Answered step by step

Verified Expert Solution

Question

1 Approved Answer

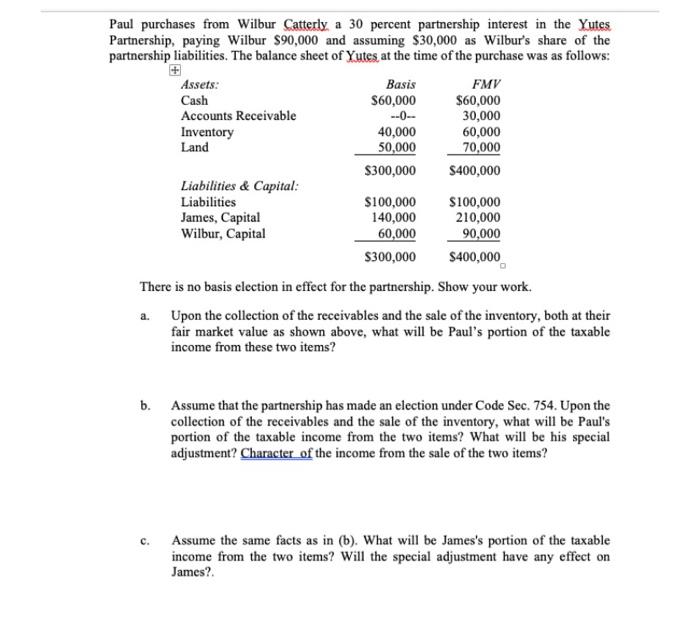

Paul purchases from Wilbur Catterly a 30 percent partnership interest in the Yutes Partnership, paying Wilbur $90,000 and assuming $30,000 as Wilbur's share of

Paul purchases from Wilbur Catterly a 30 percent partnership interest in the Yutes Partnership, paying Wilbur $90,000 and assuming $30,000 as Wilbur's share of the partnership liabilities. The balance sheet of Yutes at the time of the purchase was as follows: Assets: Basis FMV Cash Accounts Receivable S60,000 --0- $60,000 30,000 60,000 70,000 Inventory Land 40,000 50,000 $300,000 $400,000 Liabilities & Capital: Liabilities James, Capital Wilbur, Capital $100,000 140,000 60,000 S100,000 210,000 90,000 $300,000 $400,000 There is no basis election in effect for the partnership. Show your work. a. Upon the collection of the receivables and the sale of the inventory, both at their fair market value as shown above, what will be Paul's portion of the taxable income from these two items? b. Assume that the partnership has made an election under Code Sec. 754. Upon the collection of the receivables and the sale of the inventory, what will be Paul's por of the taxable income from the two items? What will be his special adjustment? Character of the income from the sale of the two items? Assume the same facts as in (b). What will be James's portion of the taxable income from the two items? Will the special adjustment have any effect on James?.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Basis Receivable Inventory 4000000 4000000 Paul share 30 Taxable Income 1200000 2 FMV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started