Answered step by step

Verified Expert Solution

Question

1 Approved Answer

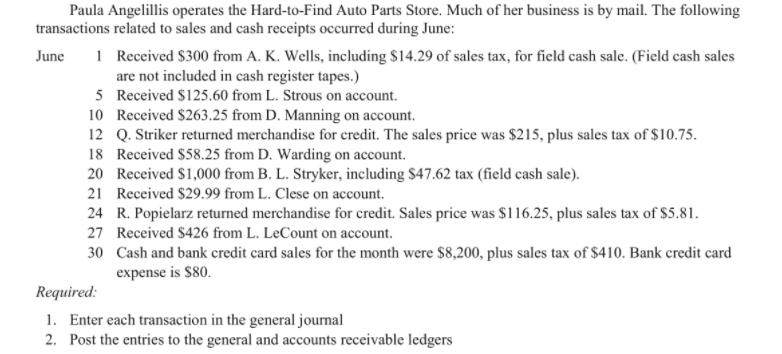

Paula Angelillis operates the Hard-to-Find Auto Parts Store. Much of her business is by mail. The following transactions related to sales and cash receipts

Paula Angelillis operates the Hard-to-Find Auto Parts Store. Much of her business is by mail. The following transactions related to sales and cash receipts occurred during June: 1 Received $300 from A. K. Wells, including $14.29 of sales tax, for field cash sale. (Field cash sales are not included in cash register tapes.) 5 Received S125.60 from L. Strous on account. 10 Received $263.25 from D. Manning on account. 12 Q. Striker returned merchandise for credit. The sales price was $215, plus sales tax of $10.75. 18 Received $58.25 from D. Warding on account. 20 Received S1,000 from B. L. Stryker, including $47.62 tax (field cash sale). 21 Received $29.99 from L. Clese on account. June 24 R. Popielarz returned merchandise for credit. Sales price was $116.25, plus sales tax of $5.81. 27 Received $426 from L. LeCount on account. 30 Cash and bank credit card sales for the month were $8,200, plus sales tax of $410. Bank credit card expense is $80. Required: 1. Enter each transaction in the general journal 2. Post the entries to the general and accounts receivable ledgers

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A F G 1 Dr Accounts Receivable Ledger Cr 2 Date Particulars ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started