Answered step by step

Verified Expert Solution

Question

1 Approved Answer

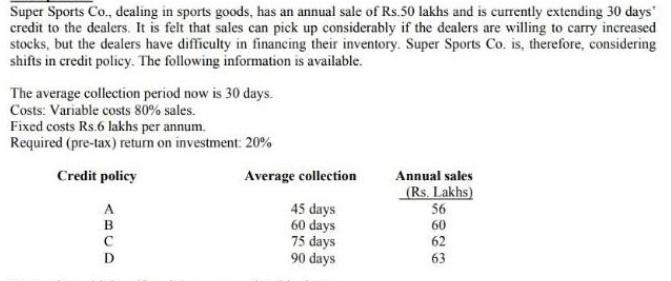

Super Sports Co., dealing in sports goods, has an annual sale of Rs.50 lakhs and is currently extending 30 days credit to the dealers.

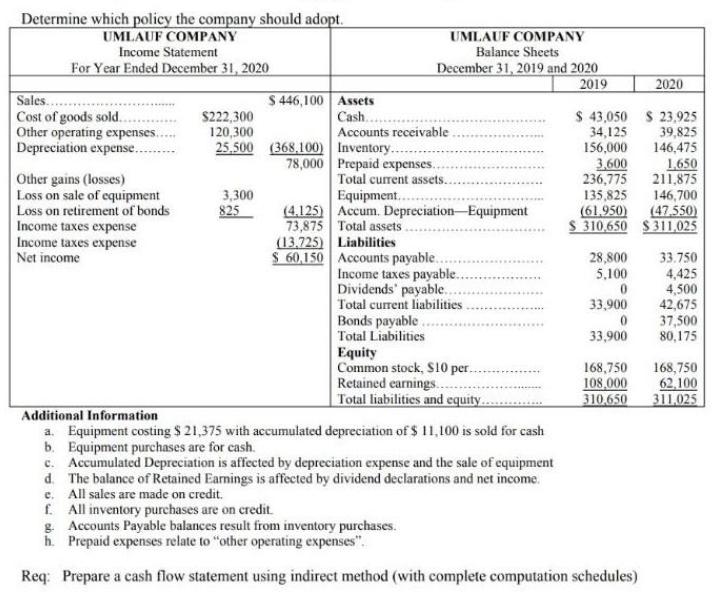

Super Sports Co., dealing in sports goods, has an annual sale of Rs.50 lakhs and is currently extending 30 days credit to the dealers. It is felt that sales can pick up considerably if the dealers are willing to carry increased stocks, but the dealers have difficulty in financing their inventory. Super Sports Co. is, therefore, considering shifts in credit policy. The following information is available. The average collection period now is 30 days. Costs: Variable costs 80% sales. Fixed costs Rs.6 lakhs per annum. Required (pre-tax) return on investment: 20% Credit policy A B C Average collection 45 days 60 days 75 days 90 days Annual sales (Rs. Lakhs) 56 60 62 63 Determine which policy the company should adopt. UMLAUF COMPANY Income Statement For Year Ended December 31, 2020 Sales... Cost of goods sold... Other operating expenses... Depreciation expense... Other gains (losses) Loss on sale of equipment Loss on retirement of bonds Income taxes expense Income taxes expense Net income $222,300 120,300 25,500 3,300 825 $ 446,100 Assets Cash.. (368,100) UMLAUF COMPANY Balance Sheets December 31, 2019 and 2020 2019 Accounts receivable Inventory... 78,000 Prepaid expenses... Total current assets.. Equipment.... (4.125) Accum. Depreciation Equipment 73,875 Total assets. (13,725) Liabilities $ 60,150 Accounts payable... Income taxes payable. Dividends' payable.. Total current liabilities. Bonds payable.. Total Liabilities Equity Common stock, $10 per. Retained earnings... Total liabilities and equity.. **** Additional Information a. Equipment costing $ 21,375 with accumulated depreciation of $11,100 is sold for cash b. Equipment purchases are for cash. c. Accumulated Depreciation is affected by depreciation expense and the sale of equipment d. The balance of Retained Earnings is affected by dividend declarations and net income. e. All sales are made on credit. $ 43,050 34,125 156,000 135,825 (61.950) $ 310,650 3,600 1,650 236,775 211,875 146,700 (47,550) $311,025 28,800 5,100 0 33,900 0 33,900 2020 $23,925 39,825 146,475 f. All inventory purchases are on credit. g. Accounts Payable balances result from inventory purchases. h. Prepaid expenses relate to "other operating expenses". Req: Prepare a cash flow statement using indirect method (with complete computation schedules) 33.750 4,425 4,500 42,675 37,500 80,175 168,750 168,750 108,000 62,100 310,650 311,025

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Question summary Choice of credit policy Answer To choose the most profitable policy profits are com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started