Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pearl is the holder of a check drawn by Sharpe on Washington State Bank. Pearl also maintains an account at Washington State Bank. The

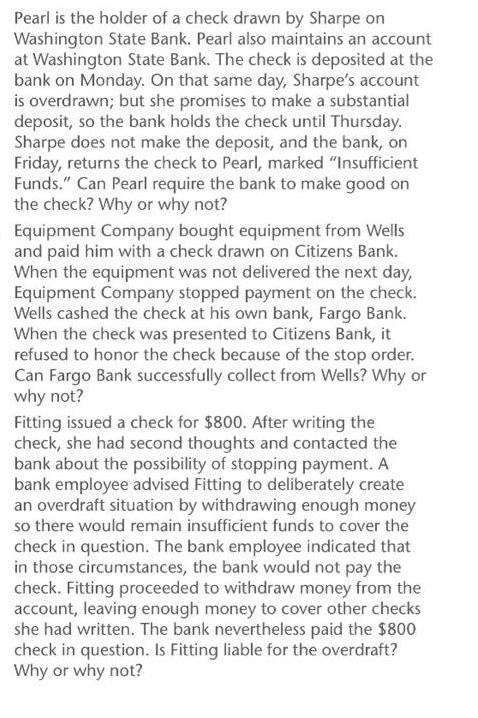

Pearl is the holder of a check drawn by Sharpe on Washington State Bank. Pearl also maintains an account at Washington State Bank. The check is deposited at the bank on Monday. On that same day, Sharpe's account is overdrawn; but she promises to make a substantial deposit, so the bank holds the check until Thursday. Sharpe does not make the deposit, and the bank, on Friday, returns the check to Pearl, marked "Insufficient Funds." Can Pearl require the bank to make good on the check? Why or why not? Equipment Company bought equipment from Wells and paid him with a check drawn on Citizens Bank. When the equipment was not delivered the next day, Equipment Company stopped payment on the check. Wells cashed the check at his own bank, Fargo Bank. When the check was presented to Citizens Bank, it refused to honor the check because of the stop order. Can Fargo Bank successfully collect from Wells? Why or why not? Fitting issued a check for $800. After writing the check, she had second thoughts and contacted the bank about the possibility of stopping payment. A bank employee advised Fitting to deliberately create an overdraft situation by withdrawing enough money so there would remain insufficient funds to cover the check in question. The bank employee indicated that in those circumstances, the bank would not pay the check. Fitting proceeded to withdraw money from the account, leaving enough money to cover other checks she had written. The bank nevertheless paid the $800 check in question. Is Fitting liable for the overdraft? Why or why not?

Step by Step Solution

★★★★★

3.28 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

PART A Pearl cannot ask the bank to make good on the cheque because the bank is not liable for the cheque bounce and pearl can only ask Sharpe to make good of the cheque or file a legal case against S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started