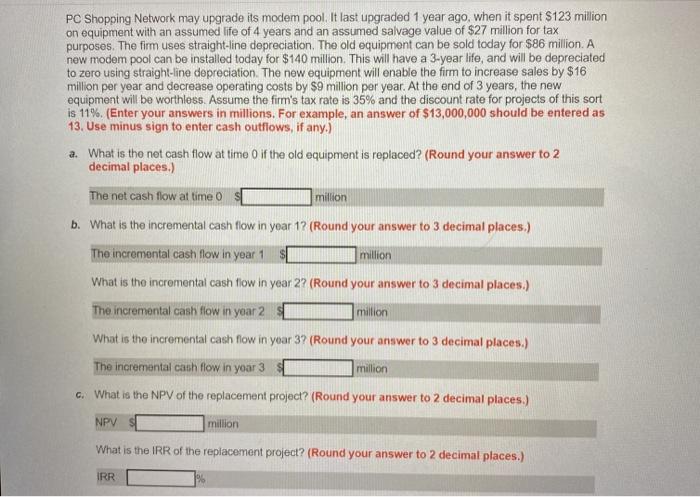

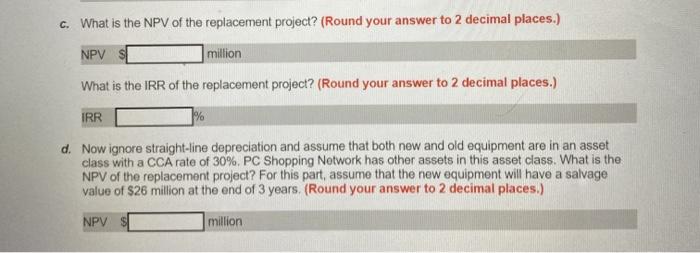

PC Shopping Network may upgrade its modem pool. It last upgraded 1 year ago, when it spent $123 million on equipment with an assumed life of 4 years and an assumed salvage value of $27 million for tax purposes. The firm uses straight-line depreciation. The old equipment can be sold today for $86 million. A new modem pool can be installed today for $140 million. This will have a 3-year life, and will be depreciated to zero using straight-line depreciation. The new equipment will enable the firm to increase sales by $16 million per year and decrease operating costs by $9 million per year. At the end of 3 years, the new equipment will be worthless. Assume the firm's tax rate is 35% and the discount rate for projects of this sort is 11%. (Enter your answers in millions. For example, an answer of $13,000,000 should be entered as 13. Use minus sign to enter cash outflows, if any.) a. What is the net cash flow at time of the old equipment is replaced? (Round your answer to 2 decimal places.) The net cash flow at time 0 million b. What is the incremental cash flow in yoar 12 (Round your answer to 3 decimal places.) The incremental cash flow in year 1 million What is the incremental cash flow in year 2? (Round your answer to 3 decimal places.) The incremental cash flow in year 2 million What is the incremental cash flow in year 3? (Round your answer to 3 decimal places.) The incremental cash flow in yoar 3 million G. What is the NPV of the replacement project? (Round your answer to 2 decimal places.) NPV million What is the IRR of the replacement project? (Round your answer to 2 decimal places.) IRR c. What is the NPV of the replacement project? (Round your answer to 2 decimal places.) NPV million What is the IRR of the replacement project? (Round your answer to 2 decimal places.) IRR d. Now ignore straight-line depreciation and assume that both new and old equipment are in an asset class with a CCA rate of 30%. PC Shopping Network has other assets in this asset class. What is the NPV of the replacement project? For this part , assume that the new equipment will have a salvage value of $26 million at the end of 3 years. (Round your answer to 2 decimal places.) NPV million