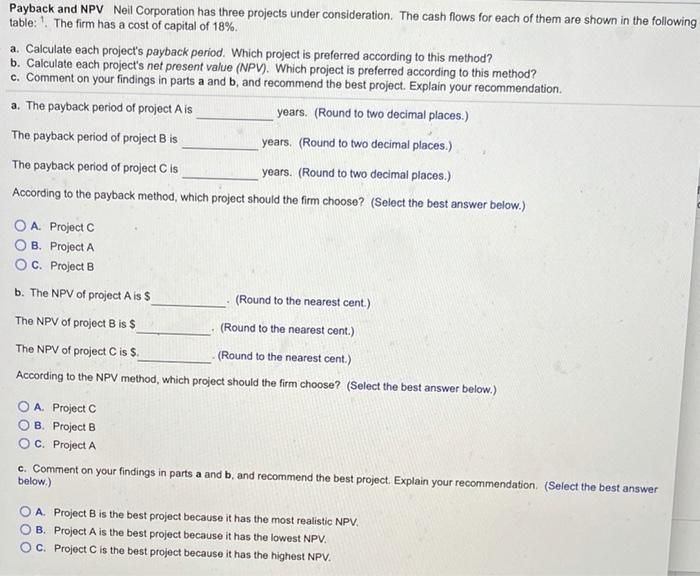

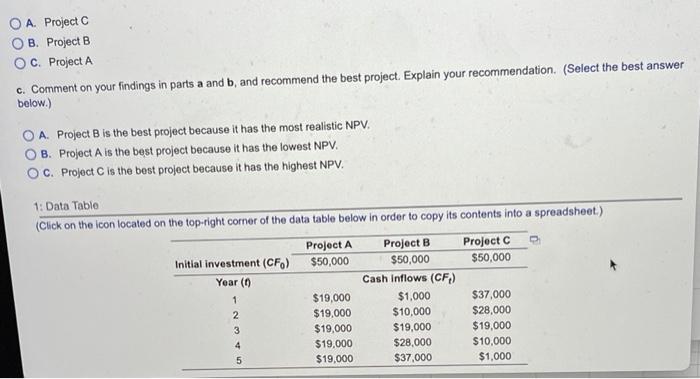

Payback and NPV Neil Corporation has three projects under consideration. The cash flows for each of them are shown in the following table. The firm has a cost of capital of 18%. a. Calculate each project's payback period. Which project is preferred according to this method? b. Calculate each project's net present value (NPV). Which project is preferred according to this method? c. Comment on your findings in parts a and b, and recommend the best project. Explain your recommendation. a. The payback period of project Ais years. (Round to two decimal places.) The payback period of project is years. (Round to two decimal places.) The payback period of project is years. (Round to two decimal places.) According to the payback method, which project should the firm choose? (Select the best answer below.) O A Project C B. Project A C. Project B b. The NPV of project Ais $ (Round to the nearest cent.) The NPV of project B is $ (Round to the nearest cent.) The NPV of project Cis 5 (Round to the nearest cent.) According to the NPV method, which project should the firm choose? (Select the best answer below.) A. Project B. Project B OC. Project A c. Comment on your findings in parts a and b, and recommend the best project. Explain your recommendation (Select the best answer below.) O A Project Bis the best project because it has the most realistic NPV. O B. Project A is the best project because it has the lowest NPV. OC. Project C is the best project because it has the highest NPV. A. Project C OB. Project B OC. Project A c. Comment on your findings in parts a and b, and recommend the best project. Explain your recommendation. (Select the best answer below.) O A. Project B is the best project because it has the most realistic NPV. B. Project A is the best project because it has the lowest NPV. OC. Project C is the best project because it has the highest NPV. 1: Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Project A Project B Project C Initial investment (CF) $50,000 $50,000 $50,000 Year (0) Cash Inflows (CF) 1 $19,000 $1,000 $37,000 2 $19,000 $10,000 $28,000 3 $19,000 $19,000 $19,000 4 $19,000 $28,000 $10,000 5 $19,000 $37,000 $1,000