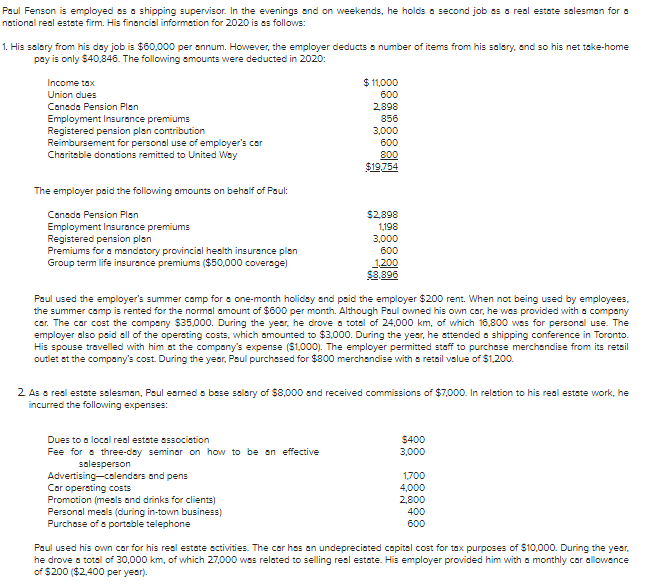

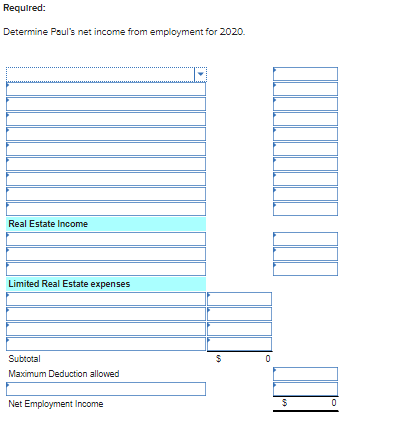

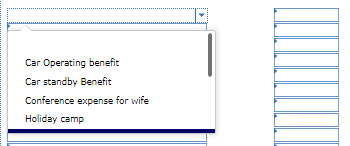

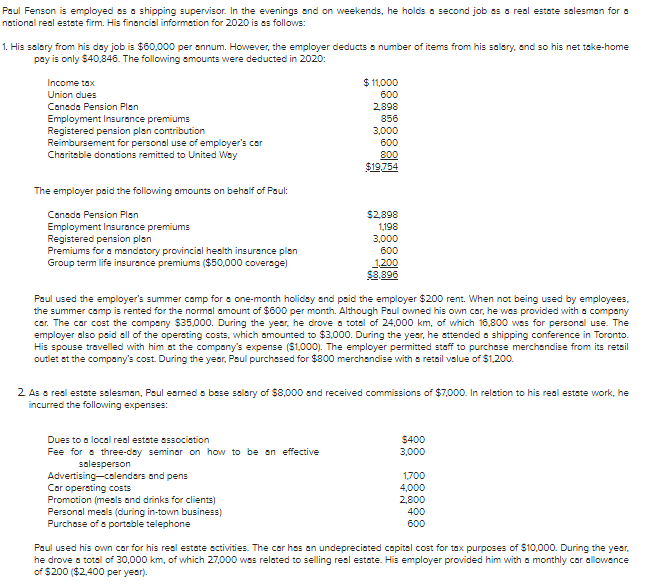

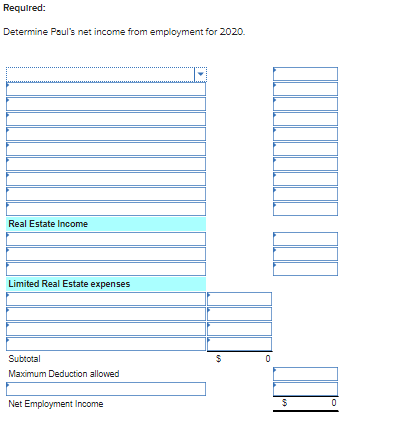

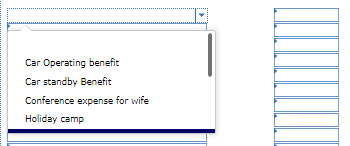

Paul Fenson is employed as a shipping supervisor. In the evenings and on weekends, he holds a second job as a real estate salesman for a national real estate firm. His financial information for 2020 is as follows: 1. His salary from his day job is $60.000 per annum. However, the employer deducts a number of items from his salary, and so his net take-home pay is only $40.846. The following amounts were deducted in 2020: Income tax Union dues Canada Pension Plan Employment Insurance premiums Registered pension plan contribution Reimbursement for personal use of employer's cer Charitable donations remitted to United Way $ 11,000 600 2.898 856 3,000 600 800 $19.754 The employer paid the following amounts on behalf of Poul: Canada Pension Plan Employment Insurance premiums Registered pension plan Premiums for a mandatory provincial health insurance plan Group term life insurance premiums ($50,000 coverage) $2.898 1,198 3,000 600 1.200 $8.896 Poul used the employer's summer camp for one-month holiday and paid the employer $200 rent. When not being used by employees. the summer camp is rented for the normal amount of $600 per month. Although Poul owned his own cer, he was provided with a company car. The car cost the company $35.000. During the year, he drove a total of 24.000 km, of which 15,800 was for personal use. The employer also paid all of the operating costs, which amounted to $3.000. During the year, he attended a shipping conference in Toronto. His spouse travelled with him at the company's expense ($1.000). The employer permitted staff to purchase merchandise from its retail outlet at the company's cost. During the year, Poul purchased for $300 merchandise with a retail value of $1.200. 2 As a real estate salesman, Poul earned a base salary of $3,000 and received commissions of $7.000. In relation to his real estate work, he incurred the following expenses: Dues to a local real estate association $400 Fee for three-day seminar on how to be an effective 3,000 salesperson Advertising-calendars and pens 1,700 Car operating costs 4,000 Promotion (meals and drinks for clients) 2,800 Personal mesls (during in-town business) 400 Purchase of e portable telephone 600 Paul used his own car for his real estate activities. The car has an undepreciated capital cost for tax purposes of $10,000. During the year, he drove a total of 30,000 km, of which 27,000 wes related to selling real estate. His employer provided him with a monthly cor allowance of $200 ($2.400 per year). Required: Determine Poul's net income from employment for 2020. Real Estate Income Limited Real Estate expenses 10 A Subtotal Maximum Deduction allowed INI Net Employment Income 0 Car Operating benefit Car standby Benefit Conference expense for wife Holiday camp Provincial health care Registered Pension Plan (RPP) Reimbursement for car use Salary Union dues Real Estate Income