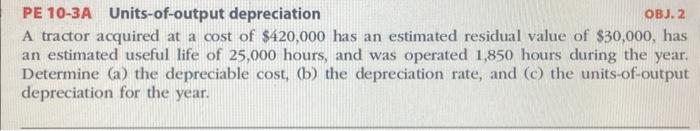

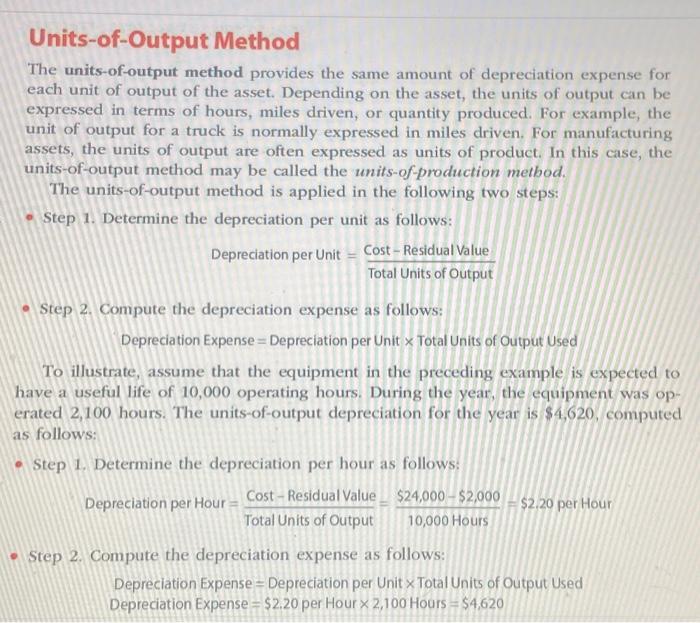

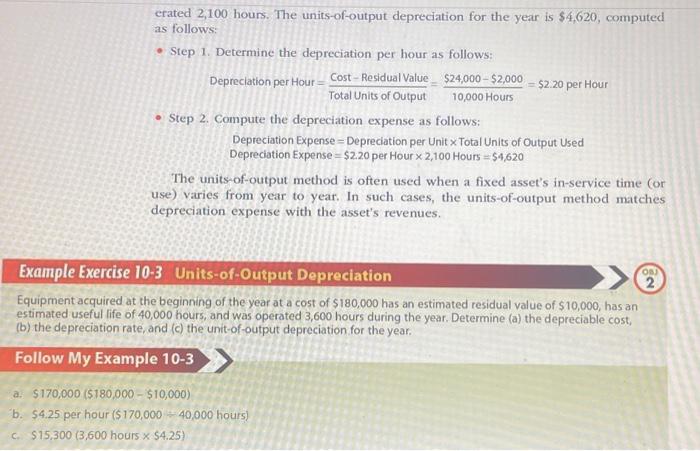

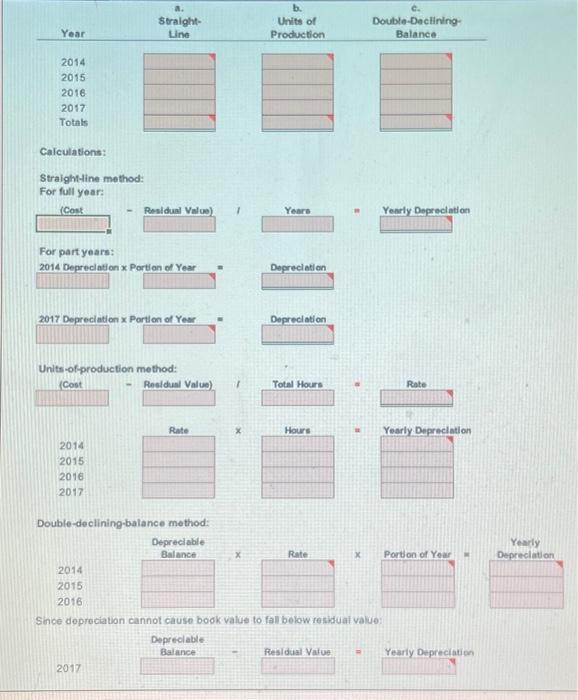

PE 10-3A Units-of-output depreciation OBJ. 2 A tractor acquired at a cost of $420,000 has an estimated residual value of $30,000, has an estimated useful life of 25,000 hours, and was operated 1,850 hours during the year. Determine (a) the depreciable cost, (b) the depreciation rate, and (c) the units-of-output depreciation for the year. Units-of-Output Method The units-of-output method provides the same amount of depreciation expense for each unit of output of the asset. Depending on the asset, the units of output can be expressed in terms of hours, miles driven, or quantity produced. For example, the unit of output for a truck is normally expressed in miles driven. For manufacturing assets, the units of output are often expressed as units of product. In this case, the units-of-output method may be called the units-of-production metbod. The units-of-output method is applied in the following two steps: - Step 1. Determine the depreciation per unit as follows: DepreciationperUnit=TotalUnitsofOutputCostResidualValue - Step 2. Compute the depreciation expense as follows: Depreciation Expense = Depreciation per Unit Total Units of Output Used To illustrate, assume that the equipment in the preceding example is expected to have a useful life of 10,000 operating hours. During the year, the equipment was operated 2,100 hours. The units-of-output depreciation for the year is $4,620, computed as follows: - Step 1. Determine the depreciation per hour as follows: DepreciationperHour=TotalUnitsofOutputCostResidualValue=10,000Hours$24,000$2,000=$2,20perHour erated 2,100 hours. The units-of-output depreciation for the year is $4,620, computed as follows: - Step 1. Determine the depreciation per hour as follows: DepreciationperHour=TotalUnitsofOutputCostResidualValue=10,000Hours$24,000$2,000=$2.20perHour - Step 2. Compute the depreciation expense as follows: Depreciation Expense = Depreciation per Unit Total Units of Output Used Depreciation Expense =$2.20 per Hour 2,100 Hours =$4,620 The units-of-output method is often used when a fixed asset's in-service time cor use) varies from year to year. In such cases, the units-of-output method matches depreciation expense with the asset's revenues. Example Exercise 10-3 Units-of-Output Depreciation (2) Equipment acquired at the beginning of the year at a cost of $180,000 has an estimated residual value of $10,000, has an estimated useful life of 40,000 hours, and was operated 3,600 hours during the year. Determine (a) the depreciable cost, (b) the depreciation rate, and (c) the unit-of-output depreciation for the year: \begin{tabular}{|c|c|c|} \hline Yoar & \begin{tabular}{l} a. \\ straight- \\ Uine \end{tabular} & \begin{tabular}{c} b. \\ Units of \\ Production \end{tabular} \\ \hline 2014 & & \\ \hline 2015 & & 4 \\ \hline 2016 & & \\ \hline 2017 & & \\ \hline Totals & 7 & \\ \hline \end{tabular} Double-Declining- Balance Calculations: Straighline method: For full yoar: For part years: Double-declining-balance method: Depreciable Balance 2014 2015 Yearly Depreciation Depreciation, Since depreciation cannot cause book value to fall below residual value: DepreclableBalance2017PesildailValue Residual Value Yearly Depreciation 2017