Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Peep Corporation acquired 100% of Seen Corporation's outstanding voting common stock on January 1, 2019, for $660,000 cash. Seen's stockholders' equity on this date

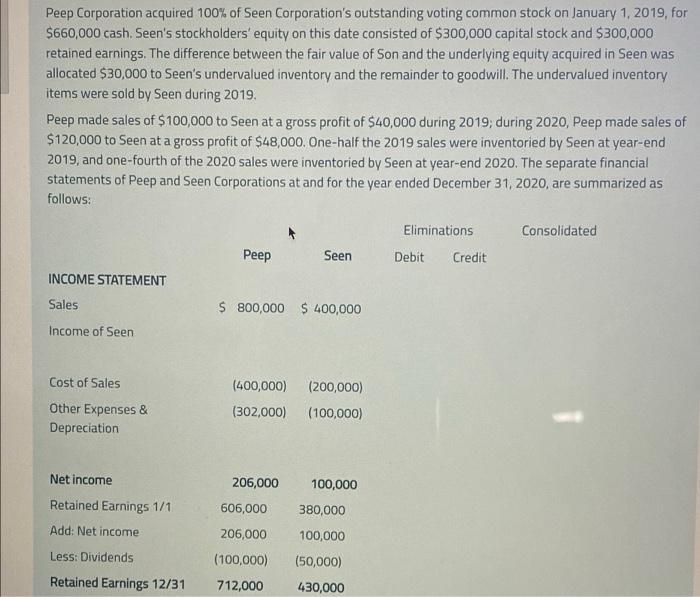

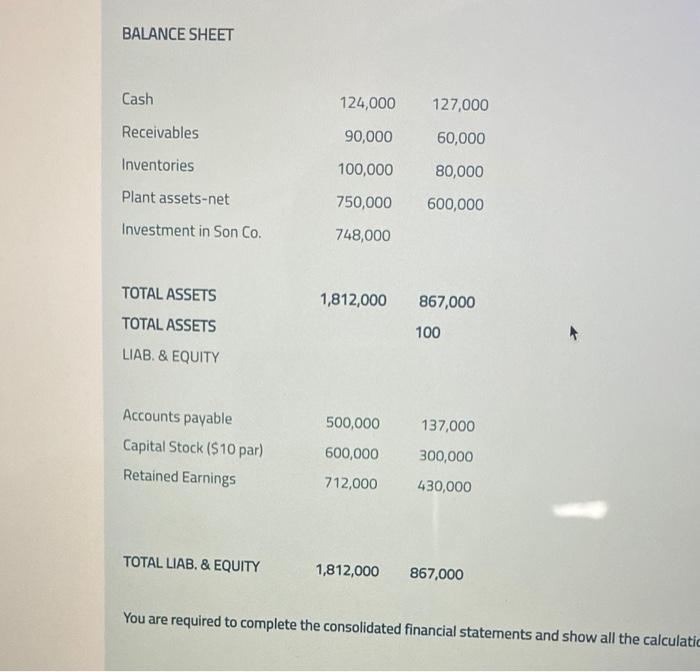

Peep Corporation acquired 100% of Seen Corporation's outstanding voting common stock on January 1, 2019, for $660,000 cash. Seen's stockholders' equity on this date consisted of $300,000 capital stock and $300,000 retained earnings. The difference between the fair value of Son and the underlying equity acquired in Seen was allocated $30,000 to Seen's undervalued inventory and the remainder to goodwill. The undervalued inventory items were sold by Seen during 2019. Peep made sales of $100,000 to Seen at a gross profit of $40,000 during 2019; during 2020, Peep made sales of $120,000 to Seen at a gross profit of $48,000. One-half the 2019 sales were inventoried by Seen at year-end 2019, and one-fourth of the 2020 sales were inventoried by Seen at year-end 2020. The separate financial statements of Peep and Seen Corporations at and for the year ended December 31, 2020, are summarized as follows: Eliminations Consolidated Seen Debit Credit INCOME STATEMENT Sales $ 800,000 $ 400,000 Income of Seen Cost of Sales (400,000) (200,000) Other Expenses & Depreciation (302,000) (100,000) Net income 206,000 100,000 Retained Earnings 1/1 606,000 380,000 Add: Net income 206,000 100,000 Less: Dividends (100,000) (50,000) Retained Earnings 12/31 712,000 430,000 BALANCE SHEET Cash 124,000 127,000 Receivables 90,000 60,000 Inventories 100,000 80,000 Plant assets-net 750,000 600,000 Investment in Son Co. 748,000 TOTAL ASSETS 1,812,000 867,000 TOTAL ASSETS 100 LIAB. & EQUITY Accounts payable 500,000 137,000 Capital Stock ($10 par) 600,000 300,000 Retained Earnings 712,000 430,000 TOTAL LIAB. & EQUITY 1,812,000 867,000 You are required to complete the consolidated financial statements and show all the calculatic

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Peep Corporation and Subsidiary Consolidation Workpapers for the year ended December 31 2020 in thou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started