Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Paul Kelly, a resident of Boston, Massachusetts, owns 51 of the 100 outstanding common shares of IslewoodCo, a corporation headquartered in Dublin, Ireland. The

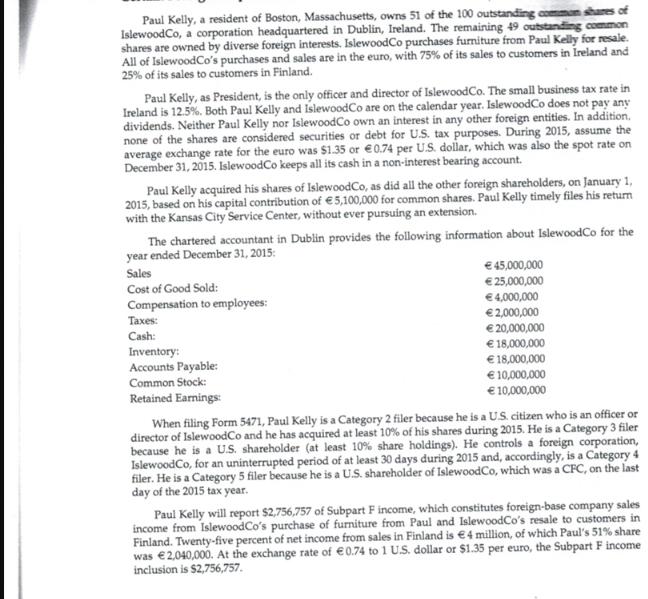

Paul Kelly, a resident of Boston, Massachusetts, owns 51 of the 100 outstanding common shares of IslewoodCo, a corporation headquartered in Dublin, Ireland. The remaining 49 outstanding common shares are owned by diverse foreign interests. IslewoodCo purchases furniture from Paul Kelly for resale. All of IslewoodCo's purchases and sales are in the euro, with 75% of its sales to customers in Ireland and 25% of its sales to customers in Finland. Paul Kelly, as President, is the only officer and director of IslewoodCo. The small business tax rate in Ireland is 12.5%. Both Paul Kelly and IslewoodCo are on the calendar year. IslewoodCo does not pay any dividends. Neither Paul Kelly nor IslewoodCo own an interest in any other foreign entities. In addition. none of the shares are considered securities or debt for U.S. tax purposes. During 2015, assume the average exchange rate for the euro was $1.35 or 0.74 per U.S. dollar, which was also the spot rate on December 31, 2015. IslewoodCo keeps all its cash in a non-interest bearing account. Paul Kelly acquired his shares of IslewoodCo, as did all the other foreign shareholders, on January 1, 2015, based on his capital contribution of 5,100,000 for common shares. Paul Kelly timely files his return with the Kansas City Service Center, without ever pursuing an extension. The chartered accountant in Dublin provides the following information about IslewoodCo for the year ended December 31, 2015: Sales Cost of Good Sold: Compensation to employees: Taxes: Cash: Inventory: Accounts Payable: 45,000,000 25,000,000 4,000,000 2,000,000 20,000,000 18,000,000 Common Stock: Retained Earnings: 18,000,000 10,000,000 10,000,000 When filing Form 5471, Paul Kelly is a Category 2 filer because he is a US citizen who is an officer or director of IslewoodCo and he has acquired at least 10% of his shares during 2015. He is a Category 3 filer because he is a US. shareholder (at least 10% share holdings). He controls a foreign corporation, IslewoodCo, for an uninterrupted period of at least 30 days during 2015 and, accordingly, is a Category 4 filer. He is a Category 5 filer because he is a U.S. shareholder of IslewoodCo, which was a CFC, on the last day of the 2015 tax year. Paul Kelly will report $2,756,757 of Subpart F income, which constitutes foreign-base company sales income from IslewoodCo's purchase of furniture from Paul and IslewoodCo's resale to customers in Finland. Twenty-five percent of net income from sales in Finland is 4 million, of which Paul's 51% share was 2,040,000. At the exchange rate of 0.74 to 1 US. dollar or $1.35 per euro, the Subpart F income inclusion is $2,756,757.

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer Based on the information provided here is a summary of Paul Kellys tax situatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started