Question

Pauls Fitness Store has the Following: On 1 Jan, Paul started a Fitness Store selling protein shakes as a Sole Trader On 31

Paul’s Fitness Store has the Following:

• On 1 Jan, Paul started a Fitness Store selling protein shakes as a Sole Trader

• On 31 Dec, he provides you with the following list of transactions

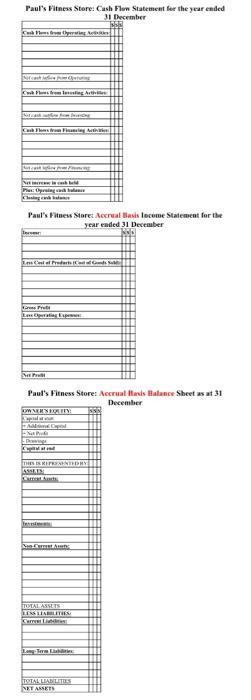

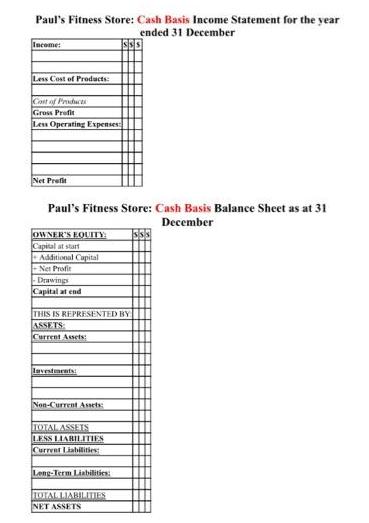

• Prepare a Cash Flow Statement, Income Statement, and Balance Sheet for the year ended 31 December

– Using the Accrual Basis

– Using the Cash Basis

Transactions for the period

• On 1 Jan, Paul invested $80,000 of his own money to start the business

• On 1 Jan, the business received a loan from the Bank of $40,000 which will be paid off over 10 years

• On 1 Jan, the business paid a Rental Bond of $2,000 that will be returned when the lease ends

• On 1 Jan, the business paid $50,000 for Equipment & Fittings, which should last for 10 years with a salvage value of $10,000

• On 1 Jan, Paul invested his Vehicle worth $10,000 into the business, which should last 5 years with no salvage value

• On 1 July, the business bought Furniture for $9,000 on credit which will be paid for in 2 years. It should last for 4 years with a salvage value of $1,000.

• Cash collected from customers during the year was $200,000. This included $1,000 of Sales that will only be earned in the following period.

• At 31 Dec, Sales owing from customers was $15,000

• Cash paid for protein shakes purchased to resell during the year was $100,000

• At 31 Dec, the business still owed $8,000 for protein shakes purchased to resell

• At 31 Dec, the business had protein shakes on hand that had cost $20,000

• Cash paid for Operating Expenses (excluding Rent) during the year was $45,000

• During the year, 13 months of Rent were paid, totaling $13,000

• During the year, the business paid $4,000 of Principal repayments and $2,000 of Interest on the Bank Loan

• During the year, Paul paid $1,000 for a TV for his home using the business bank account

• During the year, Paul took his wife on holiday for $1,500 paying with his personal bank account

• At 31 Dec, the business bank balance was $103,000

Paul's Fitness Store: Cash Flow Statement fer the year ended 31 December S P thring k S P leting Art Neierin Opring a l ng kl Paul's Fitness Store: Accrual Basis lncome Statement for the year ended 31 December Ber ImCalel Preder m Bmlperating Ep Paul's Fitness Store: Accrual Hasis Halance Sheet as at 31 December Pwings nies s RIPRS NTORY ASSLES froTAL ASTS LESSLIABLETIES Long-Term E NET ASSETS

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Pauls Fitness Store Cash Flow Statement for year ended 31st December Cash Flow From Operating Activities Cash collected from customer 200000 Cash paid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started