Question

Peerless Corporation purchases 70% of Special Foods Corporation's outstanding Common Stock for $560,000, on 01/01/XI. At the date of acquisition, Special had accumulated depreciation of

Peerless Corporation purchases 70% of Special Foods Corporation's outstanding Common Stock for $560,000, on 01/01/XI. At the date of acquisition, Special had accumulated depreciation of S205.000?

Special reported net income for 20X1 of $160,000 and paid dividends of $26,000.?

Peerless' purchase of Special's net assets showed Fair Value exceeding Book Value by $135,000. Assets that had higher values were Inentory, $30,000; Land $100,000; and Building, $25,000?

It was determined that goodwill was impaired by $100.000,?

All of the inventory was sold during 20X1. The Building has 5 years remaining on its useful life and Special uses straight line depreciation.?

Equity at 20x1 for Special was Common Stock, S200,000 and Retained Earnings, $100,000.?

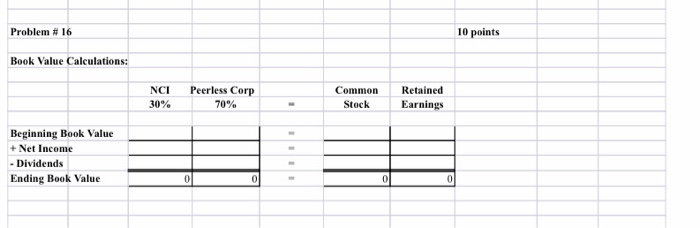

16 - Prepare the Book Value Calculations on the provided worksheet.?

17. Prepare the Basic Consolidation Entry on the Journal Entry Form below.?

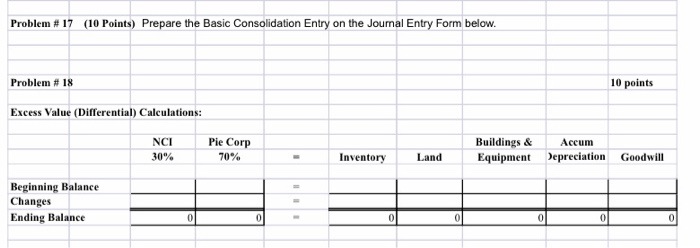

18 - Prepare the Excess Value (Differential) Calculations on the provided worksheet.?

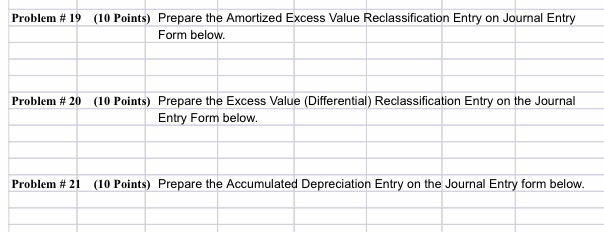

19. Prepare the Amortized Value Reclassification Entry on the Joirnal Entry Form below?

20 - Prepare the Excess Value (Differential) Reclassification Entry on the Journal Entry Form below.?

21 - Prepare the Accumulated Depreciation Consolidated Entry on the Journal Entry Form below.?

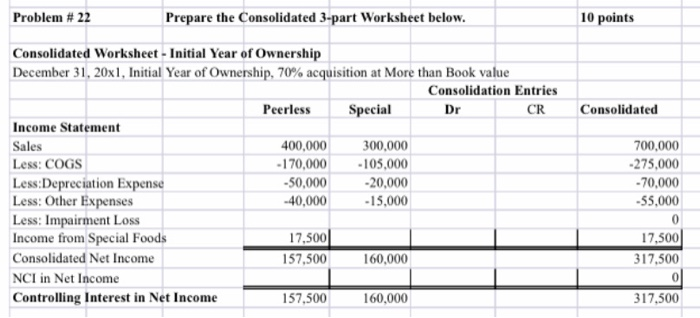

22 - Prepare the 3-Part Consolidation Worksheet, attached.

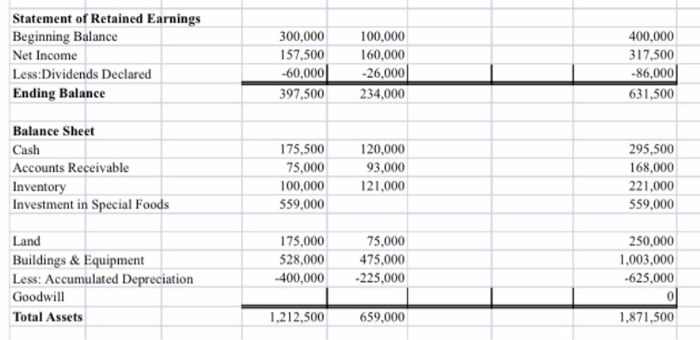

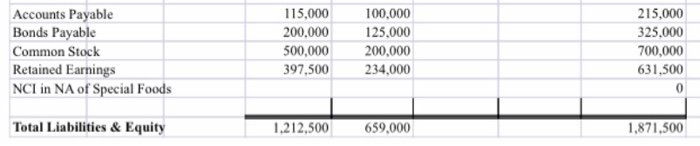

Problem # 16 Book Value Calculations: Beginning Book Value + Net Income - Dividends Ending Book Value NCI 30% Peerless Corp 70% 0 0 - E - - Common Stock 0 Retained Earnings 0 10 points Problem #17 (10 Points) Prepare the Basic Consolidation Entry on the Journal Entry Form below. Problem # 18 Excess Value (Differential) Calculations: Beginning Balance Changes Ending Balance NCI 30% 0 Pie Corp 70% 0 - = Inventory 0 Land 0 Buildings & Equipment 0 Accum Depreciation 0 10 points Goodwill 0 Problem # 19 (10 Points) Prepare the Amortized Excess Value Reclassification Entry on Journal Entry Form below. Problem #20 (10 Points) Prepare the Excess Value (Differential) Reclassification Entry on the Journal Entry Form below. Problem #21 (10 Points) Prepare the Accumulated Depreciation Entry on the Journal Entry form below. Problem # 22 Consolidated Worksheet - Initial Year of Ownership December 31, 20x1, Initial Year of Ownership, 70% acquisition at More than Book value Consolidation Entries Special Dr CR Income Statement Sales Less: COGS Prepare the Consolidated 3-part Worksheet below. Less:Depreciation Expense Less: Other Expenses Less: Impairment Loss Income from Special Foods Consolidated Net Income NCI in Net Income Controlling Interest in Net Income Peerless 400,000 -170,000 -50,000 -40,000 17,500 157,500 157,500 300,000 -105,000 -20,000 -15,000 160,000 160,000 10 points Consolidated 700,000 -275,000 -70,000 -55,000 0 17,500 317,500 0 317,500 Statement of Retained Earnings Beginning Balance Net Income Less:Dividends Declared Ending Balance Balance Sheet Cash Accounts Receivable Inventory Investment in Special Foods Land Buildings & Equipment Less: Accumulated Depreciation Goodwill Total Assets 300,000 157,500 -60,000 397,500 175,500 75,000 100,000 559,000 175,000 528,000 -400,000 1,212,500 100,000 160,000 -26,000 234,000 120,000 93,000 121,000 75,000 475,000 -225,000 659,000 400,000 317,500 -86,000 631,500 295,500 168,000 221,000 559,000 250,000 1,003,000 -625,000 1,871,500 Accounts Payable Bonds Payable Common Stock Retained Earnings NCI in NA of Special Foods Total Liabilities & Equity 115,000 200,000 500,000 397,500 1,212,500 100,000 125,000 200,000 234,000 659,000 215,000 325,000 700,000 631,500 0 1,871,500

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Acquisition analysis on 0101X1 Fair value of consideration Add Fair value of noncontrolling interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started