Answered step by step

Verified Expert Solution

Question

1 Approved Answer

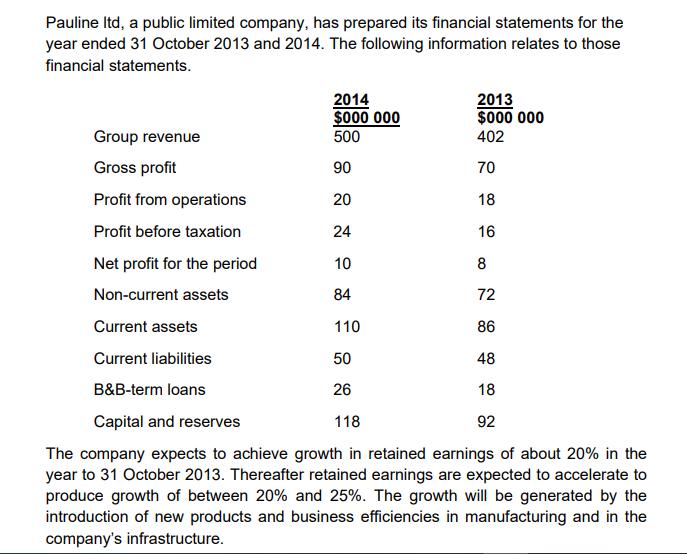

Pauline Itd, a public limited company, has prepared its financial statements for the year ended 31 October 2013 and 2014. The following information relates

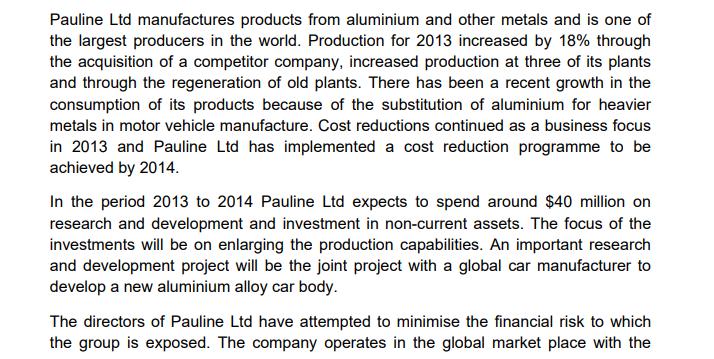

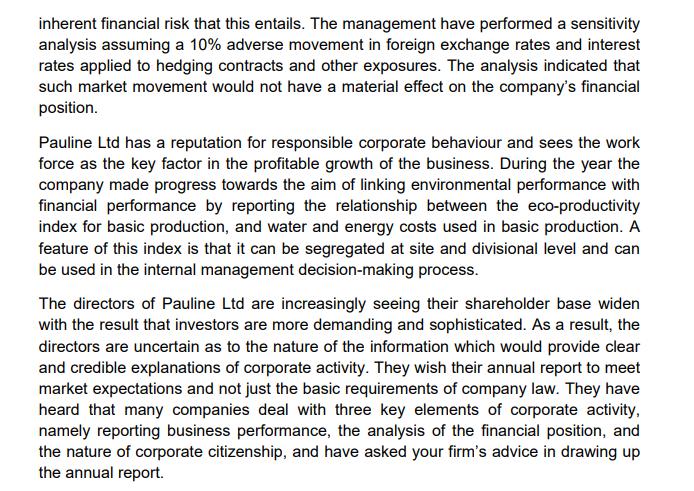

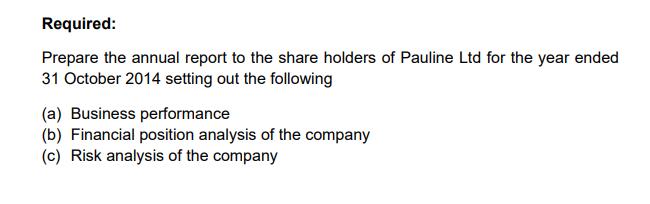

Pauline Itd, a public limited company, has prepared its financial statements for the year ended 31 October 2013 and 2014. The following information relates to those financial statements. 2014 S000 000 500 2013 $000 000 Group revenue 402 Gross profit 90 70 Profit from operations 20 18 Profit before taxation 24 16 Net profit for the period 10 8 Non-current assets 84 72 Current assets 110 86 Current liabilities 50 48 B&B-term loans 26 18 Capital and reserves 118 92 The company expects to achieve growth in retained earnings of about 20% in the year to 31 October 2013. Thereafter retained earnings are expected to accelerate to produce growth of between 20% and 25%. The growth will be generated by the introduction of new products and business efficiencies in manufacturing and in the company's infrastructure. Pauline Ltd manufactures products from aluminium and other metals and is one of the largest producers in the world. Production for 2013 increased by 18% through the acquisition of a competitor company, increased production at three of its plants and through the regeneration of old plants. There has been a recent growth in the consumption of its products because of the substitution of aluminium for heavier metals in motor vehicle manufacture. Cost reductions continued as a business focus in 2013 and Pauline Ltd has implemented a cost reduction programme to be achieved by 2014. In the period 2013 to 2014 Pauline Ltd expects to spend around $40 million on research and development and investment in non-current assets. The focus of the investments will be on enlarging the production capabilities. An important research and development project will be the joint project with a global car manufacturer to develop a new aluminium alloy car body. The directors of Pauline Ltd have attempted to minimise the financial risk to which the group is exposed. The company operates in the global market place with the inherent financial risk that this entails. The management have performed a sensitivity analysis assuming a 10% adverse movement in foreign exchange rates and interest rates applied to hedging contracts and other exposures. The analysis indicated that such market movement would not have a material effect on the company's financial position. Pauline Ltd has a reputation for responsible corporate behaviour and sees the work force as the key factor in the profitable growth of the business. During the year the company made progress towards the aim of linking environmental performance with financial performance by reporting the relationship between the eco-productivity index for basic production, and water and energy costs used in basic production. A feature of this index is that it can be segregated at site and divisional level and can be used in the internal management decision-making process. The directors of Pauline Ltd are increasingly seeing their shareholder base widen with the result that investors are more demanding and sophisticated. As a result, the directors are uncertain as to the nature of the information which would provide clear and credible explanations of corporate activity. They wish their annual report to meet market expectations and not just the basic requirements of company law. They have heard that many companies deal with three key elements of corporate activity, namely reporting business performance, the analysis of the financial position, and the nature of corporate citizenship, and have asked your firm's advice in drawing up the annual report. Required: Prepare the annual report to the share holders of Pauline Ltd for the year ended 31 October 2014 setting out the following (a) Business performance (b) Financial position analysis of the company (c) Risk analysis of the company Pauline Itd, a public limited company, has prepared its financial statements for the year ended 31 October 2013 and 2014. The following information relates to those financial statements. 2014 S000 000 500 2013 $000 000 Group revenue 402 Gross profit 90 70 Profit from operations 20 18 Profit before taxation 24 16 Net profit for the period 10 8 Non-current assets 84 72 Current assets 110 86 Current liabilities 50 48 B&B-term loans 26 18 Capital and reserves 118 92 The company expects to achieve growth in retained earnings of about 20% in the year to 31 October 2013. Thereafter retained earnings are expected to accelerate to produce growth of between 20% and 25%. The growth will be generated by the introduction of new products and business efficiencies in manufacturing and in the company's infrastructure. Pauline Ltd manufactures products from aluminium and other metals and is one of the largest producers in the world. Production for 2013 increased by 18% through the acquisition of a competitor company, increased production at three of its plants and through the regeneration of old plants. There has been a recent growth in the consumption of its products because of the substitution of aluminium for heavier metals in motor vehicle manufacture. Cost reductions continued as a business focus in 2013 and Pauline Ltd has implemented a cost reduction programme to be achieved by 2014. In the period 2013 to 2014 Pauline Ltd expects to spend around $40 million on research and development and investment in non-current assets. The focus of the investments will be on enlarging the production capabilities. An important research and development project will be the joint project with a global car manufacturer to develop a new aluminium alloy car body. The directors of Pauline Ltd have attempted to minimise the financial risk to which the group is exposed. The company operates in the global market place with the inherent financial risk that this entails. The management have performed a sensitivity analysis assuming a 10% adverse movement in foreign exchange rates and interest rates applied to hedging contracts and other exposures. The analysis indicated that such market movement would not have a material effect on the company's financial position. Pauline Ltd has a reputation for responsible corporate behaviour and sees the work force as the key factor in the profitable growth of the business. During the year the company made progress towards the aim of linking environmental performance with financial performance by reporting the relationship between the eco-productivity index for basic production, and water and energy costs used in basic production. A feature of this index is that it can be segregated at site and divisional level and can be used in the internal management decision-making process. The directors of Pauline Ltd are increasingly seeing their shareholder base widen with the result that investors are more demanding and sophisticated. As a result, the directors are uncertain as to the nature of the information which would provide clear and credible explanations of corporate activity. They wish their annual report to meet market expectations and not just the basic requirements of company law. They have heard that many companies deal with three key elements of corporate activity, namely reporting business performance, the analysis of the financial position, and the nature of corporate citizenship, and have asked your firm's advice in drawing up the annual report. Required: Prepare the annual report to the share holders of Pauline Ltd for the year ended 31 October 2014 setting out the following (a) Business performance (b) Financial position analysis of the company (c) Risk analysis of the company Pauline Itd, a public limited company, has prepared its financial statements for the year ended 31 October 2013 and 2014. The following information relates to those financial statements. 2014 S000 000 500 2013 $000 000 Group revenue 402 Gross profit 90 70 Profit from operations 20 18 Profit before taxation 24 16 Net profit for the period 10 8 Non-current assets 84 72 Current assets 110 86 Current liabilities 50 48 B&B-term loans 26 18 Capital and reserves 118 92 The company expects to achieve growth in retained earnings of about 20% in the year to 31 October 2013. Thereafter retained earnings are expected to accelerate to produce growth of between 20% and 25%. The growth will be generated by the introduction of new products and business efficiencies in manufacturing and in the company's infrastructure. Pauline Ltd manufactures products from aluminium and other metals and is one of the largest producers in the world. Production for 2013 increased by 18% through the acquisition of a competitor company, increased production at three of its plants and through the regeneration of old plants. There has been a recent growth in the consumption of its products because of the substitution of aluminium for heavier metals in motor vehicle manufacture. Cost reductions continued as a business focus in 2013 and Pauline Ltd has implemented a cost reduction programme to be achieved by 2014. In the period 2013 to 2014 Pauline Ltd expects to spend around $40 million on research and development and investment in non-current assets. The focus of the investments will be on enlarging the production capabilities. An important research and development project will be the joint project with a global car manufacturer to develop a new aluminium alloy car body. The directors of Pauline Ltd have attempted to minimise the financial risk to which the group is exposed. The company operates in the global market place with the inherent financial risk that this entails. The management have performed a sensitivity analysis assuming a 10% adverse movement in foreign exchange rates and interest rates applied to hedging contracts and other exposures. The analysis indicated that such market movement would not have a material effect on the company's financial position. Pauline Ltd has a reputation for responsible corporate behaviour and sees the work force as the key factor in the profitable growth of the business. During the year the company made progress towards the aim of linking environmental performance with financial performance by reporting the relationship between the eco-productivity index for basic production, and water and energy costs used in basic production. A feature of this index is that it can be segregated at site and divisional level and can be used in the internal management decision-making process. The directors of Pauline Ltd are increasingly seeing their shareholder base widen with the result that investors are more demanding and sophisticated. As a result, the directors are uncertain as to the nature of the information which would provide clear and credible explanations of corporate activity. They wish their annual report to meet market expectations and not just the basic requirements of company law. They have heard that many companies deal with three key elements of corporate activity, namely reporting business performance, the analysis of the financial position, and the nature of corporate citizenship, and have asked your firm's advice in drawing up the annual report. Required: Prepare the annual report to the share holders of Pauline Ltd for the year ended 31 October 2014 setting out the following (a) Business performance (b) Financial position analysis of the company (c) Risk analysis of the company Pauline Itd, a public limited company, has prepared its financial statements for the year ended 31 October 2013 and 2014. The following information relates to those financial statements. 2014 S000 000 500 2013 $000 000 Group revenue 402 Gross profit 90 70 Profit from operations 20 18 Profit before taxation 24 16 Net profit for the period 10 8 Non-current assets 84 72 Current assets 110 86 Current liabilities 50 48 B&B-term loans 26 18 Capital and reserves 118 92 The company expects to achieve growth in retained earnings of about 20% in the year to 31 October 2013. Thereafter retained earnings are expected to accelerate to produce growth of between 20% and 25%. The growth will be generated by the introduction of new products and business efficiencies in manufacturing and in the company's infrastructure. Pauline Ltd manufactures products from aluminium and other metals and is one of the largest producers in the world. Production for 2013 increased by 18% through the acquisition of a competitor company, increased production at three of its plants and through the regeneration of old plants. There has been a recent growth in the consumption of its products because of the substitution of aluminium for heavier metals in motor vehicle manufacture. Cost reductions continued as a business focus in 2013 and Pauline Ltd has implemented a cost reduction programme to be achieved by 2014. In the period 2013 to 2014 Pauline Ltd expects to spend around $40 million on research and development and investment in non-current assets. The focus of the investments will be on enlarging the production capabilities. An important research and development project will be the joint project with a global car manufacturer to develop a new aluminium alloy car body. The directors of Pauline Ltd have attempted to minimise the financial risk to which the group is exposed. The company operates in the global market place with the inherent financial risk that this entails. The management have performed a sensitivity analysis assuming a 10% adverse movement in foreign exchange rates and interest rates applied to hedging contracts and other exposures. The analysis indicated that such market movement would not have a material effect on the company's financial position. Pauline Ltd has a reputation for responsible corporate behaviour and sees the work force as the key factor in the profitable growth of the business. During the year the company made progress towards the aim of linking environmental performance with financial performance by reporting the relationship between the eco-productivity index for basic production, and water and energy costs used in basic production. A feature of this index is that it can be segregated at site and divisional level and can be used in the internal management decision-making process. The directors of Pauline Ltd are increasingly seeing their shareholder base widen with the result that investors are more demanding and sophisticated. As a result, the directors are uncertain as to the nature of the information which would provide clear and credible explanations of corporate activity. They wish their annual report to meet market expectations and not just the basic requirements of company law. They have heard that many companies deal with three key elements of corporate activity, namely reporting business performance, the analysis of the financial position, and the nature of corporate citizenship, and have asked your firm's advice in drawing up the annual report. Required: Prepare the annual report to the share holders of Pauline Ltd for the year ended 31 October 2014 setting out the following (a) Business performance (b) Financial position analysis of the company (c) Risk analysis of the company

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Pauline ltd Comparable Financial Data 31 October 2013 and 2014 2014 2013 Group Revenue 500 402 Gross Profit 90 70 Profit from Operations 20 18 Profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started