Question

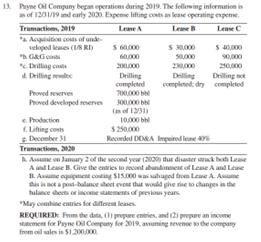

Payne Oil Company began operations during 2019. The following information is as of 12/31/19 and early 2020. Expense lifting costs as lease operating expense. Transactions,

Payne Oil Company began operations during 2019. The following information is as of 12/31/19 and early 2020. Expense lifting costs as lease operating expense.

Transactions, 2019 Lease A Lease B Lease C *a. Acquisition costs of undeveloped leases (1/8 RI) $ 60,000 $ 30,000 $ 40,000 *b. G&G costs 60,000 50,000 90,000 *c. Drilling costs 200,000 230,000 250,000 d. Drilling results: Drilling completed Drilling completed; dry Drilling not completed Proved reserves 700,000 bbl Proved developed reserves 300,000 bbl (as of 12/31) e. Production 10,000 bbl f. Lifting costs $ 250,000 g. December 31 Recorded DD&A Impaired lease 40% Transactions, 2020 h. Assume on January 2 of the second year (2020) that disaster struck both Lease A and Lease B. Give the entries to record abandonment of Lease A and Lease B. Assume equipment costing $15,000 was salvaged from Lease A. Assume this is not a postbalance sheet event that would give rise to changes in the balance sheets or income statements of previous years. *May combine entries for different leases. REQUIRED: From the data, (1) prepare entries, and (2) prepare an income statement for Payne Oil Company for 2019, assuming revenue to the company from oil sales is $1,200,000.

A. Pryse O1 Cempary began eperaticns burieg 2019. The fellowing informution is an of 1331/9 axd early 2030 Expense lifting colts an kave operating espense. "Ming centure entries for difeetal leaks. wascmeet for Prone OlCompiny for 2019 , avuming sevenae to the eompury from oll sales is \$1 100,000 . A. Pryse O1 Cempary began eperaticns burieg 2019. The fellowing informution is an of 1331/9 axd early 2030 Expense lifting colts an kave operating espense. "Ming centure entries for difeetal leaks. wascmeet for Prone OlCompiny for 2019 , avuming sevenae to the eompury from oll sales is \$1 100,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started