Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pearl Inc. is a Canadian controlled private corporation (CCPC) that owns 100% of the voting shares of Oyster Ltd. and 25% of the voting

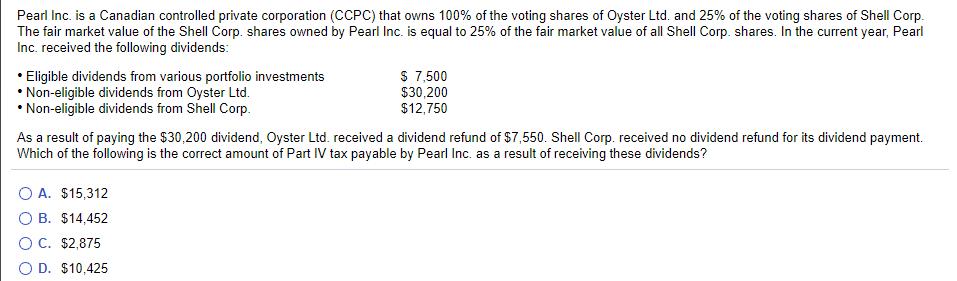

Pearl Inc. is a Canadian controlled private corporation (CCPC) that owns 100% of the voting shares of Oyster Ltd. and 25% of the voting shares of Shell Corp. The fair market value of the Shell Corp. shares owned by Pearl Inc. is equal to 25% of the fair market value of all Shell Corp. shares. In the current year, Pearl Inc. received the following dividends: Eligible dividends from various portfolio investments Non-eligible dividends from Oyster Ltd. Non-eligible dividends from Shell Corp. $ 7,500 $30,200 $12,750 As a result of paying the $30,200 dividend, Oyster Ltd. received a dividend refund of $7,550. Shell Corp. received no dividend refund for its dividend payment. Which of the following is the correct amount of Part IV tax payable by Pearl Inc. as a result of receiving these dividends? O A. $15,312 O B. $14,452 O C. $2,875 O D. $10,425

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Pearl Inc is a Canadiancontrolled private corporation Owns 100 voting shares of Oyster Ltd an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started