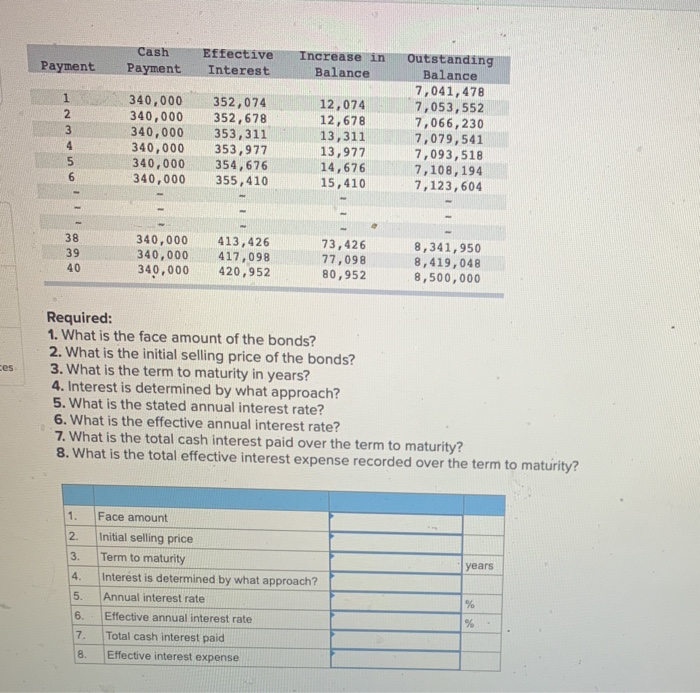

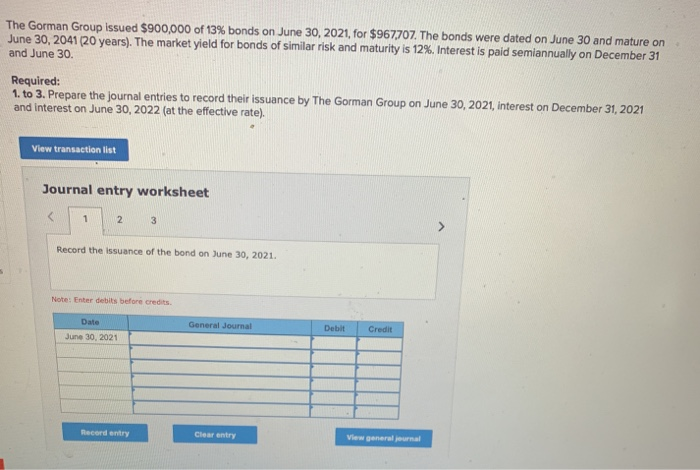

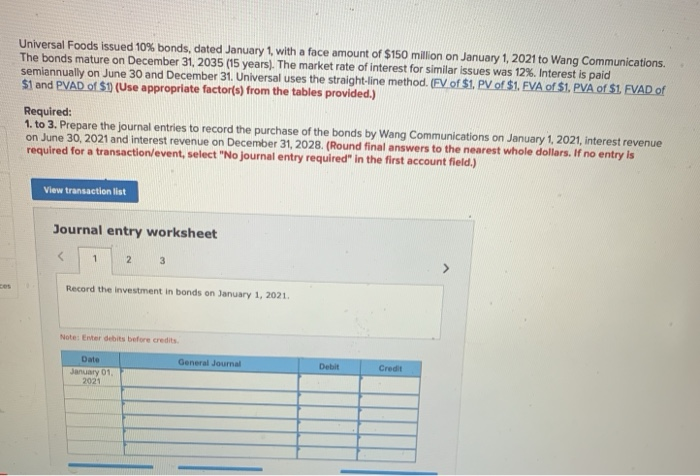

Payment Cash Payment Effective Interest Increase in Balance 1 2 3 4 5 6 340,000 340,000 340,000 340,000 340,000 340,000 352,074 352,678 353,311 353,977 354,676 355, 410 12,074 12,678 13,311 13,977 14,676 15,410 Outstanding Balance 7,041, 478 7,053,552 7,066,230 7,079,541 7,093,518 7,108,194 7,123, 604 340,000 340,000 340,000 413,426 417,098 420,952 73,426 77,098 80,952 8,341,950 8,419,048 8,500,000 ces Required: 1. What is the face amount of the bonds? 2. What is the initial selling price of the bonds? 3. What is the term to maturity in years? 4. Interest is determined by what approach? 5. What is the stated annual interest rate? 6. What is the effective annual interest rate? 7. What is the total cash interest paid over the term to maturity? 8. What is the total effective interest expense recorded over the term to maturity? 1. 2. 3. years 4. 5. Face amount Initial selling price Term to maturity Interest is determined by what approach? Annual interest rate Effective annual interest rate Total cash interest paid % 6. % 7. 8. Effective interest expense The Gorman Group issued $900,000 of 13% bonds on June 30, 2021, for $967707. The bonds were dated on June 30 and mature on June 30, 2041 (20 years). The market yield for bonds of similar risk and maturity is 12%. Interest is paid semiannually on December 31 and June 30 Required: 1. to 3. Prepare the journal entries to record their issuance by The Gorman Group on June 30, 2021, interest on December 31, 2021 and interest on June 30, 2022 (at the effective rate). View transaction list Journal entry worksheet 1 2 3 > Record the issuance of the bond on June 30, 2021. Note: Enter debits before credits General Journal Date June 30, 2021 Debit Credit Record entry Clear entry View general mal Universal Foods issued 10% bonds, dated January 1, with a face amount of $150 million on January 1, 2021 to Wang Communications. The bonds mature on December 31, 2035 (15 years). The market rate of interest for similar issues was 12%. Interest is paid semiannually on June 30 and December 31. Universal uses the straight-line method. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: 1. to 3. Prepare the journal entries to record the purchase of the bonds by Wang Communications on January 1, 2021, interest revenue on June 30, 2021 and interest revenue on December 31, 2028. (Round final answers to the nearest whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the investment in bonds on January 1, 2021. Note: Enter debits before credits General Journal Date January 01 2021 Debit Credit