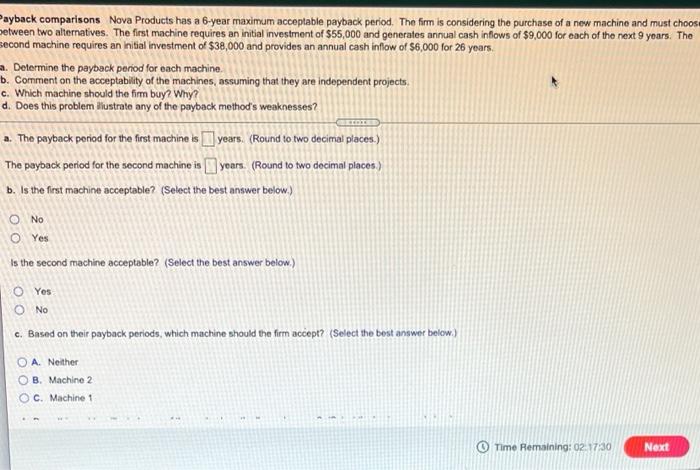

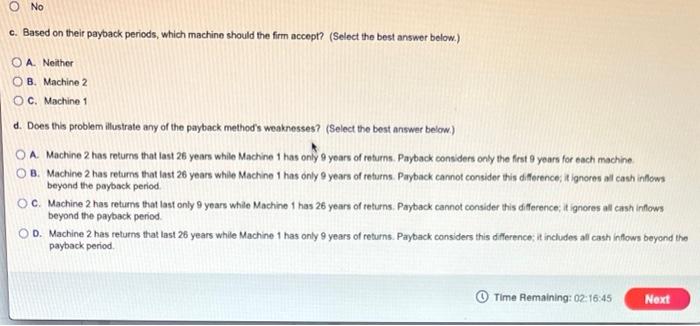

Payback comparisons Nova Products has a 6-year maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose between two alternatives. The first machine requires an initial investment of $65,000 and generates annual cash inflows of $9,000 for each of the next 9 years. The second machine requires an initial investment of $38,000 and provides an annual cash inflow of $6,000 for 26 years. a. Determine the payback period for each machine. b. Comment on the acceptability of the machines, assuming that they are independent projects c. Which machine should the firm buy? Why? d. Does this problem llustrato any of the payback method's weaknesses? a. The payback period for the first machine is years. (Round to two decimal places.) The payback period for the second machine is yours. (Round to two decimal places.) b. Is the first machine acceptable? (Select the best answer below.) O No Yes Is the second machine acceptable? (Select the best answer below.) O Yes O No c. Based on their payback periods, which machine should the firm accept? (Select the best answer below) O A. Neither OB Machine 2 C. Machine 1 Time Remaining: 02:17:30 Next c. Based on their payback periods, which machine should the firm accept? (Select the best answer below.) OA. Neither OB. Machine 2 OC. Machine 1 d. Does this problem illustrato any of the payback method's weaknesses? (Select the best answer below) OA Machine 2 has returns that fast 25 years while Machine 1 has only a years of returns. Payback considers only the first years for each machine OB. Machine 2 has returns that last 26 years while Machine 1 has only years of returns. Payback cannot consider this difference in ignoron al cathindows beyond the payback period OC Machine 2 has returns that tast only 9 years while Machine t has 26 years of returns Payback cannot consider this diference; it ignores al cash indows beyond the payback period OD. Machine 2 has returns that last 26 years while Machine 1 has only 9 years of returns. Payback considers this difference; it includes all cash inflows beyond the payback period Time Remaining: 02:16:45 Next