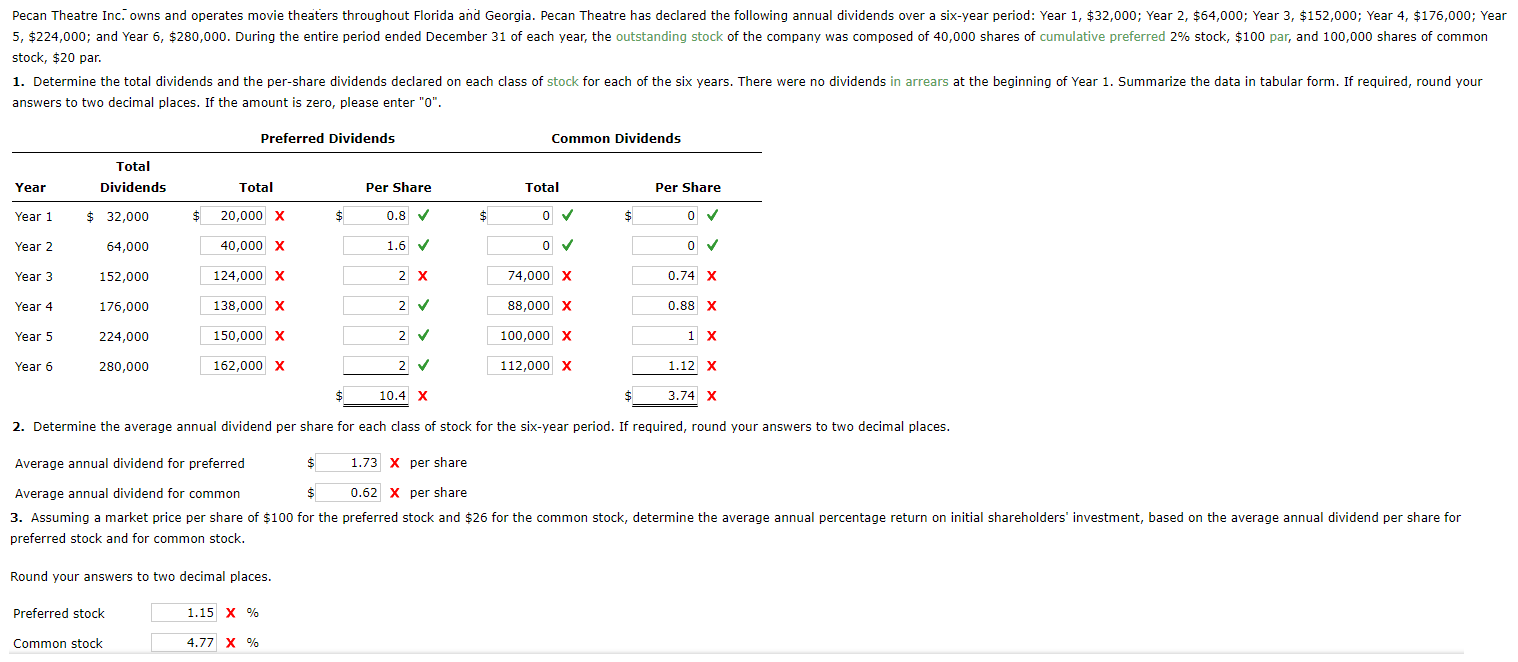

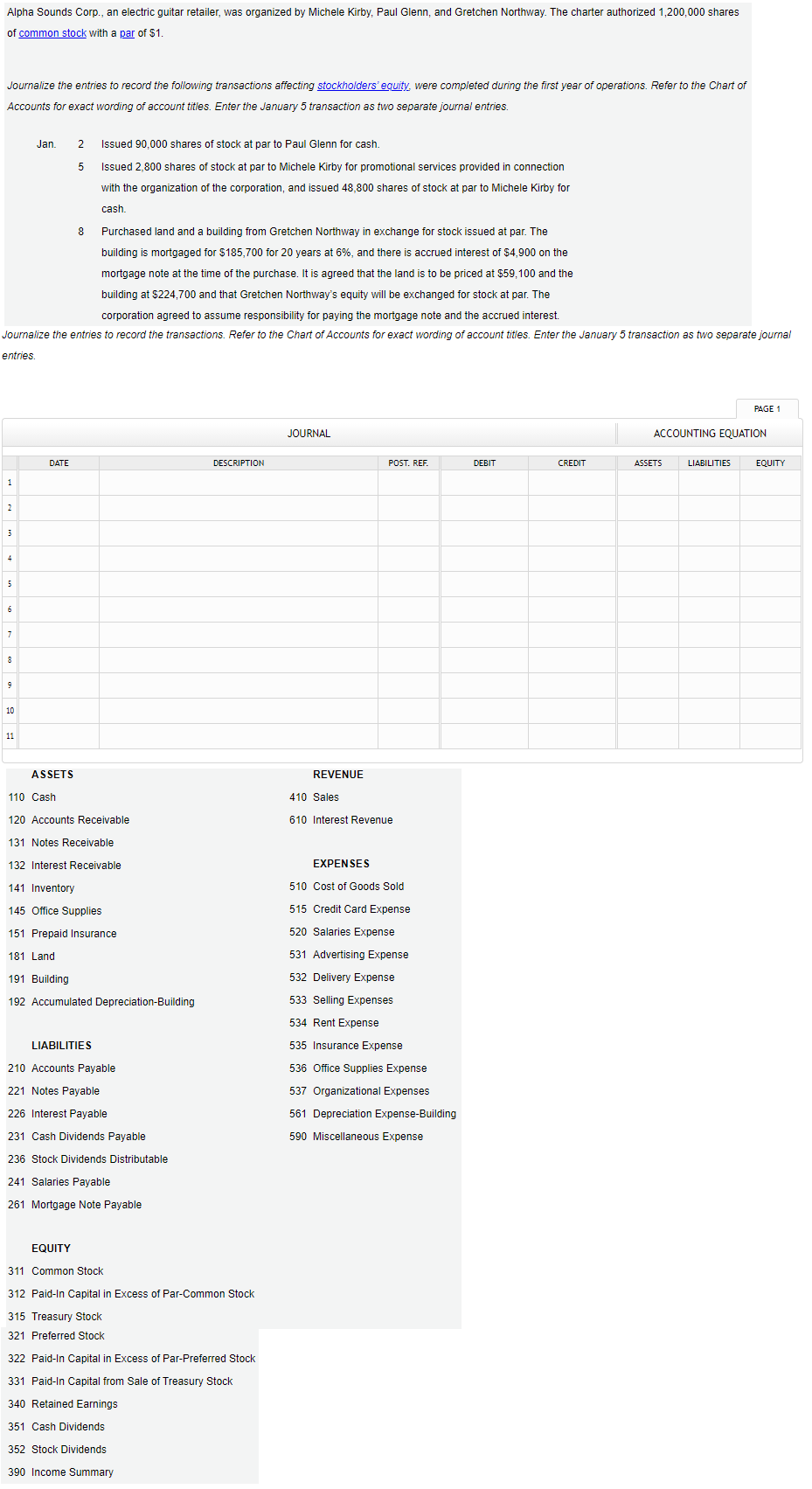

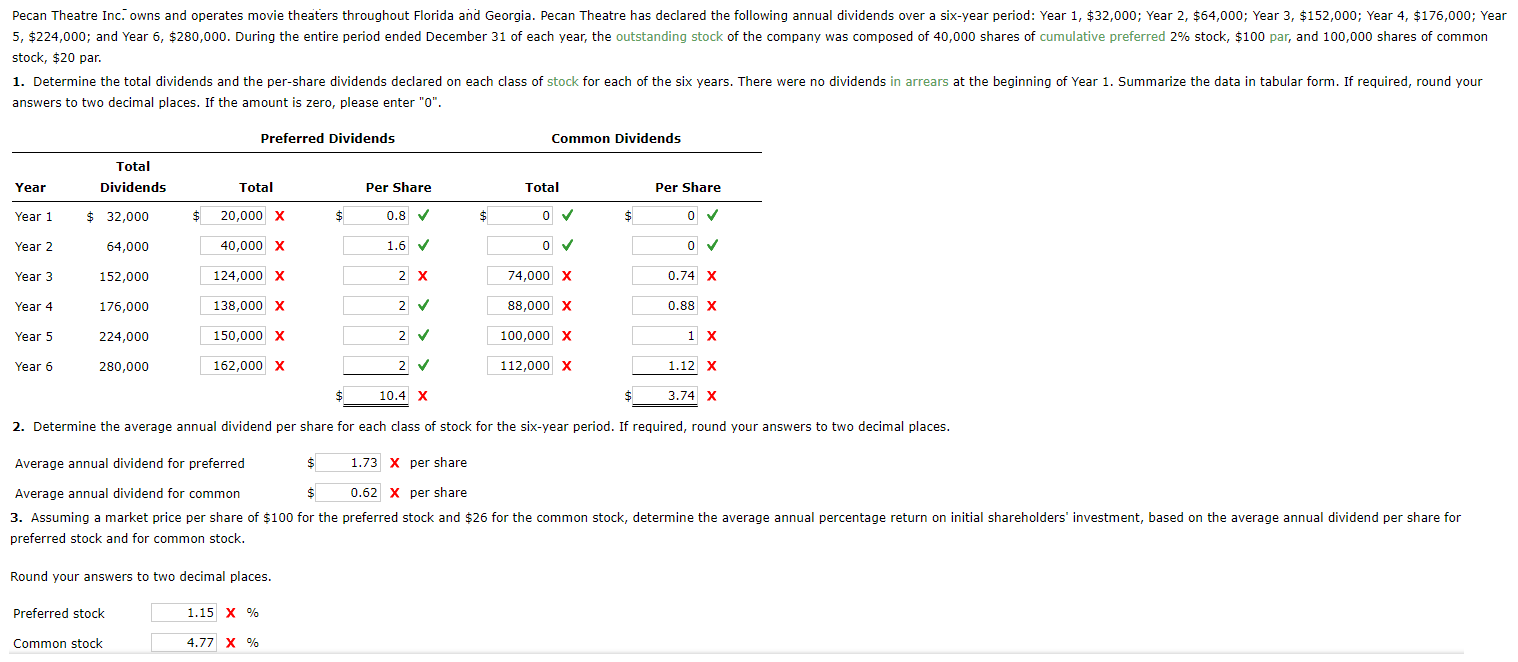

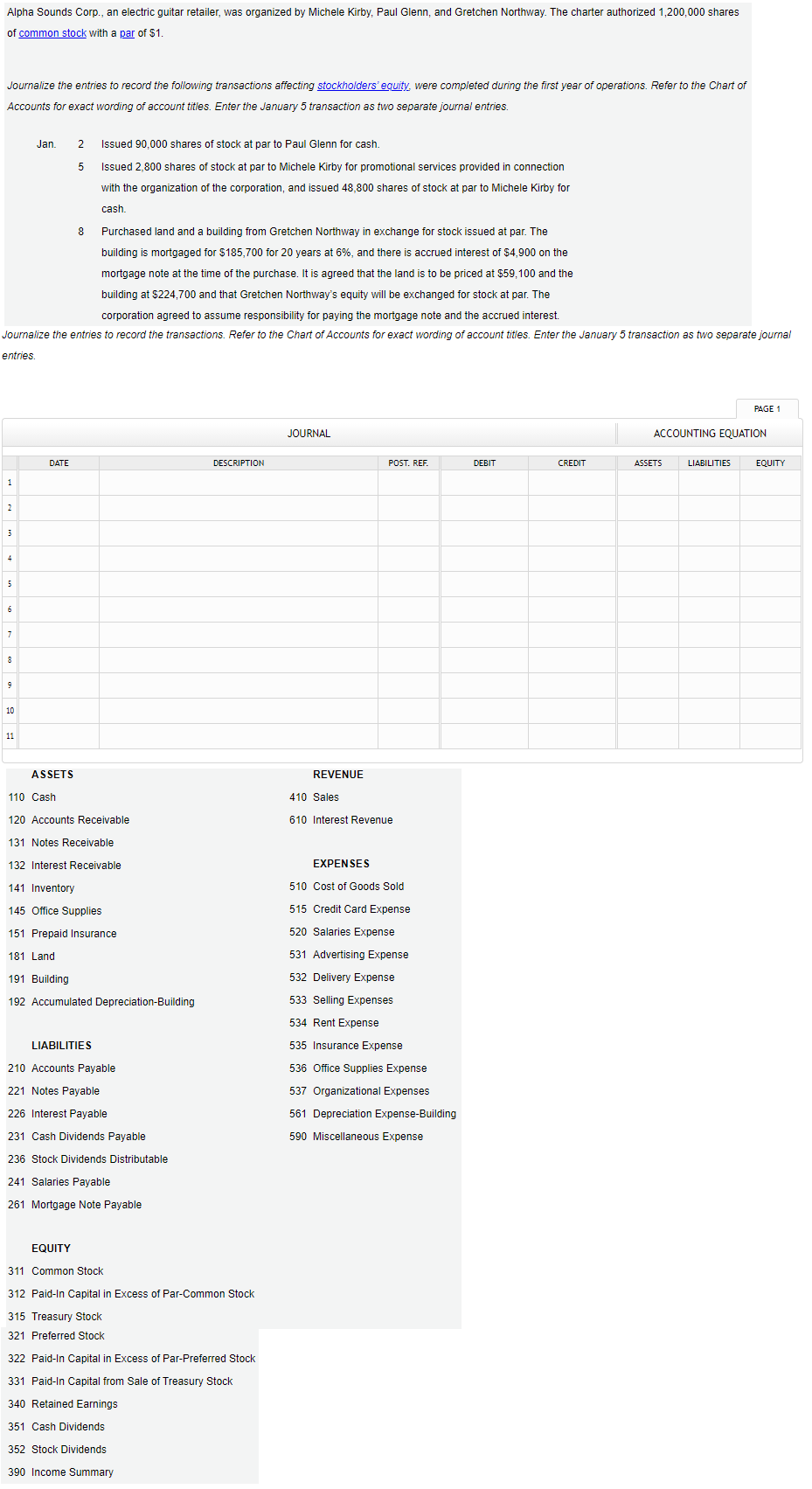

Pecan Theatre Inc. owns and operates movie theaters throughout Florida and Georgia. Pecan Theatre has declared the following annual dividends over a six-year period: Year 1, $32,000; Year 2, $64,000; Year 3, $152,000; Year 4, $176,000; Year 5, $224,000; and Year 6, $280,000. During the entire period ended December 31 of each year, the outstanding stock of the company was composed of 40,000 shares of cumulative preferred 2% stock, $100 par, and 100,000 shares of common stock, $20 par. 1. Determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividends in arrears at the beginning of Year 1. Summarize the data in tabular form. If required, round your answers to two decimal places. If the amount is zero, please enter "0". Preferred Dividends Common Dividends Total Dividends Year Total Per Share Total Per Share Year 1 $ 32,000 $ 20,000 X $ 0.8 $ 0 0 Year 2 64,000 40,000 X 1.6 0 0 Year 3 152,000 124,000 X 2 x 74,000 X 0.74 X Year 4 176,000 138,000 x 2 88,000 X 0.88 X Year 5 224,000 150,000 x 2 100,000 X 1 X Year 6 280,000 162,000 X 2 112,000 X 1.12 x $ 10.4 x 3.74 x 2. Determine the average annual dividend per share for each class of stock for the six-year period. If required, round your answers to two decimal places. Average annual dividend for preferred 1.73 per share Average annual dividend for common $ 0.62 X per share 3. Assuming a market price per share of $100 for the preferred stock and $26 for the common stock, determine the average annual percentage return on initial shareholders' investment, based on the average annual dividend per share for preferred stock and for common stock. Round your answers to two decimal places. Preferred stock 1.15 X % Common stock 4.77 X % Alpha Sounds Corp., an electric guitar retailer, was organized by Michele Kirby, Paul Glenn, and Gretchen Northway. The charter authorized 1,200,000 shares of common stock with a par of $1. Journalize the entries to record the following transactions affecting stockholders' equity, were completed during the first year of operations. Refer to the Chart of Accounts for exact wording of account titles. Enter the January 5 transaction as two separate journal entries. Jan. 2 Issued 90,000 shares of stock at par to Paul Glenn for cash. 5 Issued 2,800 shares of stock at par to Michele Kirby for promotional services provided in connection with the organization of the corporation, and issued 48,800 shares of stock at par to Michele Kirby for cash. 8 Purchased land and a building from Gretchen Northway in exchange for stock issued at par. The building is mortgaged for $185,700 for 20 years at 6%, and there is accrued interest of $4,900 on the mortgage note at the time of the purchase. It is agreed that the land is to be priced at $59,100 and the building at $224,700 and that Gretchen Northway's equity will be exchanged for stock at par. The corporation agreed to assume responsibility for paying the mortgage note and the accrued interest. Journalize the entries to record the transactions. Refer to the Chart of Accounts for exact wording of account titles. Enter the January 5 transaction as two separate journal entries. PAGE 1 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 5 9 10 11 ASSETS REVENUE 110 Cash 410 Sales 120 Accounts Receivable 610 Interest Revenue 131 Notes Receivable 132 Interest Receivable EXPENSES 510 Cost of Goods Sold 141 Inventory 145 Office Supplies 515 Credit Card Expense 520 Salaries Expense 151 Prepaid Insurance 181 Land 531 Advertising Expense 532 Delivery Expense 191 Building 192 Accumulated Depreciation-Building 533 Selling Expenses 534 Rent Expense LIABILITIES 535 Insurance Expense 210 Accounts Payable 536 Office Supplies Expense 221 Notes Payable 226 Interest Payable 537 Organizational Expenses 561 Depreciation Expense-Building 590 Miscellaneous Expense 231 Cash Dividends Payable 236 Stock Dividends Distributable 241 Salaries Payable 261 Mortgage Note Payable EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock Dividends 390 Income Summary