Answered step by step

Verified Expert Solution

Question

1 Approved Answer

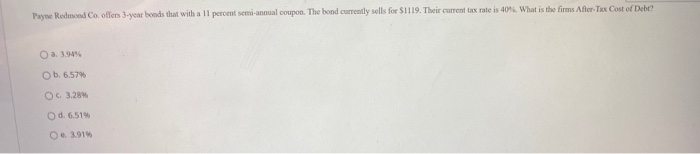

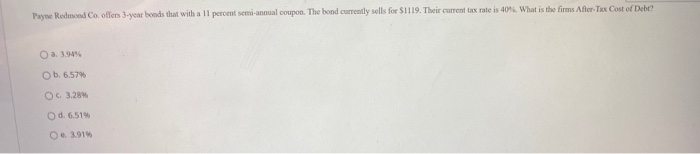

Payme Remed Co offers 3-year boods that with all peront semi-annual coupon. The bond currently sells for $1119. Their current tax rate is 40%. What

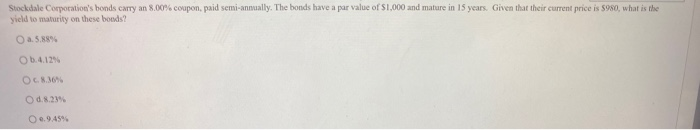

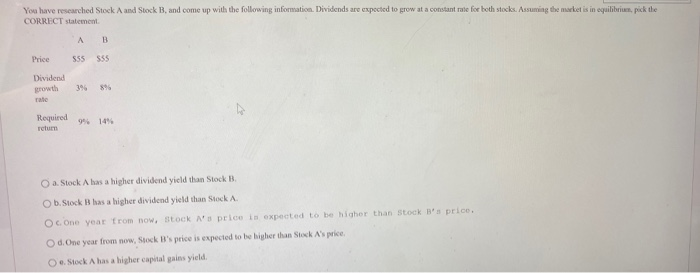

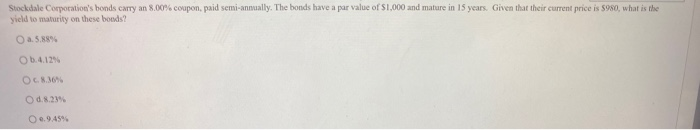

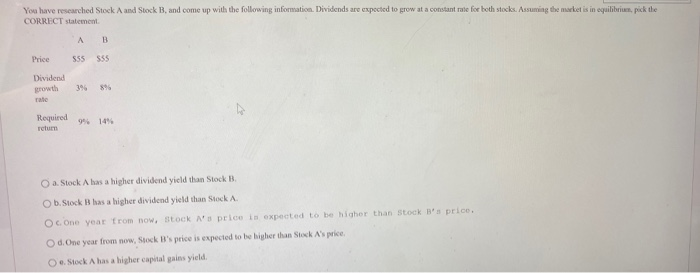

Payme Remed Co offers 3-year boods that with all peront semi-annual coupon. The bond currently sells for $1119. Their current tax rate is 40%. What is the firms After Tax Cost of Debt? a. 3.94% b. 6.57% OC 3.28 Od. 6.51% O. 3.91% Stockdale Corporation's bonds carry an 8.00% coupon, paid semi-annually. The bonds have a par value of $1,000 and mature in 15 years. Given that their current price is $980, what is the yield to maturity on these bonds? a. 5,88% 6.4.12% OC8.36% 0.8.29% O 0.9.45% You have researched Stock A and Stock B, and come up with the following information Dividends are expected to grow at a constant rate for both stocks. Assuming the market is in equilibrius, pick the CORRECT statement B Price 555 555 Dividend 39 896 rate Required 14% retum aStock A has a higher dividend yield than Stock B b. Stock Bhas a higher dividend yield than Stock A OC One year from now, Stock A's price is expected to be higher than stock B's price, Od. One year from now, Stock B's price is expected to be higher than Stock A's price, O. Stock A has a higher capital gains yield

Payme Remed Co offers 3-year boods that with all peront semi-annual coupon. The bond currently sells for $1119. Their current tax rate is 40%. What is the firms After Tax Cost of Debt? a. 3.94% b. 6.57% OC 3.28 Od. 6.51% O. 3.91% Stockdale Corporation's bonds carry an 8.00% coupon, paid semi-annually. The bonds have a par value of $1,000 and mature in 15 years. Given that their current price is $980, what is the yield to maturity on these bonds? a. 5,88% 6.4.12% OC8.36% 0.8.29% O 0.9.45% You have researched Stock A and Stock B, and come up with the following information Dividends are expected to grow at a constant rate for both stocks. Assuming the market is in equilibrius, pick the CORRECT statement B Price 555 555 Dividend 39 896 rate Required 14% retum aStock A has a higher dividend yield than Stock B b. Stock Bhas a higher dividend yield than Stock A OC One year from now, Stock A's price is expected to be higher than stock B's price, Od. One year from now, Stock B's price is expected to be higher than Stock A's price, O. Stock A has a higher capital gains yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started