Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peaky Lights LLC is a new asset management boutique offering the general public the opportunity to invest in some derivative instruments such as stock

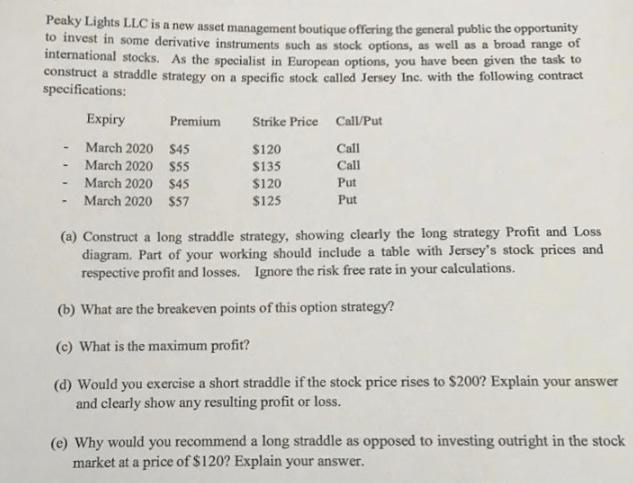

Peaky Lights LLC is a new asset management boutique offering the general public the opportunity to invest in some derivative instruments such as stock options, as well as a broad range of international stocks. As the specialist in European options, you have been given the task to construct a straddle strategy on a specific stock called Jersey Inc. with the following contract specifications: - - Expiry March 2020 $45 March 2020 $55 March 2020 $45 March 2020 $57 Premium Strike Price Call/Put $120 $135 $120 $125 Call Call Put Put (a) Construct a long straddle strategy, showing clearly the long strategy Profit and Loss diagram. Part of your working should include a table with Jersey's stock prices and respective profit and losses. Ignore the risk free rate in your calculations. (b) What are the breakeven points of this option strategy? (c) What is the maximum profit? (d) Would you exercise a short straddle if the stock price rises to $200? Explain your answer and clearly show any resulting profit or loss. (e) Why would you recommend a long straddle as opposed to investing outright in the stock market at a price of $120? Explain your answer.

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a A long straddle strategy involves buying both a call option and a put option with the same expiration date and strike price Heres the profit and loss diagram for the long straddle strategy on Jersey ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started