Answered step by step

Verified Expert Solution

Question

1 Approved Answer

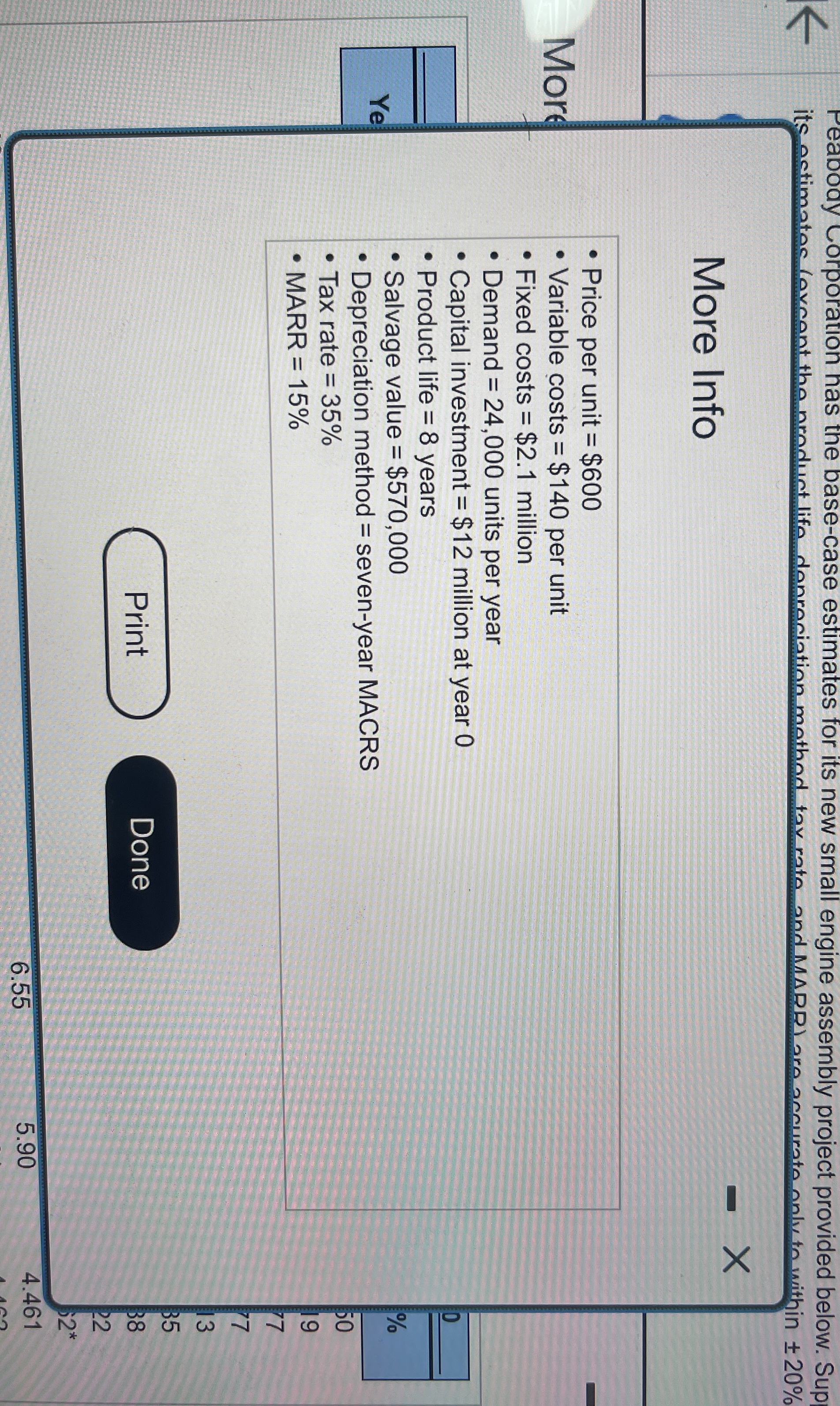

Peabody Corporation has the base - case estimates for its new small engine assembly project provided below. Suppose the company believes that all of its

Peabody Corporation has the basecase estimates for its new small engine assembly project provided below. Suppose the company believes that all of its estimates except the product life, depreciation method, tax rate, and MARR are accurate only to within

Click the icon to view the basecase estimates for the investment project.

Click the icon to view the MACRS depreciation schedules.

Click the icon to view the interest factors for discrete compounding when per year.

a What is the NPW of the project based on its basecase scenario?

The NPW of the project based on its basecase scenario is $ thousand. Round to one decimal place.

More Info

Price per unit $

Variable costs $ per unit

Fixed costs $ million

Demand units per year

Capital investment $ million at year

Product life years

Salvage value $

Depreciation method sevenyear MACRS

Tax rate

MARR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started