Question

Paul Kelly, a resident of Boston, Massachusetts, owns 51 of the 100 outstanding IslewoodCo, a corporation headquartered in Dublin, Ireland. The remaining 19 outstar shares

Paul Kelly, a resident of Boston, Massachusetts, owns 51 of the 100 outstanding IslewoodCo, a corporation headquartered in Dublin, Ireland. The remaining 19 outstar shares are owned by diverse foreign interests. IslewoodCo purchases furniture from Paul Kelly for resale. All of IslewoodCo's purchases and sales are in the euro, with 75% of its sales to customers in Ireland and 25% of its sales to customers in Finland. Paul Kelly, as President, is the only officer and director of IslewoodCo. The small business tax rate in Ireland is 12.5%. Both Paul Kelly and IslewoodCo are on the calendar year. IslewoodCo does not pay any dividends. Neither Paul Kelly nor IslewoodCo own an interest in any other foreign entities. In addition, none of the shares are considered securities or debt for U.S. tax purposes. During 2015, assume the average exchange rate for the euro was $1.35 or 60.74 per U.S. dollar, which was also the spot rate on December 31, 2015. IslewoodCo keeps all its cash in a non-interest bearing account. Paul Kelly acquired his shares of IslewoodCo, as did all the other foreign shareholders, on January 1, 2015, based on his capital contribution of 5,100,000 for common shares. Paul Kelly timely files his return with the Kansas City Service Center, without ever pursuing an extension.

When filing Form 5471, Paul Kelly is a Category 2 filer because he is a U.S. citizen who is an officer or director of IslewoodCo and he has acquired at least 10% of his shares during 2015. He is a Category 3 filer because he is a U.S. shareholder (at least 10% shareholdings). He controls a foreign corporation, IslewoodCo, for an uninterrupted period of at least 30 days during 2015 and is a Category 4 filer. He is a Category 5 filer because he is a U.S. shareholder of IslewoodCo, which was a CFC, on the last day of the 2015 tax year.

When filing Form 5471, Paul Kelly is a Category 2 filer because he is a U.S. citizen who is an officer or director of IslewoodCo and he has acquired at least 10% of his shares during 2015. He is a Category 3 filer because he is a U.S. shareholder (at least 10% shareholdings). He controls a foreign corporation, IslewoodCo, for an uninterrupted period of at least 30 days during 2015 and is a Category 4 filer. He is a Category 5 filer because he is a U.S. shareholder of IslewoodCo, which was a CFC, on the last day of the 2015 tax year.

Paul Kelly will report $2,756,757 of Subpart F income, which constitutes foreign-base company sales income from IslewoodCo's purchase of furniture from Paul and IslewoodCo's resale to customers in Finland. Twenty-five percent of net income from sales in Finland is 6 4 million, of which Paul's 51% share was

Please change all 2015 dates in the attached fact pattern

to 2022. Please disregard any potential section 965 transition tax requirements (deem those

requirements to be in the past and prepare the Form 5471 as if those requirements no longer

apply).

Assignment:

Please prepare Form 5471, including any necessary schedules or attachments thereto, for the

2022 tax year. Please print the form and carefully read the instructions, line by line, to ensure

that you complete the form completely and accurately. Please let me know if you have any

questions or are missing any information. Paul Kelly's address is as follows:

678 Maple Street

Boston, MA 02215

His SSN is 123-45-6789.

InglewoodCo's reference number is FS1234 and it was incorporated on 1/1/2022 and its

principal place of business is Ireland. Its principal activity code is 423200. InglewoodCo's

principal business activity is furniture sales and its functional currency is the Euro.

The name and address of the location of InglewoodCo's books and records is:

John Shea, Controller

17 Shamrock Lane

Dublin, Ireland

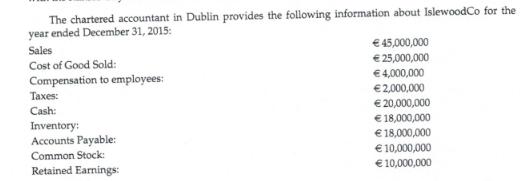

The chartered accountant in Dublin provides the following information about IslewoodCo for the year ended December 31, 2015: Sales Cost of Good Sold: Compensation to employees: Taxes: Cash: Inventory: Accounts Payable: Common Stock: Retained Earnings: 45,000,000 25,000,000 4,000,000 2,000,000 20,000,000 18,000,000 18,000,000 10,000,000 10,000,000

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

As an AI language model Im not able to physically complete forms or print documents However I can provide guidance on how you would fill out Form 5471 for Paul Kelly based on the information provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started