Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pear Corporation is a hypothetical company with financial results similar to Apple, Inc. Pear has been entering into a variety of financing transactions over the

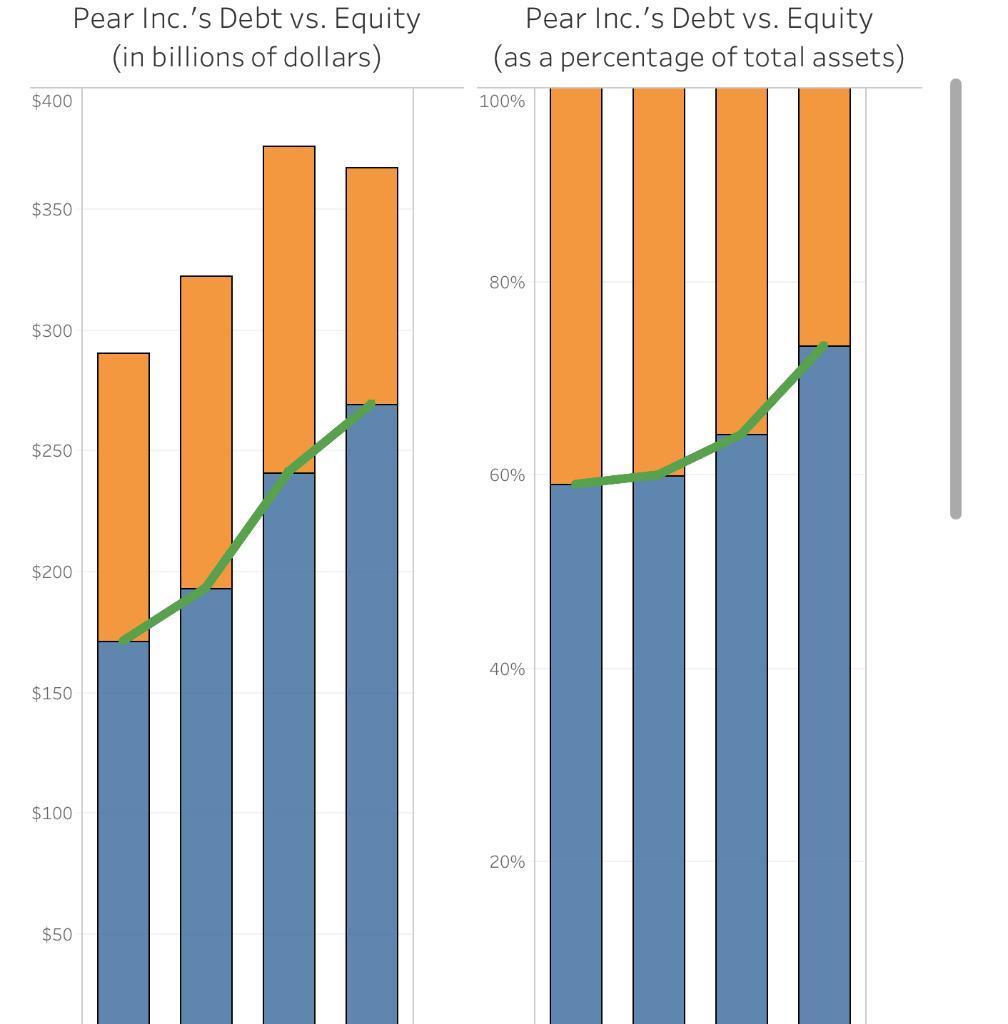

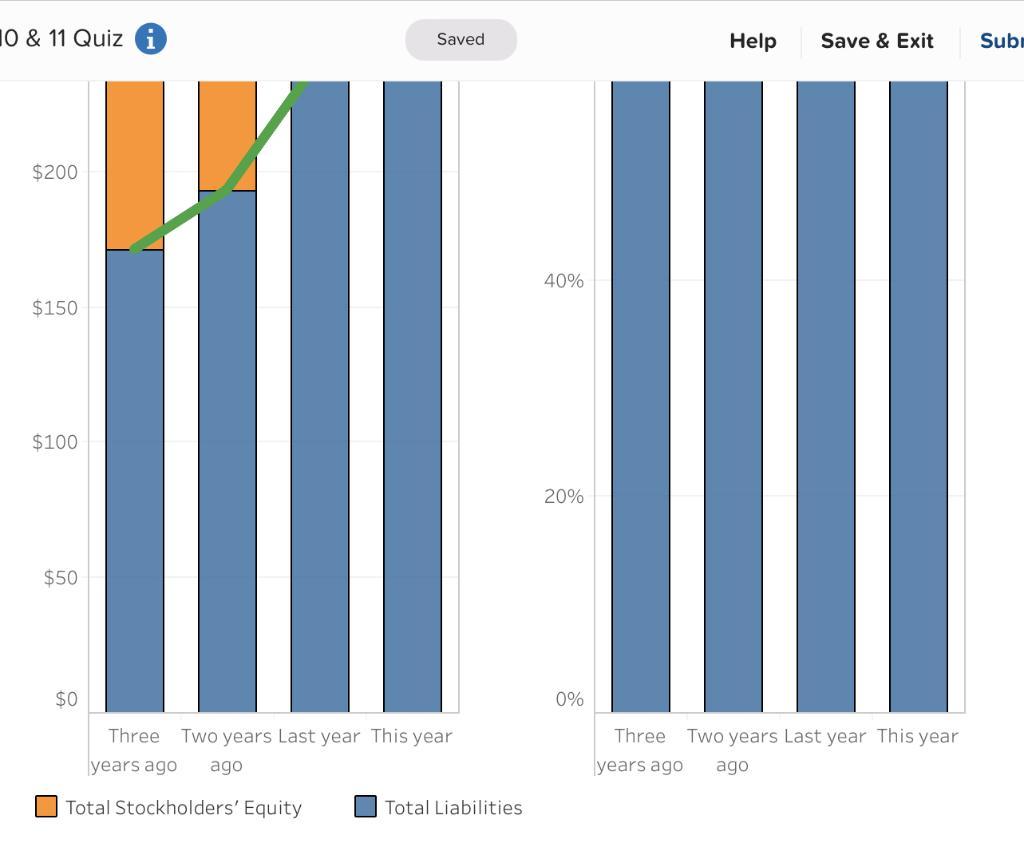

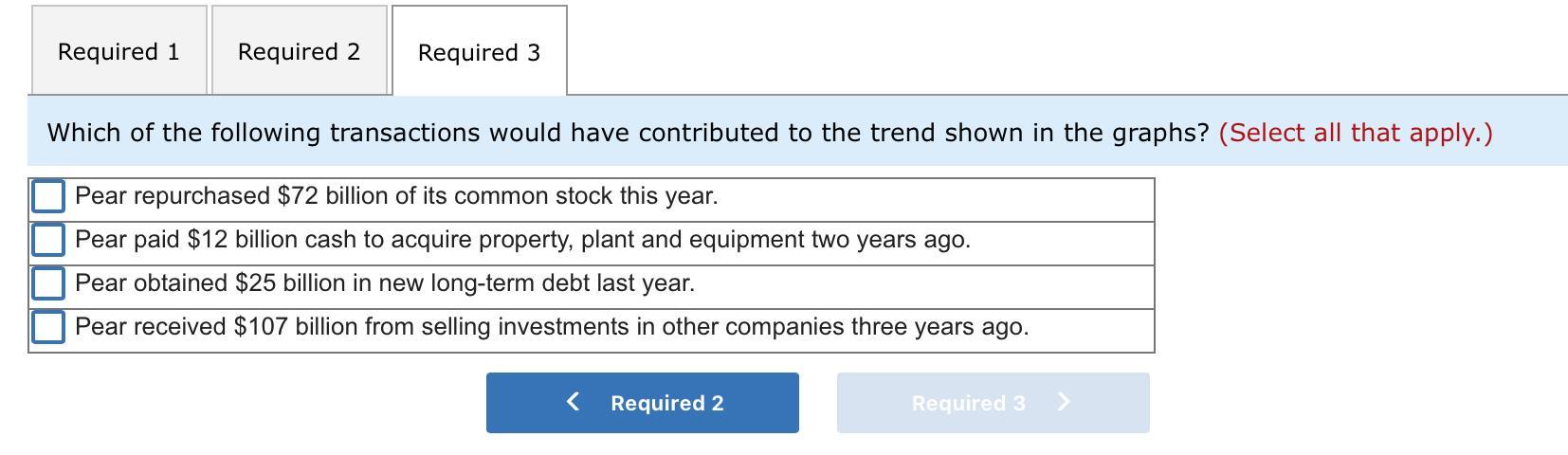

Pear Corporation is a hypothetical company with financial results similar to Apple, Inc. Pear has been entering into a variety of financing transactions over the past few years, the results of which can be seen in stacked line graphs:

$400 $350 $300 $250 $200 $150 $100 Pear Inc.'s Debt vs. Equity (in billions of dollars) $50 Pear Inc.'s Debt vs. Equity (as a percentage of total assets) 100% 80% 60% 40% 20%

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

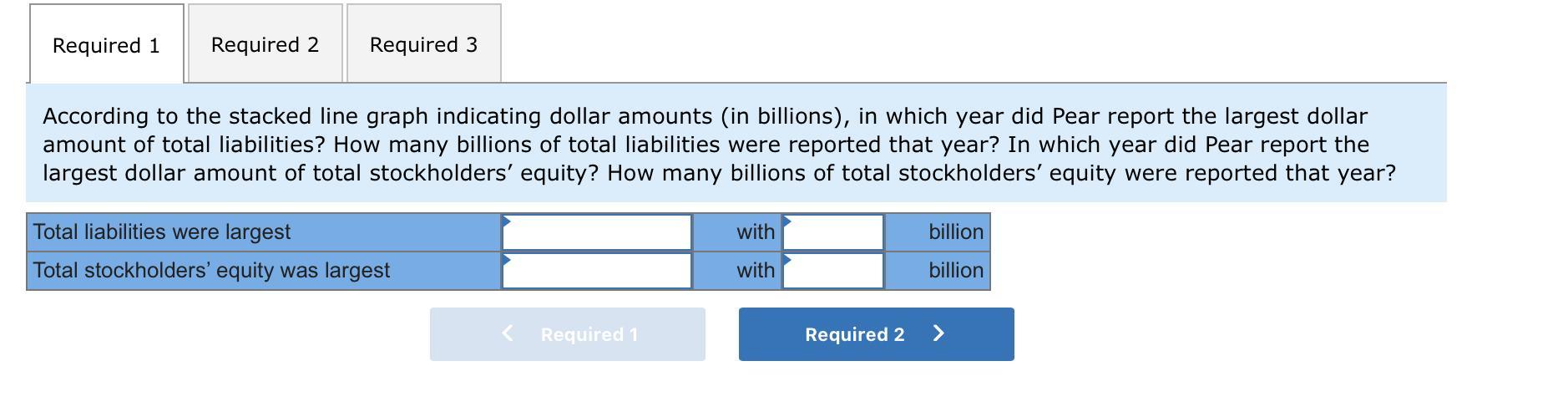

Answer for Required 1 a This years total liabilities at 270 billion are the highest ever b Last year with 140 billion total shareholder equity was at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started