Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PeggySue is single and supports her dependent aunt, who lives with her. PeggySue's earned income is $12,000, and she makes a $500 contribution to her

PeggySue is single and supports her dependent aunt, who lives with her. PeggySue's earned income is $12,000, and she makes a $500 contribution to her traditional IRA.

Carry out computations to two decimal places, and round your final answer to the nearest dollar.

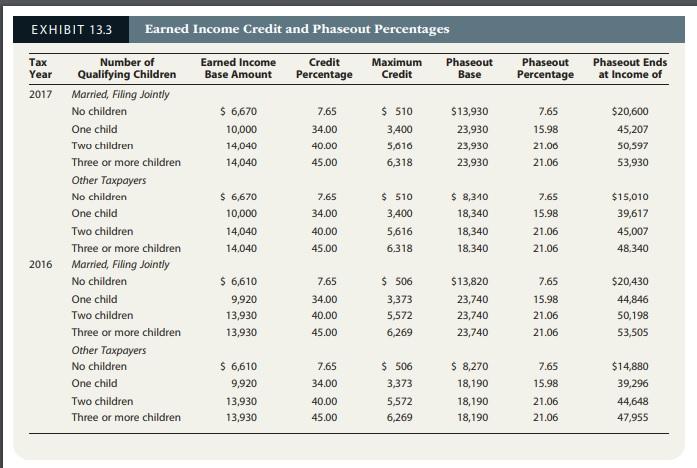

EXHIBIT 13.3 Earned Income Credit and Phaseout Percentages x Year Number of Qualifying Children Earned Income Base Amount Credit Maximum Phaseout Base Phaseout Phaseout Ends at Income of Percentage Credit Percentage 2017 Married, Filing Jointly No children $ 6670 7.65 $ 510 $13,930 7.65 $20,600 One child 10,000 34.00 400 23,930 15.98 45,207 Two children 14,040 40.00 5,010 23,930 21.00 50,597 Three or more children 14,040 45.00 6,318 23,930 21.06 53,930 Other Taxpayers No children $ 6,670 7.65 $ 510 $ 8,310 7.65 $15,010 One child 10,000 34.00 3,400 18,340 15.98 39,617 Two children 14,040 40.00 5,616 18,340 21.06 45,007 Three or more children 14,040 45.00 6,318 18.340 21.06 48,340 2016 Married, Filing Jointly No children $ 6,610 7.65 $ 506 $13,820 7.65 $20,430 One child 9,920 34.00 3,373 23,740 15.98 44,846 Two children 13,930 40.00 5,572 23,740 21.06 50,198 Three or more children 13,930 45.00 6,269 23,740 21.06 53,505 Other Taxpayers No children $ 6,610 7.65 $ 506 $ 8,270 7.65 $14,880 One child 9,920 34.00 3,373 18,190 15.98 39,296 Two children 13,930 40.00 5,572 18,190 21.06 44,648 Three or more children 13,930 45.00 6,269 18,190 21.06 47,955

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

For Tax Year 2017 the EITC phases out entirely is not available for taxpayers ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started