Question

P.B. Auto manufactures automobiles, vans, and trucks. One of its plants is located in Brantford, where vinyl covers and upholstery fabric are sewn. These are

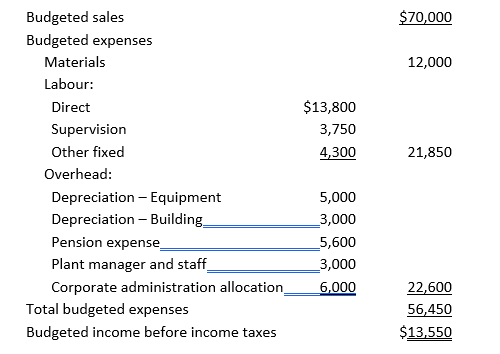

P.B. Auto manufactures automobiles, vans, and trucks. One of its plants is located in Brantford, where vinyl covers and upholstery fabric are sewn. These are used to cover interior seating and other surfaces of P. B. Auto products. The president has just received a report indicating that P.B. Auto could purchase the entire annual output of the Brantford plant from an outside supplier for $34 million. The budget (in thousands) for the Brantford plants operating revenues and expenses for the coming year follows:

- The Purchasing Department was instructed to place blanket orders with major suppliers to ensure the receipt of sufficient materials for the coming year. This has been done. If these orders are cancelled as a consequence of the plant closing, termination charges would amount to 18% of the cost of direct materials.

- . A clause in the contract with its affected union may help some employees; under the terms of the collective agreement, the company must provide employment assistance to its former employees for 12 months after a plant closing. The estimated cost for this would be $2 million for the year.

- The plant manager and her staff would not be affected by the closing of the Hamilton plant. They would still be responsible for administering three other plants in the area.

- The companys discount rate is 12%. Ignore income tax effects. Assume all cash inflows and outflows occur at year-end. The relevant time horizon for projections is a maximum of five years from today.

Perform a segment margin analysis.

The company's discount rate is 12%. Ignore tax effects. Assume all cash inflow and outflows occur at year-end. The relevant tie horizon for projections is a maximum of five year from today.

$70,000 12,000 $13,800 3,750 4,300 21,850 Budgeted sales Budgeted expenses Materials Labour: Direct Supervision Other fixed Overhead: Depreciation - Equipment Depreciation - Building Pension expense Plant manager and staff Corporate administration allocation Total budgeted expenses Budgeted income before income taxes 5,000 3,000 5,600 3,000 6,000 22,600 56,450 $13,550Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started