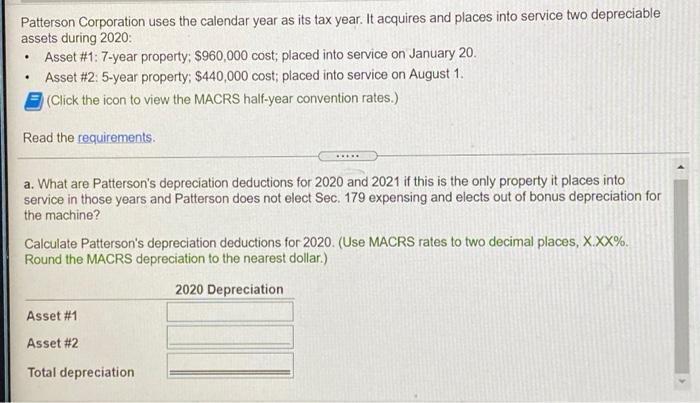

Patterson Corporation uses the calendar year as its tax year. It acquires and places into service two depreciable assets during 2020: . . Asset

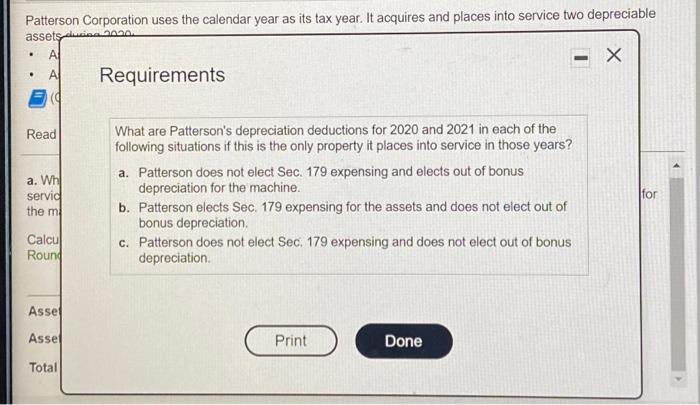

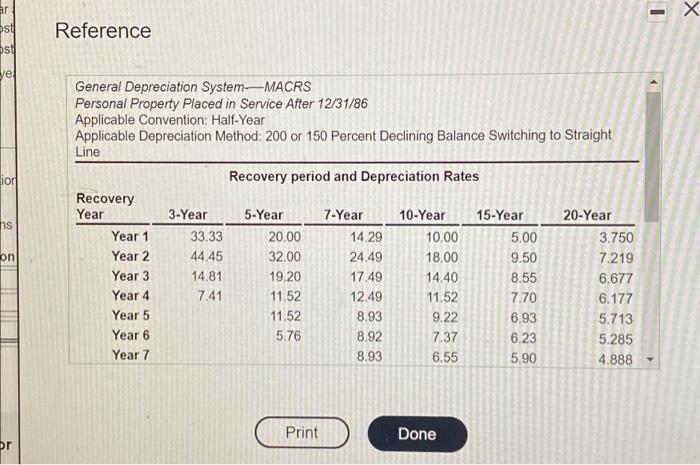

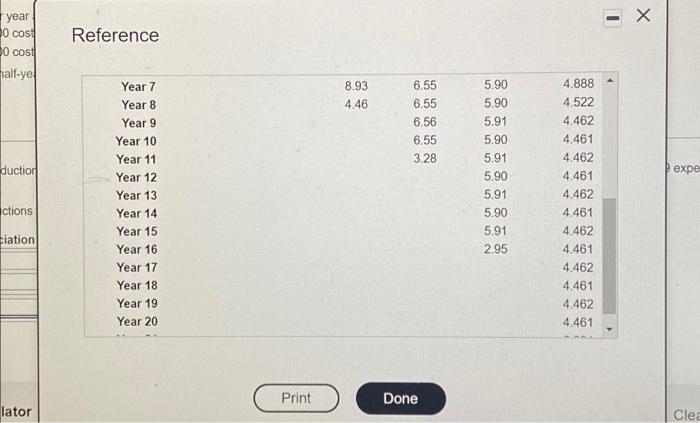

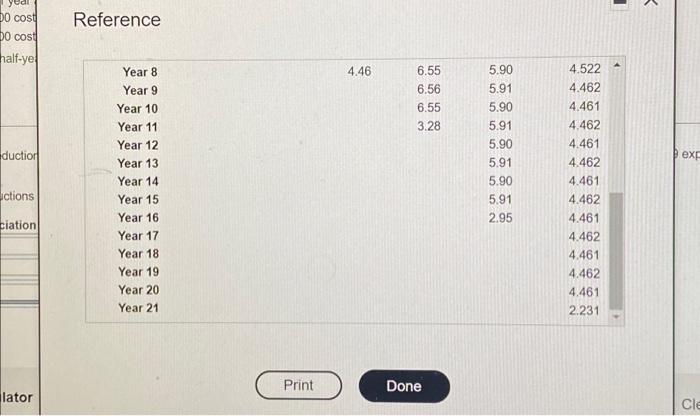

Patterson Corporation uses the calendar year as its tax year. It acquires and places into service two depreciable assets during 2020: . . Asset #1: 7-year property; $960,000 cost; placed into service on January 20. Asset #2: 5-year property; $440,000 cost; placed into service on August 1. (Click the icon to view the MACRS half-year convention rates.) Read the requirements. a. What are Patterson's depreciation deductions for 2020 and 2021 if this is the only property it places into service in those years and Patterson does not elect Sec. 179 expensing and elects out of bonus depreciation for the machine? Calculate Patterson's depreciation deductions for 2020. (Use MACRS rates to two decimal places, X.XX%. Round the MACRS depreciation to the nearest dollar.) 2020 Depreciation Asset #1 Asset #2 Total depreciation Patterson Corporation uses the calendar year as its tax year. It acquires and places into service two depreciable assets in 2020. . A A (4 . Read a. Wh servic the m Calcu Round Asse Asse Total Requirements What are Patterson's depreciation deductions for 2020 and 2021 in each of the following situations if this is the only property it places into service in those years? a. Patterson does not elect Sec. 179 expensing and elects out of bonus depreciation for the machine. b. Patterson elects Sec. 179 expensing for the assets and does not elect out of bonus depreciation. c. Patterson does not elect Sec. 179 expensing and does not elect out of bonus depreciation. Print Done for ar st st ve ior ns on pr Reference General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 3-Year 33.33 44.45 14.81 7.41 Recovery period and Depreciation Rates 5-Year 20,00 32.00 19,20 11.52 11.52 5.76 Print 7-Year 10-Year 15-Year 10.00 18.00 14.40 11.52 9.22 7.37 6.55 14.29 24.49 17.49 12.49 8.93 8.92 8.93 Done 5.00 9.50 8.55 7.70 6.93 6.23 5.90 20-Year 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4 X year. 0 cost 0 cost half-ye duction ctions ciation lator Reference Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14. Year 15 Year 16 Year 17 Year 18 Year 19 Year 20 Print 8.93 4.46 6.55 6.55 6.56 6.55 3.28 Done 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 I exper Clea 00 cost 00 cost half-ye duction actions ciation lator Reference Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15. Year 16. Year 17 Year 18 Year 19 Year 20 Year 21 Print 4.46 6.55 6.56 6.55 3.28 Done 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 K exp Cle

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

As assets were not placed into service during the last quarter of year ther...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started