Answered step by step

Verified Expert Solution

Question

1 Approved Answer

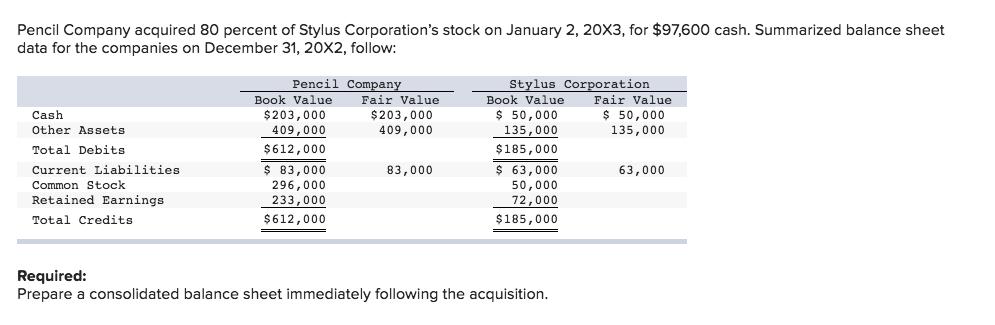

Pencil Company acquired 80 percent of Stylus Corporation's stock on January 2, 20X3, for $97,600 cash. Summarized balance sheet data for the companies on

Pencil Company acquired 80 percent of Stylus Corporation's stock on January 2, 20X3, for $97,600 cash. Summarized balance sheet data for the companies on December 31, 20X2, follow: Cash Other Assets Total Debits Current Liabilities. Common Stock Retained Earnings Total Credits Pencil Company Book Value $203,000 409,000 $612,000 $ 83,000 296,000 233,000 $612,000 Fair Value $203,000 409,000 83,000 Stylus Corporation Book Value $ 50,000 135,000 $185,000 $ 63,000 50,000 72,000 $185,000 Required: Prepare a consolidated balance sheet immediately following the acquisition. Fair Value $ 50,000 135,000 63,000 Required: Prepare a consolidated balance sheet immediately following the acquisition. Assets PENCIL COMPANY AND SUBSIDIARY Consolidated Balance Sheet January 2, 20X3 Total Assets Liabilities and Stockholders' Equity Total Liabilities and Stockholders' Equity

Step by Step Solution

★★★★★

3.35 Rating (185 Votes )

There are 3 Steps involved in it

Step: 1

PENCIL COMPANY AND SUBSIDIARY Consolidated Balance January 2 20x3 Sheet Ass...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started