Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pelangi Berhad granted 200,000 share appreciation rights to an employee. At the grant date, the companys share price is RM5.00. The share appreciation rights vest

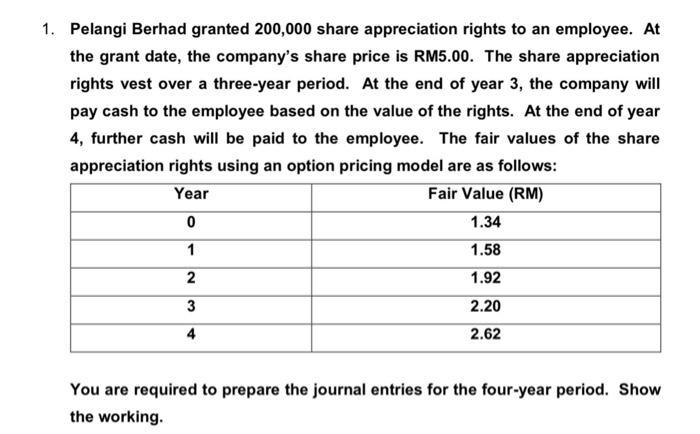

Pelangi Berhad granted 200,000 share appreciation rights to an employee. At the grant date, the companys share price is RM5.00. The share appreciation rights vest over a three-year period. At the end of year 3, the company will pay cash to the employee based on the value of the rights. At the end of year 4, further cash will be paid to the employee. The fair values of the share appreciation rights using an option pricing model are as follows:

Pelangi Berhad granted 200,000 share appreciation rights to an employee. At the grant date, the companys share price is RM5.00. The share appreciation rights vest over a three-year period. At the end of year 3, the company will pay cash to the employee based on the value of the rights. At the end of year 4, further cash will be paid to the employee. The fair values of the share appreciation rights using an option pricing model are as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started