Answered step by step

Verified Expert Solution

Question

1 Approved Answer

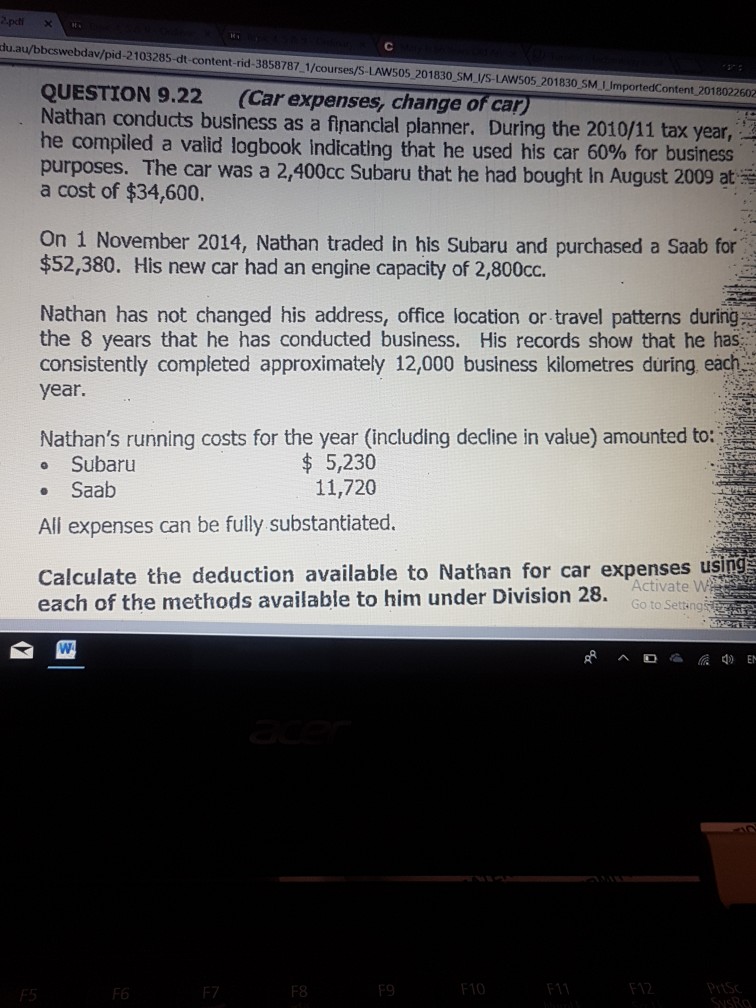

.pdiX du.au/bbcswebdav/pid-2103285-dt-content-rid-3858787 1/courses/S-LAw505 201830 SM /S-LAW505 201830 SM. I ImportedContent 2018022602 QUESTION 9.22 (Car expenses, change of ca Nathan conducts business as a financlal planner.

.pdiX du.au/bbcswebdav/pid-2103285-dt-content-rid-3858787 1/courses/S-LAw505 201830 SM /S-LAW505 201830 SM. I ImportedContent 2018022602 QUESTION 9.22 (Car expenses, change of ca Nathan conducts business as a financlal planner. During the 2010/11 tax year, he compiled a valid logbook indicating that he used his car 60% for business purposes. The car was a 2,400cc Subaru that he had bought In August 2009 at a cost of $34,600. On 1 November 2014, Nathan traded in his Subaru and purchased a Saab for $52,380. His new car had an engine capacity of 2,800cc. Nathan has not changed his address, office location or travel patterns during the 8 years that he has conducted business. His records show that he has consistently completed approximately 12,000 business kilometres during each year Nathan's running costs for the year (including decline in value) amounted to: $5,230 11,720 Subaru e Saab All expenses can be fully substantiated. Calculate the deduction available to Nathan for car expenses usi each of the methods available to him under Division 28. Activate W Go to Setting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started