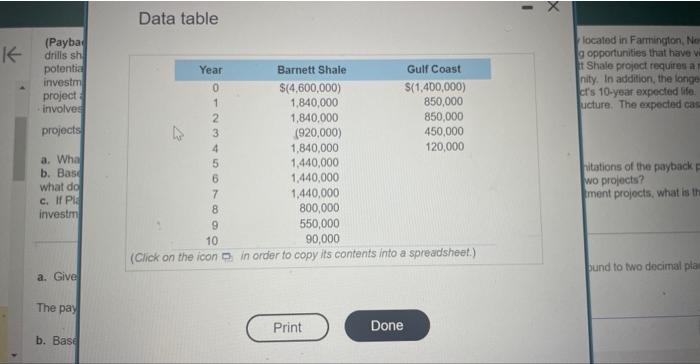

(Payback period and NPV calculations) Plato Energy is an oll and gas exploration and dovelopment company located in Farmington. Now Mowco. The conpowy drills shallow wells in hopes of finding significant of and gas deposits. The firm is considering two different driling opportunities that have very different procuction potentials. The first is in the Barnelt Shale region of central Texas and the other is in the Gult Coast. The Barnot Shale project lequires a much iargot initial investment but provides cash flows (it successful) over a much longer period of tme than the Guif Coast oppontunty, In adoifion, the langer life of the Barnelt shat projoct ahso results in additional expencitures in year 3 of the project to onhance production throughout the project's 10-year expeded ife. This expenditure involves pumping either water or CO2 down into the wells in order to increase the llow of oll and gas from the structure. The expected cash fows far ine two projocts are as follows: a. What is the payback period for each of the two projects? b. Based on the payback periods, which of the two projocts appears to be the best altornatwe? What are the limntabions of the payback period rarking? That is. what does the payback peniod not consider that is important in dotermining the value creation potential of these fwo projects? c. If Plato's management uses a discount rate of 19.1 percent to oviluate the present valises of its energy investment projocts, what is the NPV of the tho preposed investments? a. Given the cash flow information in the table, the payback period of the Baznett Staje project is years. (Round to wo docinal placos ) The payback period of the Gulf Casst project is years. (Riound to two decimal plabes) b. Based on the payback periods calculated above, the project which looks best using the payback critonion is Data table witations of the mo projocts? (Payback period and NPV calculations) Plato Energy is an oil and gas exploration and development company localod in Farmington, New Monco. The conmeny : a. Given the cash flow information in the table, the payback period of the Bamott Shate projoct is years, (Roind to huo fecimai glaces.) The payback period of the Gull Coast project is years. (Round to two decimal placeo.) b. Based on the payback periods calculatod above, the projoct which looks best using the payback citanion is drop-down menu) Which of the following are limitations of the payback period ranking, that is, what doos the payback poniod not o (Select tram the creation potential of these two projects? (Select the best choice below) A. The payback method ignores the time value of money. B. There is no clear-cut way to dofine the cutot criterion loe the piyyback poriod that is tied to the value cref c. The payback method ignores cash fows that are generated by the project beyond the end of the paryback period. D. All of the above. (Payback period and NPV calculations) Plato Energy is an oil and gas exploration and development company located in Farrington, Now Mexico. The comparry creation potential of these two projects! (Seject the best choice pewow.) A. The payback method ignores the time value of money. B. There is no clear-cut way to define the cutoff criterion for the payback period that is tied to the value creation potential of the nvestment: C. The payback method ignores cash llows that are generated by the projoct beyond the ond of the paryback period. D. All of the above. c. If Plato's managoment uses a discount rate of 19.1% to evaluate the present values of its energy investiment projects, then the NPV of the Barnat Brate proped is $ (Round to the riearest doillar.) It Plato's management uses a discount rate of 19.1% to evaluate the present vatues of iss energy investnont propects. men the NPV of the Guil Coast promet a (Round to the nearest dollar.) d. The value that will be created for Plato by the acceplance of the Bamett Shale projoct is (Round io the nearect dollar.) The value that will be created for Plato by the acceptance of the Gulf Coast project is ? (Round to the nearost dolla.)