Question: Pavement Corp. (Pavernent) nas been operating sinoe 1398. Ht is now Docember 31, 2004, and Pavement is about to prepare consolidated finendial etetements for

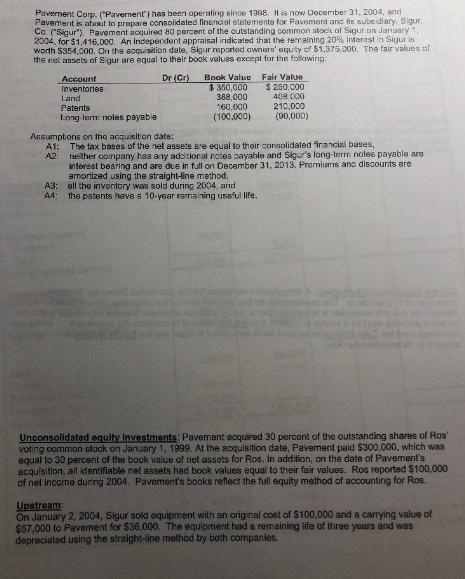

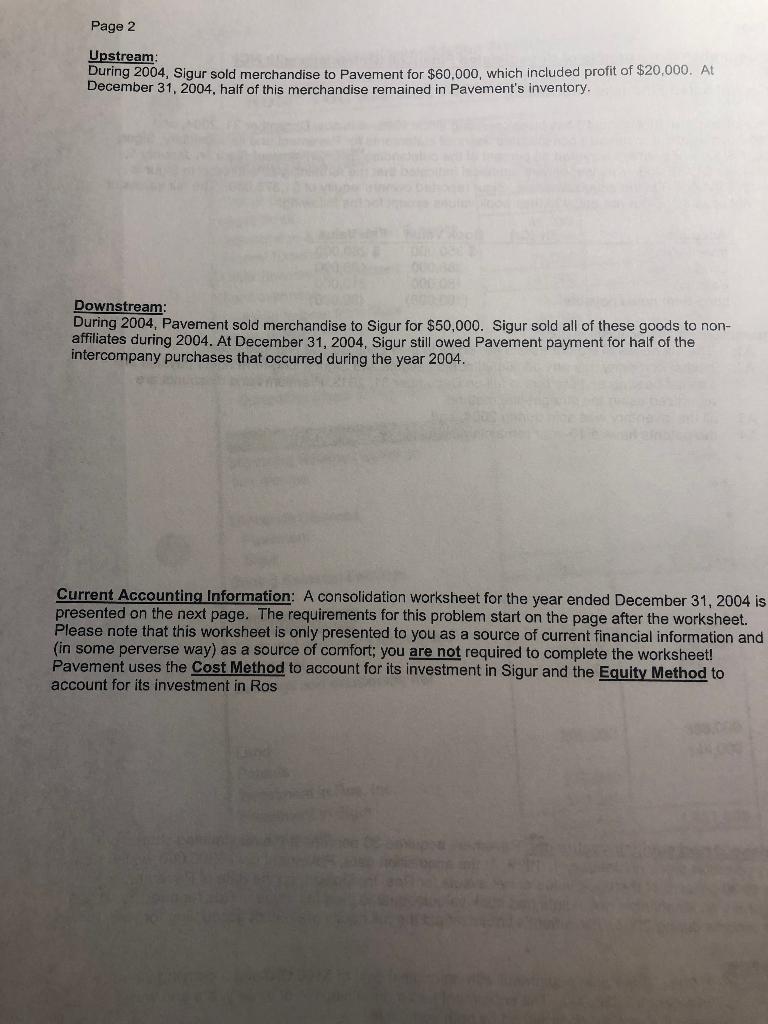

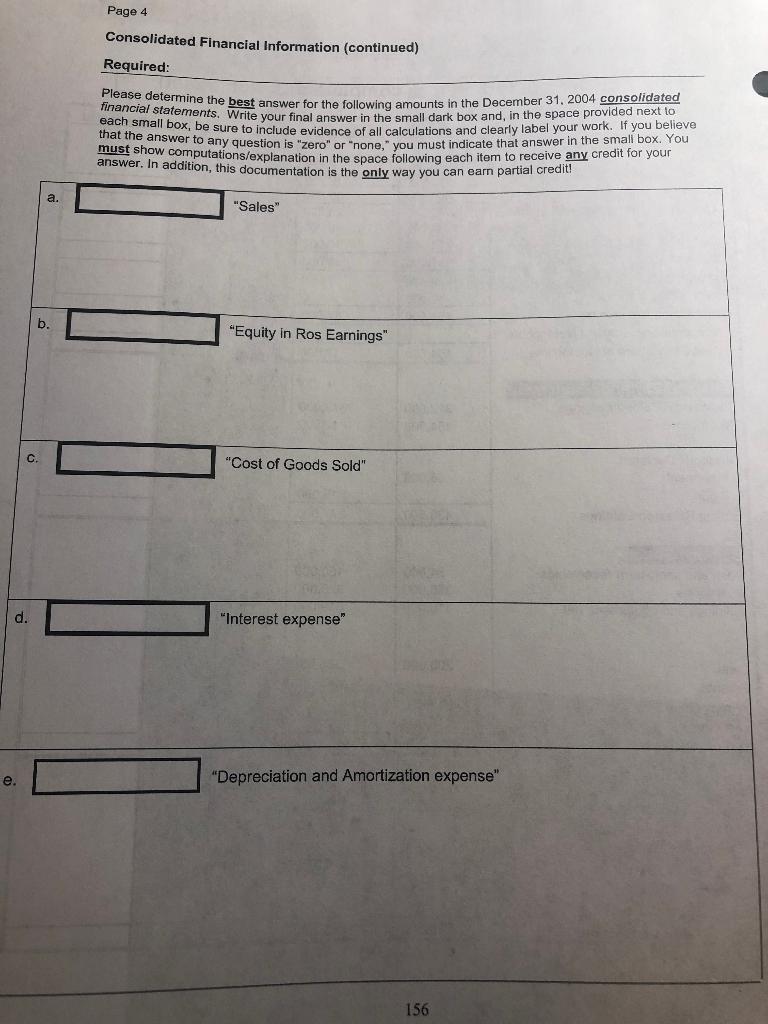

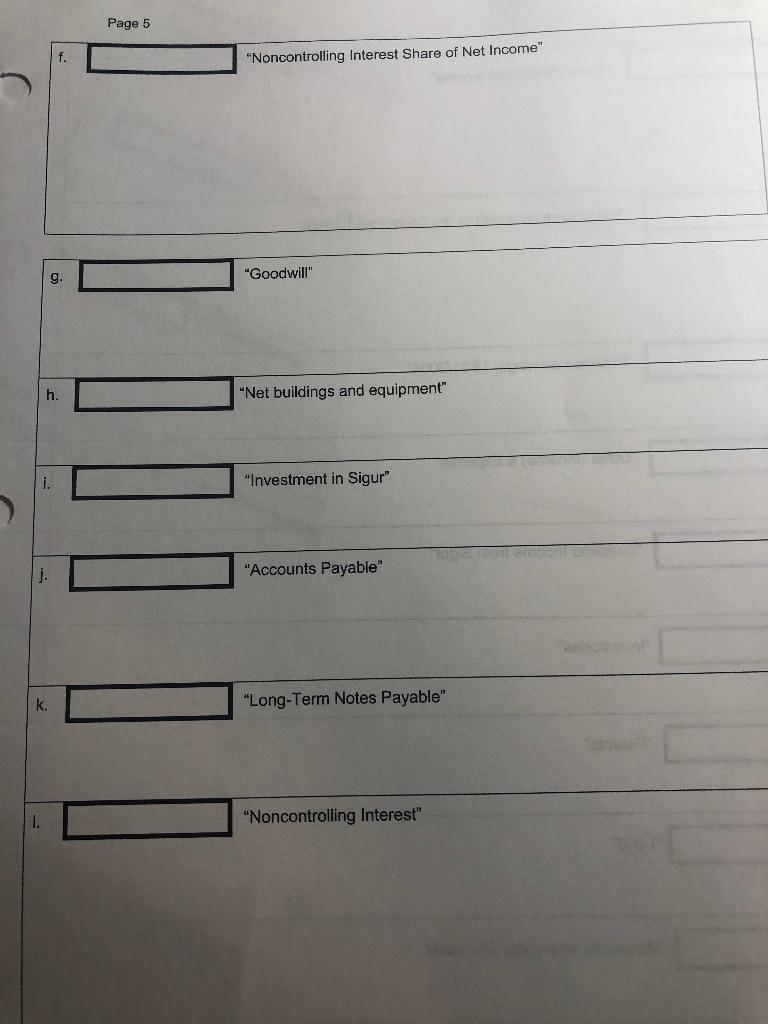

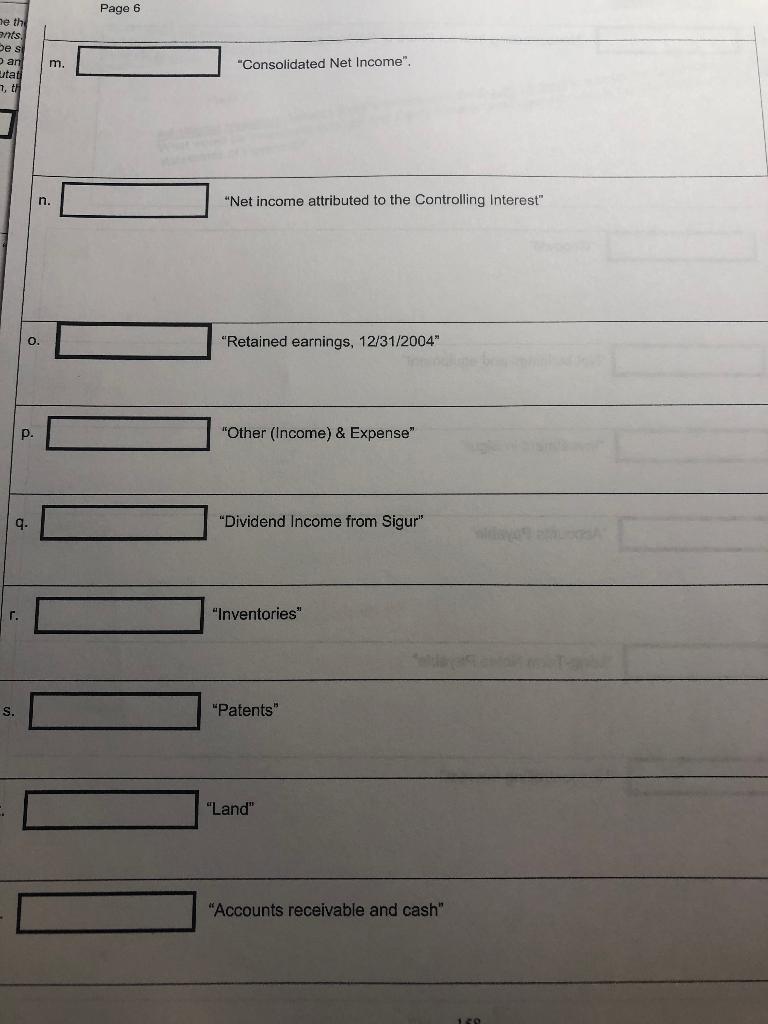

Pavement Corp. ("Pavernent) nas been operating sinoe 1398. Ht is now Docember 31, 2004, and Pavement is about to prepare consolidated finendial etetements for Favement and ts subeidiary. Sigur. Co Sigur"), Pavement acquired 80 percent of the outstanding common stock of Sigur on January 1, 2004, for $1,416.000, An Independent appraisal indicated that the remaining 20% Interest in Sigur in worth $354,000. On the acquisition date, Sigur reported ownars' oquity of $1,375.000. The fair values of the net assets of Sigur are equal to their book velues except for the following. Dr (Cr) Book Value $ 350,000 388,000 160,000 (100.00) Fair Value Account Inventories Land $ 260.C00 408 000 210.000 (90,000) Patents Long-term noles payabie Assumptons on the acquisit on date: A1: The tax bases of the net assets are equal to their consolidated irancial bases, A2: nether coinpany has any adsitional notes payable and Sigur's long-term notes payable are interest bearing and are due in full on December 31, 2013. Promiums anc discounts are amortized using the straight-line method, A3: all the inventory was sold during 2004, and A4: the patents have a 10-year ramaining useful life. Unconsolidated equity Investments: Pavement acquired 30 percent of the outstanding shares ol Ros voting common slock on January 1, 1999. At the acquisition date, Pavement paid $300,000, which was equal to 30 percent of the book vaiue of not assets for Ros, In addition, on the date of Pavement's acquisition, all identifiable net assets had book values equal to their fair values. Ros reported $100,000 of nel income during 2004. Pavement's books reflect the full equity method of accounting for Ros, Upstream On January 2, 2004, Sigur sold equipment wilth an original cost of $100,000 and a carrying value of $57,000 to Pavement for $36,000. The equipment had a remaining ife of thre years and was depreciated using the straight-line method by both companles. Page 2 Upstream: During 2004, Sigur sold merchandise to Pavement for $60.000, which included profit of $20,000. At December 31, 2004, half of this merchandise remained in Pavement's inventory. Downstream: During 2004, Pavement sold merchandise to Sigur for $50,000. Sigur sold all of these goods to non- affiliates during 2004. At December 31, 2004, Sigur still owed Pavement payment for half of the intercompany purchases that occurred during the year 2004. Current Accounting Information: A consolidation worksheet for the year ended December 31, 2004 is presented on the next page. The requirements for this problem start on the page after the worksheet. Please note that this worksheet is only presented to you as a source of current financial information and (in some perverse way) as a source of comfort; you are not required to complete the worksheet! Pavement uses the Cost Method to account for its investment in Sigur and the Equity Method to account for its investment in Ros Page 4 Consolidated Financial Information (continued) Required: Finangio sterimine the best answer for the following amounts in the December 31. 2004 consolldated rancial statements, Write your final answer in the small dark box and, in the space provided next to that the pox, be sure to include evidence of all calculations and clearly label your work. If you believe must show computations/explanation in the space following each item to receive any credit for your answer. In addition, this documentation is the only way you can earn partial crediti a. "Sales" b. "Equity in Ros Earnings" C. "Cost of Goods Sold" d. "Interest expense" . "Depreciation and Amortization expense" 156 Page 5 "Noncontrolling Interest Share of Net Income" g. "Goodwill" h. "Net buildings and equipment" "Investment in Sigur" ont j. "Accounts Payable" "Long-Term Notes Payable" 1. "Noncontrolling Interest" Page 6 De the ants De s o an utat 7, th m. "Consolidated Net Income", n. "Net income attributed to the Controlling Interest" O. "Retained earnings, 12/31/2004" . "Other (Income) & Expense" q. "Dividend Income from Sigur" . "Inventories" S. "Patents" "Land" "Accounts receivable and cash" 1111|

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

To solve this problem we need to determine the values for various items on the consolidated financial statements Heres a stepbystep approach for each required amount a Sales 1 Sales from Sigur to Pave... View full answer

Get step-by-step solutions from verified subject matter experts