Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PCO acquired 80% of the outstanding shares of SCO on January 2, 2022 for P3.250.000, excluding control premium of P125.000. On this date, the

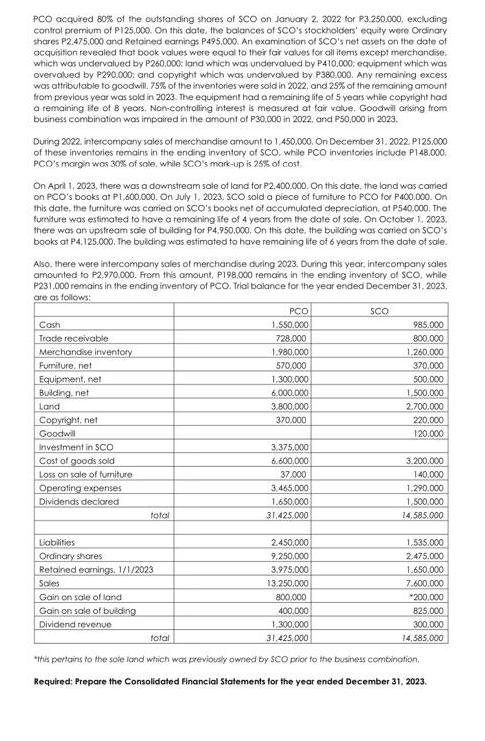

PCO acquired 80% of the outstanding shares of SCO on January 2, 2022 for P3.250.000, excluding control premium of P125.000. On this date, the balances of SCO's stockholders' equity were Ordinary shares P2.475,000 and Retained earnings P495,000. An examination of SCO's net assets on the date of acquisition revealed that book values were equal to their fair values for all items except merchandise, which was undervalued by P260,000: land which was undervalued by P410,000; equipment which was overvalued by P290.000; and copyright which was undervalued by P380.000. Any remaining excess was attributable to goodwill. 75% of the inventories were sold in 2022, and 25% of the remaining amount from previous year was sold in 2023. The equipment had a remaining life of 5 years while copyright had a remaining ite of 8 years. Non-controlling interest is measured at fair value. Goodwill arising from business combination was impaired in the amount of P30.000 in 2022, and P50,000 in 2023. During 2022, intercompany sales of merchandise amount to 1,450,000. On December 31, 2022. P125.000 of these inventories remains in the ending inventory of SCO, while PCO inventories include P148.000, PCO's margin was 30% of sale, while SCO's mark-up is 25% of cost On April 1, 2023, there was a downstream sale of land for P2.400.000. On this date, the land was carried on PCO's books at P1,600,000. On July 1, 2023, SCO sold a piece of furniture to PCO for P400.000. On this date, the furniture was carried on SCO's books net of accumulated depreciation, at P540.000. The furniture was estimated to have a remaining life of 4 years from the date of sale. On October 1, 2023, there was an upstream sale of building for P4.950.000. On this date, the building was carried on SCO's books at P4, 125.000. The building was estimated to have remaining life of 6 years from the date of sale. Also, there were intercompany sales of merchandise during 2023. During this year, intercompany sales amounted to P2.970.000. From this amount, P198.000 remains in the ending inventory of SCO, while P231,000 remains in the ending inventory of PCO. Trial balance for the year ended December 31, 2023, are as follows: Cash Trade receivable Merchandise inventory Furniture, net Equipment, net Building, net Land Copyright, net Goodwill Investment in SCO Cost of goods sold Loss on sale of furniture Operating expenses Dividends declared total Liabilities Ordinary shares Retained earnings. 1/1/2023 Sales Gain on sale of land Gain on sale of building Dividend revenue total PCO 1.550.000 728.000 1.980.000 570,000 1,300,000 6.000.000 3.800.000 370,000 3.375.000 6.600,000 37,000 3,465.000 1.650.000 31,425.000 2.450,000 9,250,000 3,975.000 13.250.000 800,000 400,000 1,300,000 31.425,000 SCO 985.000 800,000 1,260.000 370,000 500.000 1.500.000 2,700.000 220,000 120.000 3.200.000 140.000 1,290,000 1.500.000 14,585.000 1.535.000 2,475.000 1.650.000 7.600.000 *200.000 825.000 300,000 14,585.000 "this pertains to the sole land which was previously owned by SCO prior to the business combination. Required: Prepare the Consolidated Financial Statements for the year ended December 31, 2023.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Statement of Profit and Loss for the year ended December 31 2023 PCO SCO Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started