Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pearl Footwear acquired all of the voting stock of Sebogo Inc. at the beginning of 2016 The acquisition cost was $450 million, and Sebogo's

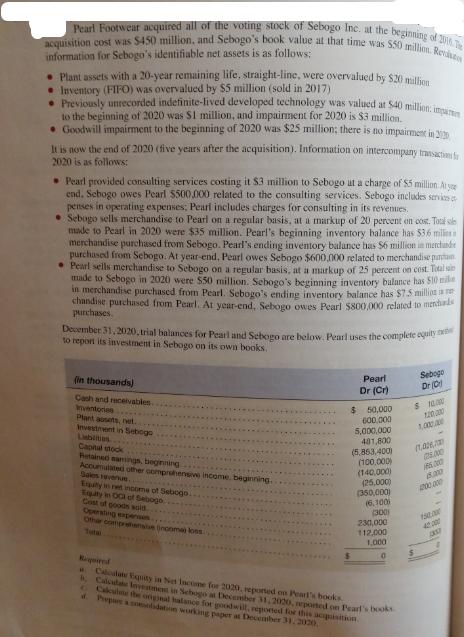

Pearl Footwear acquired all of the voting stock of Sebogo Inc. at the beginning of 2016 The acquisition cost was $450 million, and Sebogo's book value at that time was 550 million. Re information for Sebogo's identifiable net assets is as follows: Plant assets with a 20-year remaining life. straight-line, were overvalued by $20 million Inventory (FIFO) was overvalued by $5 million (sold in 2017) Previously unrecorded indefinite-lived developed technology was valued at $40 million, imp to the beginning of 2020 was $1 million, and impairment for 2020 is $3 million. Goodwill impairment to the beginning of 2020 was $25 million; there is no impairment in 2 It is now the end of 2020 (five years after the acquisition). Information on intercompany transaction f 2020 is as follows: Pearl provided consulting services costing it $3 million to Sebogo at a charge of $5 million ty end. Schogo owes Pearl 5500,000 related to the consulting services. Sebogo includes services penses in operating expenses; Pearl includes charges for consulting in its revenues. Sebogo sells merchandise to Pearl on a regular basis, at a markup of 20 percent on cost. Total made to Pearl in 2020 were $35 million. Pearl's beginning inventory balance has $3,6 mill merchandise purchased from Sebogo. Pearl's ending inventory balance has $6 million in merchandi purchased from Sebogo. At year-end. Pearl owes Sebogo $600,000 related to merchandise pan Pearl sells merchandise to Sebogo on a regular basis, at a markup of 25 percent on cost. Total made to Sebogo in 2020 were 550 million. Sebogo's beginning inventory balance has 500 mile in merchandise purchased from Pearl. Sebogo's ending inventory balance has $7.5 million i chandise purchased from Pearl. At year-end, Sebogo owes Pearl $800,000 related to mendud purchases. December 31, 2020, trial balances for Pearl and Sebogo are below. Pearl uses the complete equity to report its investment in Sebogo on its own books. (in thousands) Cash and receivables Inventores Plant assets, ret. Investment in Sebogo Lieblites Capital stock Retained samings, beginning Accumulated other comprehensive income, beginning. Sales revenue. Erally in net income of Sebogo. Equity in OC of Sebogo Cost of goods waid Operating expens Other comprehensive (nooma) loss Required Pearl Dr (Cr) $ 50,000 600,000 5,000,000 401,800 (5,863,400) (100,000) (140,000) (25,000) $ (350,000) (6,100 (300) 230,000 112,000 1,000 0 H Calcolate Viquity in Net Income for 2020, reported on Pearl's books & Calculate Investment in Sebogo at December 31, 2020, reported on Pearl's books . Calcune the original halance for goodwill, reported for this acquisition. Prepare a consolidation working paper at December 31, 2020. Sebogo Dr (0) S MAN 120.000 (1,006,70 (25.000 186.000 8.000 200 000 150.000 42.000 1317

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Acquisition of Sebogo Acquisition cost by Pearl 450 million Sebogos book value at acquisition 550 million 2 Adjustments to Sebogos identifiable net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started