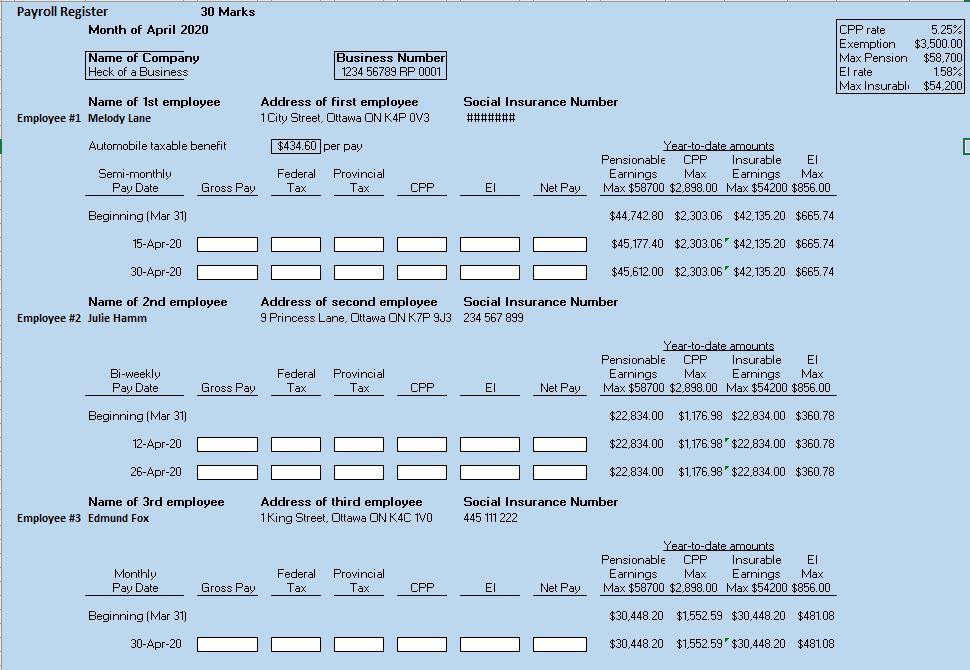

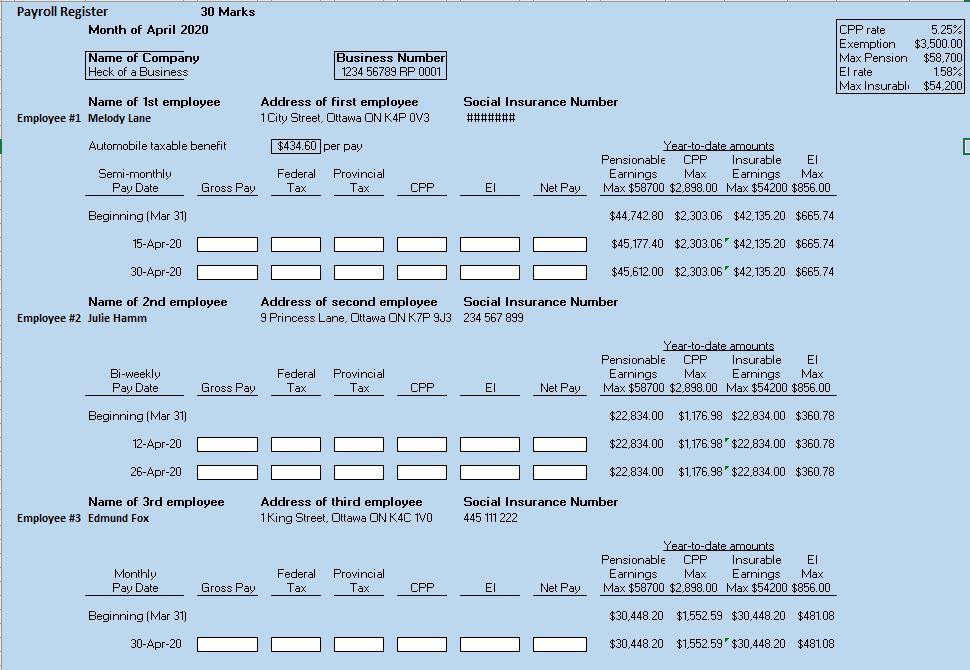

Payroll Register 30 Marks Month of April 2020 Name of Company Heck of a Business Business Number 1234 56789 RP 0001 CPP rate 5.25% Exemption $3,500.00 Max Pension $58,700 El rate 1.58% Max Insurable $54,200 Name of 1st employee Employee #1 Melody Lane Address of first employee 1 City Street, Ottawa ON K4P OV3 Social Insurance Number ####### Automobile taxable benefit $434.60 per pay Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $58700 $2,898.00 Max $54200 $856.00 Semi-monthly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay $44,742.80 $2,303.06 $42,135.20 $665.74 Beginning (Mar 31) 15-Apr-20 $45,177.40 $2,303.06' $42,135.20 $665.74 30-Apr-20 $45,612.00 $2,303.06' $42,135.20 $665.74 Name of 2nd employee Address of second employee Social Insurance Number Employee #2 Julie Hamm 9 Princess Lane, Ottawa ON K7P 9J3 234 567 899 Year-to-date amounts Pensionable CPP Insurable Bi-weekly Federal Provincial Earnings Max Earnings Max Pay Date Gross Pay Tax Tax CPP Net Pay Max $58700 $2,898.00 Max $54200 $856.00 Beginning (Mar 31) $22,834.00 $1,176.98 $22,834.00 $360.78 12-Apr-20 $22,834.00 $1,176.98'$22,834.00 $360.78 BABAE 26-Apr-20 $22,834.00 $1,176.98 $22,834.00 $360.78 Name of 3rd employee Employee #3 Edmund Fox Address of third employee 1 King Street, Ottawa ON K4C 1VO Social Insurance Number 445 111 222 Monthly Pay Date Federal Tax Provincial Tax Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $58700 $2,898.00 Max $54200 $856.00 Gross Pay CPP Net Pay Beginning (Mar 31) $30,448.20 $1,552.59 $30,448.20 $48108 30-Apr-20 $30,448.20 $1,552.59 $30,448.20 $481.08 Payroll Register 30 Marks Month of April 2020 Name of Company Heck of a Business Business Number 1234 56789 RP 0001 CPP rate 5.25% Exemption $3,500.00 Max Pension $58,700 El rate 1.58% Max Insurable $54,200 Name of 1st employee Employee #1 Melody Lane Address of first employee 1 City Street, Ottawa ON K4P OV3 Social Insurance Number ####### Automobile taxable benefit $434.60 per pay Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $58700 $2,898.00 Max $54200 $856.00 Semi-monthly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay $44,742.80 $2,303.06 $42,135.20 $665.74 Beginning (Mar 31) 15-Apr-20 $45,177.40 $2,303.06' $42,135.20 $665.74 30-Apr-20 $45,612.00 $2,303.06' $42,135.20 $665.74 Name of 2nd employee Address of second employee Social Insurance Number Employee #2 Julie Hamm 9 Princess Lane, Ottawa ON K7P 9J3 234 567 899 Year-to-date amounts Pensionable CPP Insurable Bi-weekly Federal Provincial Earnings Max Earnings Max Pay Date Gross Pay Tax Tax CPP Net Pay Max $58700 $2,898.00 Max $54200 $856.00 Beginning (Mar 31) $22,834.00 $1,176.98 $22,834.00 $360.78 12-Apr-20 $22,834.00 $1,176.98'$22,834.00 $360.78 BABAE 26-Apr-20 $22,834.00 $1,176.98 $22,834.00 $360.78 Name of 3rd employee Employee #3 Edmund Fox Address of third employee 1 King Street, Ottawa ON K4C 1VO Social Insurance Number 445 111 222 Monthly Pay Date Federal Tax Provincial Tax Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $58700 $2,898.00 Max $54200 $856.00 Gross Pay CPP Net Pay Beginning (Mar 31) $30,448.20 $1,552.59 $30,448.20 $48108 30-Apr-20 $30,448.20 $1,552.59 $30,448.20 $481.08