Answered step by step

Verified Expert Solution

Question

1 Approved Answer

payment to be purchased an 500 per mon 7. A. B. C. D. B. C. D. A. ARCA D. Ramirez Wellness borrowed RM150,000 for five

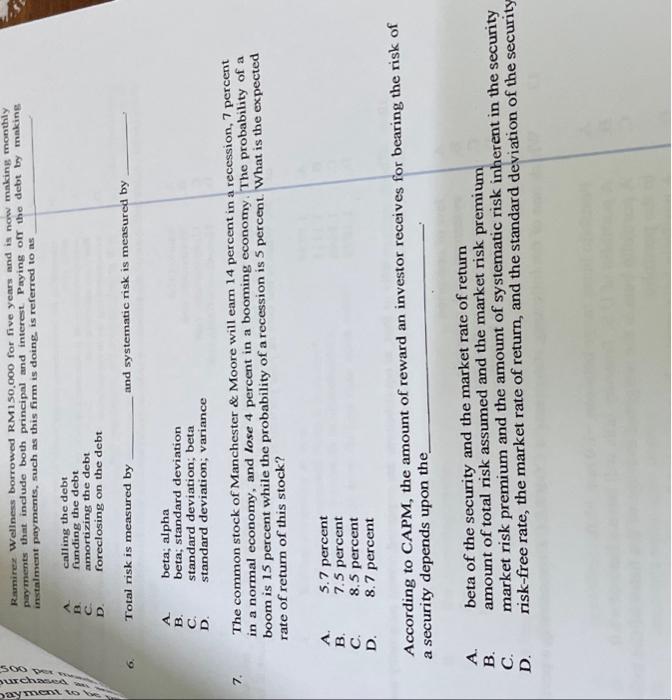

payment to be purchased an 500 per mon 7. A. B. C. D. B. C. D. A. ARCA D. Ramirez Wellness borrowed RM150,000 for five years and is now making monthly payments that include both principal and interest. Paying off the debt by making instalment payments, such as this firm is doing, is referred to as calling the debt funding the debt Total risk is measured by amortizing the debt foreclosing on the debt beta; alpha beta; standard deviation standard deviation; beta standard deviation; variance The common stock of Manchester & Moore will eam 14 percent in a recession, 7 percent in a normal economy, and lose 4 percent in a booming economy. The probability of a boom is 15 percent while the probability of a recession is 5 percent. What is the expected rate of return of this stock? 5.7 percent 7.5 percent and systematic risk is measured by 8.5 percent 8.7 percent According to CAPM, the amount of reward an investor receives for bearing the risk of a security depends upon the 8 beta of the security and the market rate of return amount of total risk assumed and the market risk premium market risk premium and the amount of systematic risk inherent in the security risk-free rate, the market rate of return, and the standard deviation of the security

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started