Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Payback comparisons Nova Products has a 4 -year maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose

Payback comparisonsNova Products has a

4-year

maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose between two alternatives. The first machine requires an initial investment of $9,000

and generates annual after-tax cash inflows of $3,000

for each of the next 10

years. The second machine requires an initial investment of $10,000

and provides an annual cash inflow after taxes of $2,000

for 24

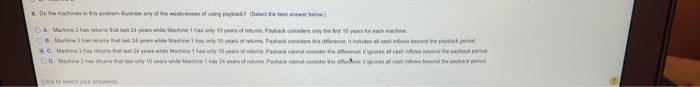

years. a.Determine the payback period for each machine.

b.Comment on the acceptability of the machines, assuming that they are independent projects.

c.

Which

machine should the firm accept? Why? d.Do the machines in this problem illustrate any of the weaknesses of using payback?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started