Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Payroll Accounting Swordstone Market, Inc., has three employees, Kindal Boyd, Brent Debenham, and Cesar Gaona. Summaries of their salaries and withholdings are as follows: Gross

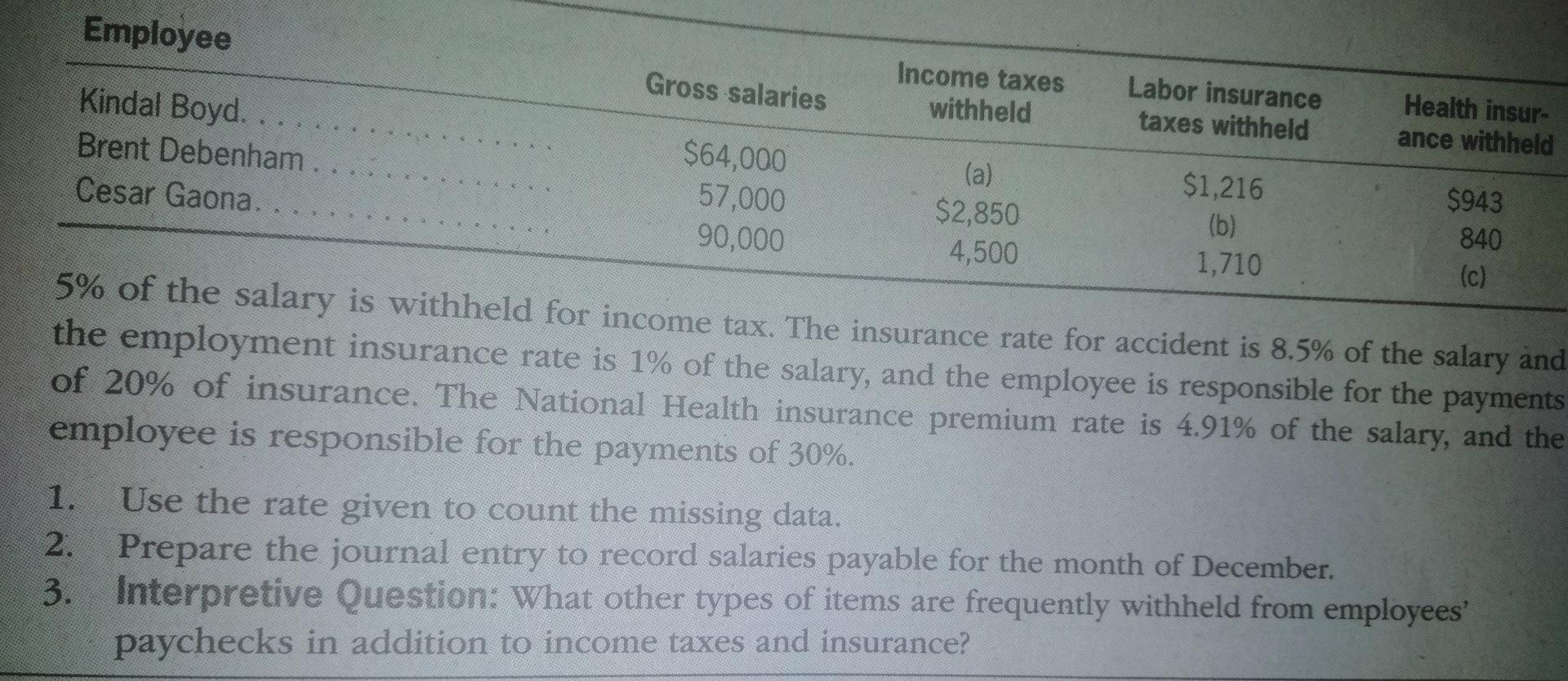

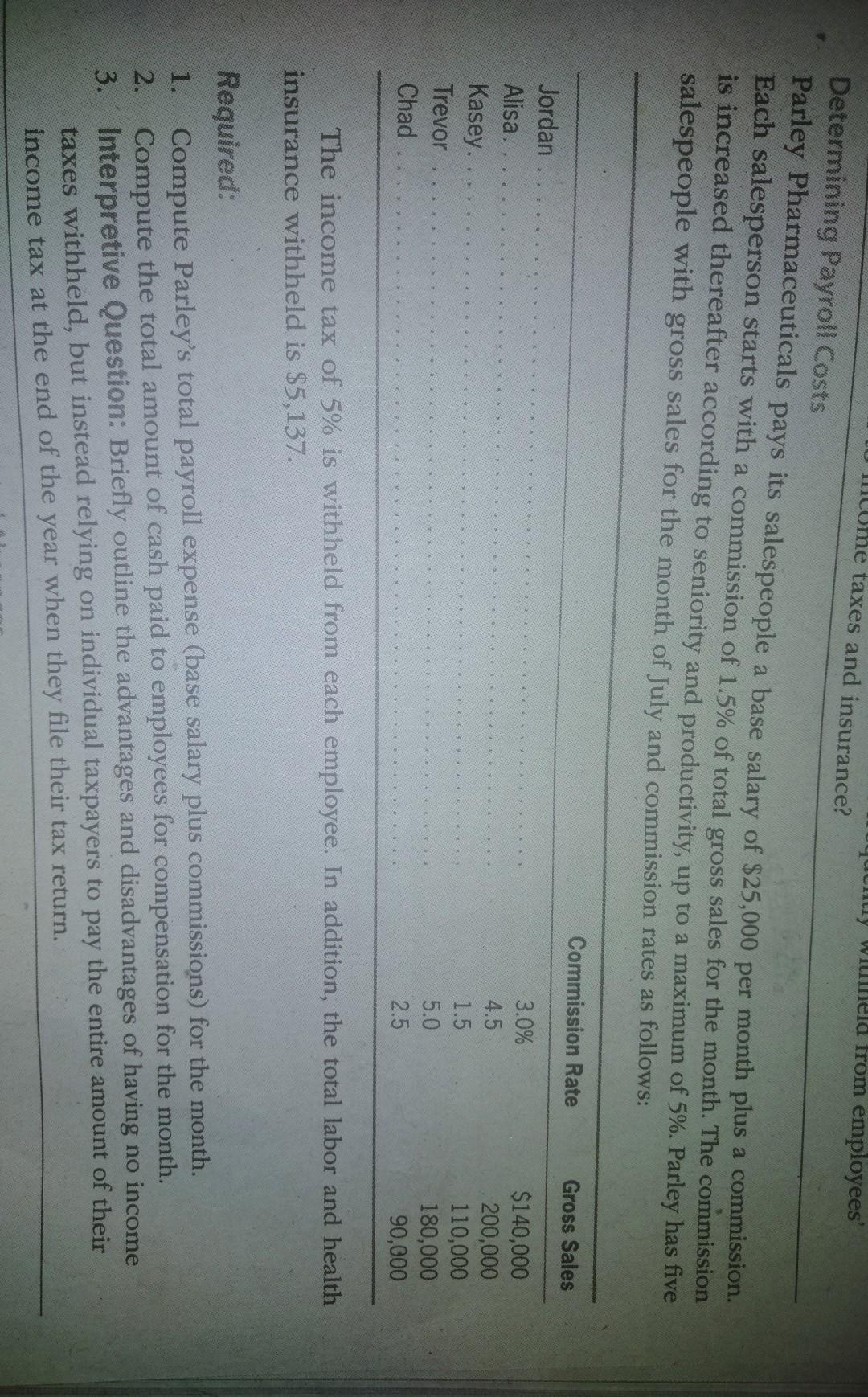

Payroll Accounting Swordstone Market, Inc., has three employees, Kindal Boyd, Brent Debenham, and Cesar Gaona. Summaries of their salaries and withholdings are as follows: Gross salaries Employee Income taxes Labor insurance Health insur- withheld taxes withheld Kindal Boyd. ance withheld Brent Debenham $64,000 (a) $1,216 $943 57,000 Cesar Gaona.. $2,850 (b) 840 90,000 4,500 1,710 (c) 5% of the salary is withheld for income tax. The insurance rate for accident is 8.5% of the salary and the employment insurance rate is 1% of the salary, and the employee is responsible for the payments of 20% of insurance. The National Health insurance premium rate is 4.91% of the salary, and the employee is responsible for the payments of 30%. 1. Use the rate given to count the missing data. 2. Prepare the journal entry to record salaries payable for the month of December. 3. Interpretive Question: What other types of items are frequently withheld from employees' paychecks in addition to income taxes and insurance? LY wilmela from employees' Hume taxes and insurance? Determining Payroll Costs Parley Pharmaceuticals pays its salespeople a base salary of $25,000 per month plus a commission. Each salesperson starts with a commission of 1.5% of total gross sales for the month. The commission is increased thereafter according to seniority and productivity, up to a maximum of 5%. Parley has five salespeople with gross sales for the month of July and commission rates as follows: Commission Rate Gross Sales Jordan Alisa, Kasey. Trevor Chad 3.0% 4.5 1.5 5.0 2.5 $140,000 200,000 110,000 180,000 90,000 The income tax of 5% is withheld from each employee. In addition, the total labor and health insurance withheld is $5,137. Required: 1. Compute Parley's total payroll expense (base salary plus commissions) for the month. 2. Compute the total amount of cash paid to employees for compensation for the month. 3. Interpretive Question: Briefly outline the advantages and disadvantages of having no income taxes withheld, but instead relying on individual taxpayers to pay the entire amount of their income tax at the end of the year when they file their tax return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started