Question

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2016. Grant A can be used to cover

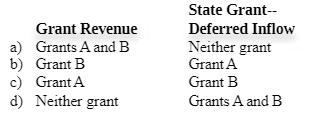

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2016. Grant A can be used to cover any operating expenses incurred during fiscal 2017. Grant B can be used at any time to acquire equipment for the city’s fire department. Should the city report these grants as grant revenues or deferred inflows in its government-wide financial statements for fiscal 2016?

State Grant- Grant Revenue Deferred Inflow a) Grants A and B b) Grant B c) Grant A d) Neither grant Neither grant Grant A Grant B Grants A and B

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Block grant that can be used to cover any operating expenses incurred during fiscal 2018 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics

Authors: Roger A. Arnold

12th edition

978-1305758674, 1305758676, 978-1285738321

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App