Answered step by step

Verified Expert Solution

Question

1 Approved Answer

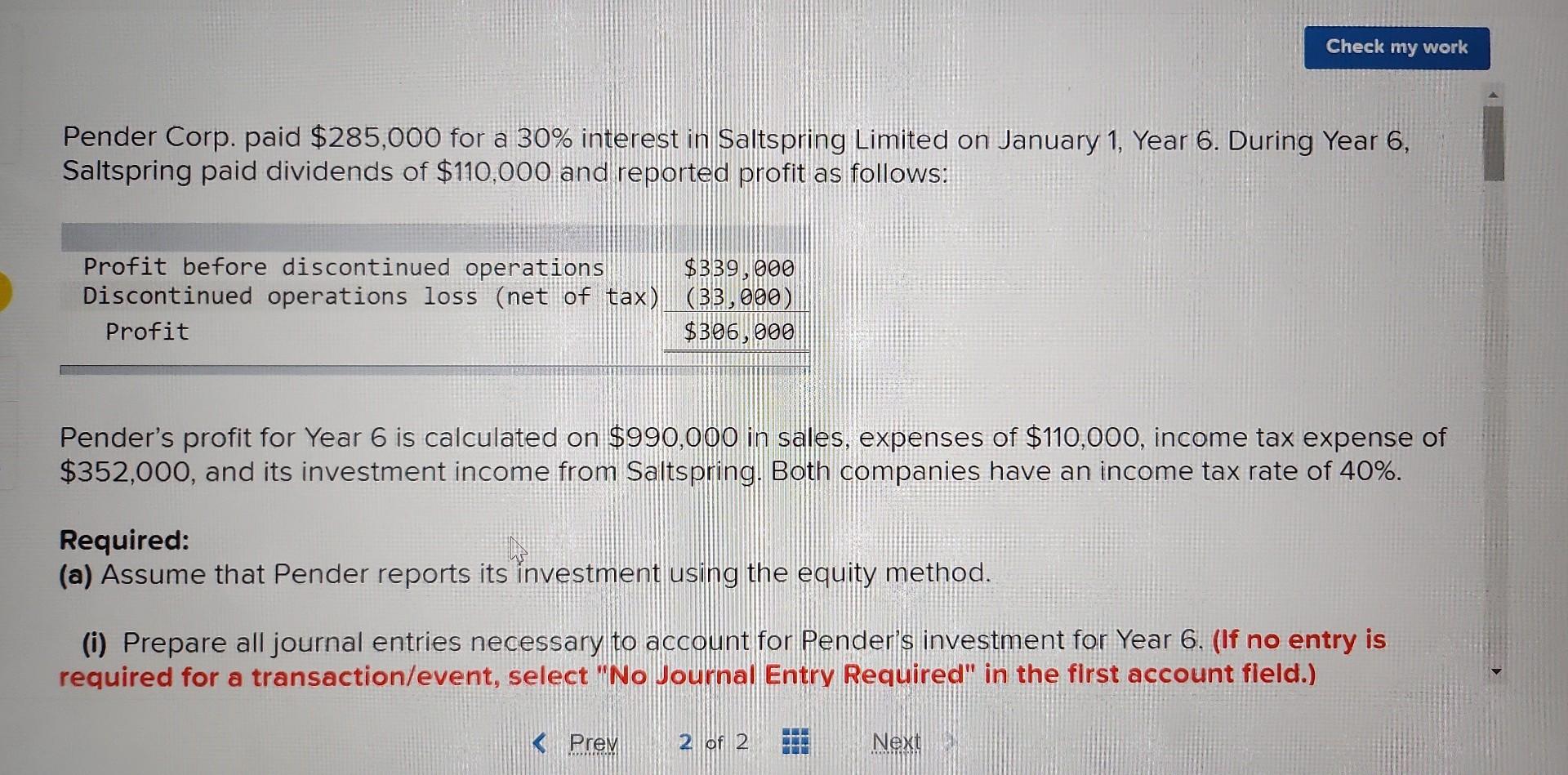

Pender Corp. paid $285,000 for a 30% interest in Saltspring Limited on January 1, Year 6 . During Year 6 , Saltspring paid dividends of

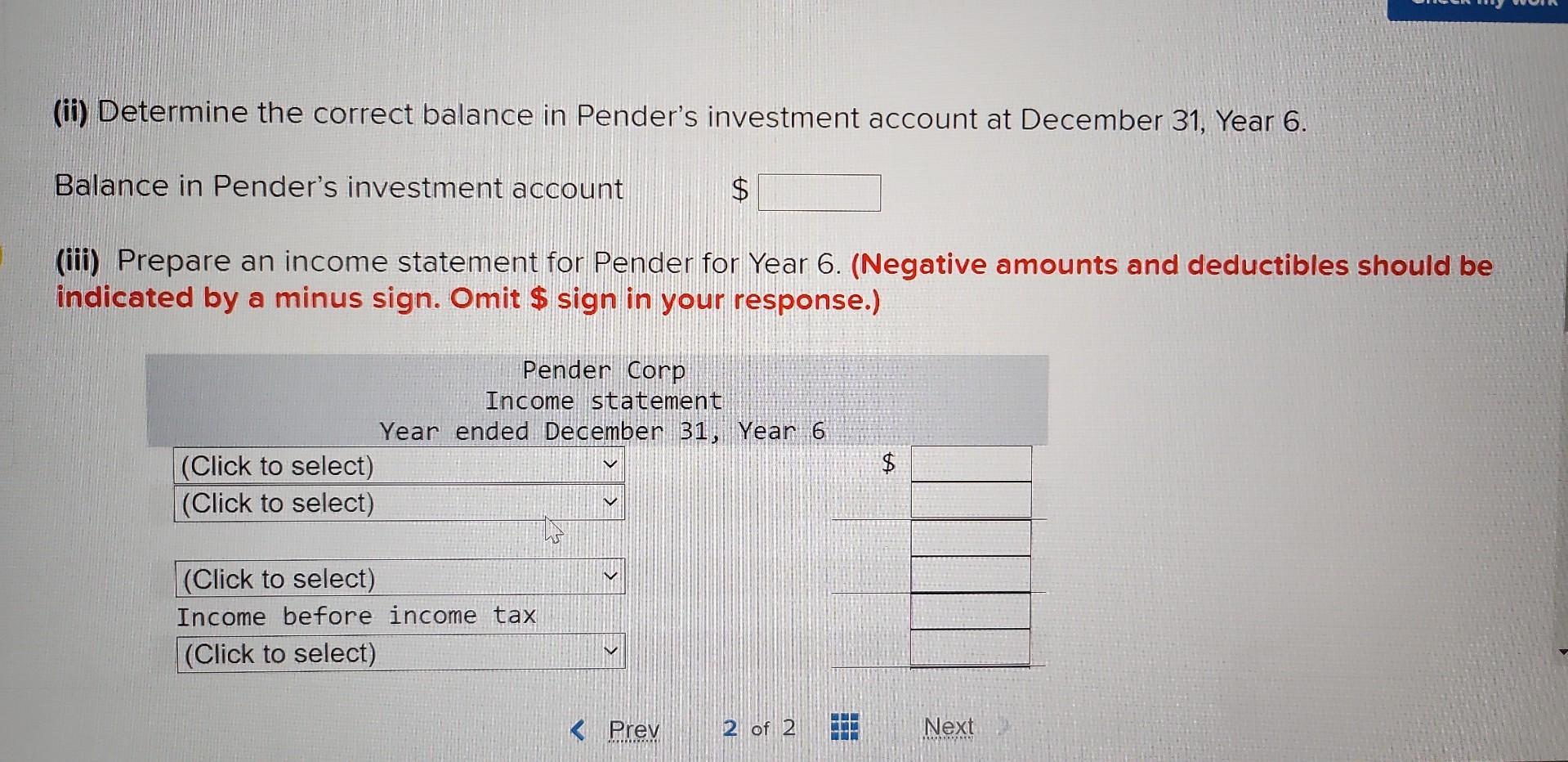

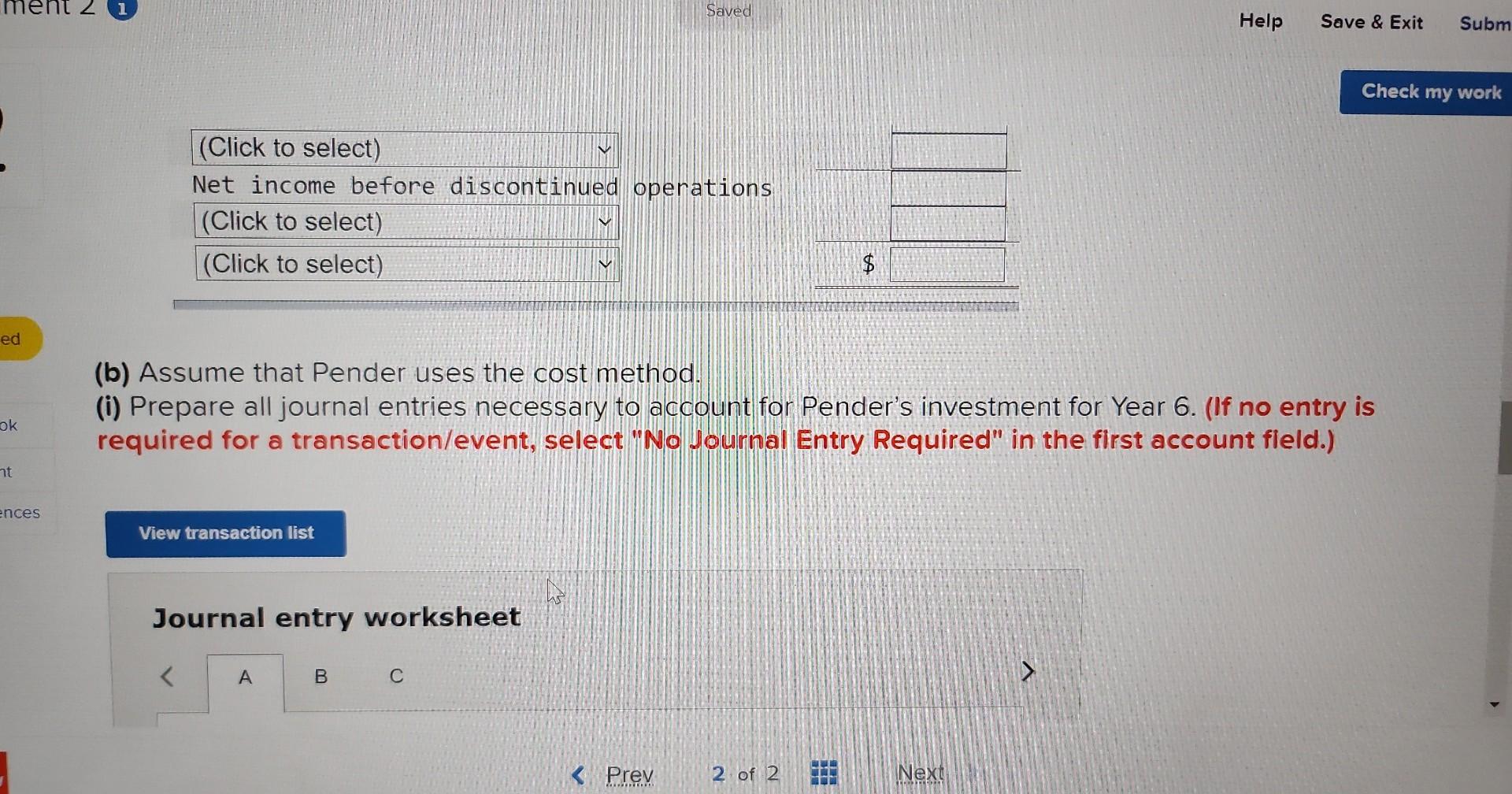

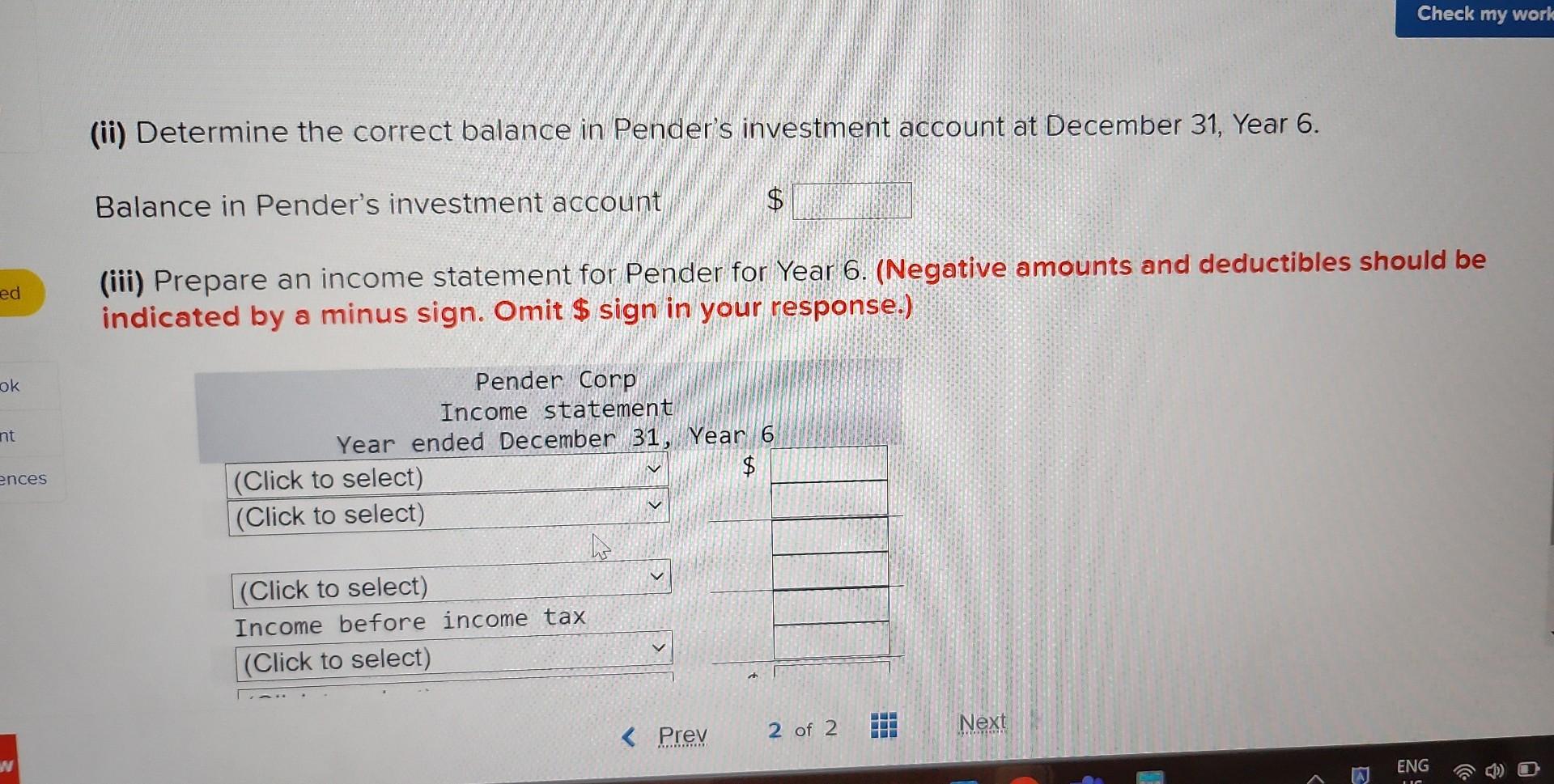

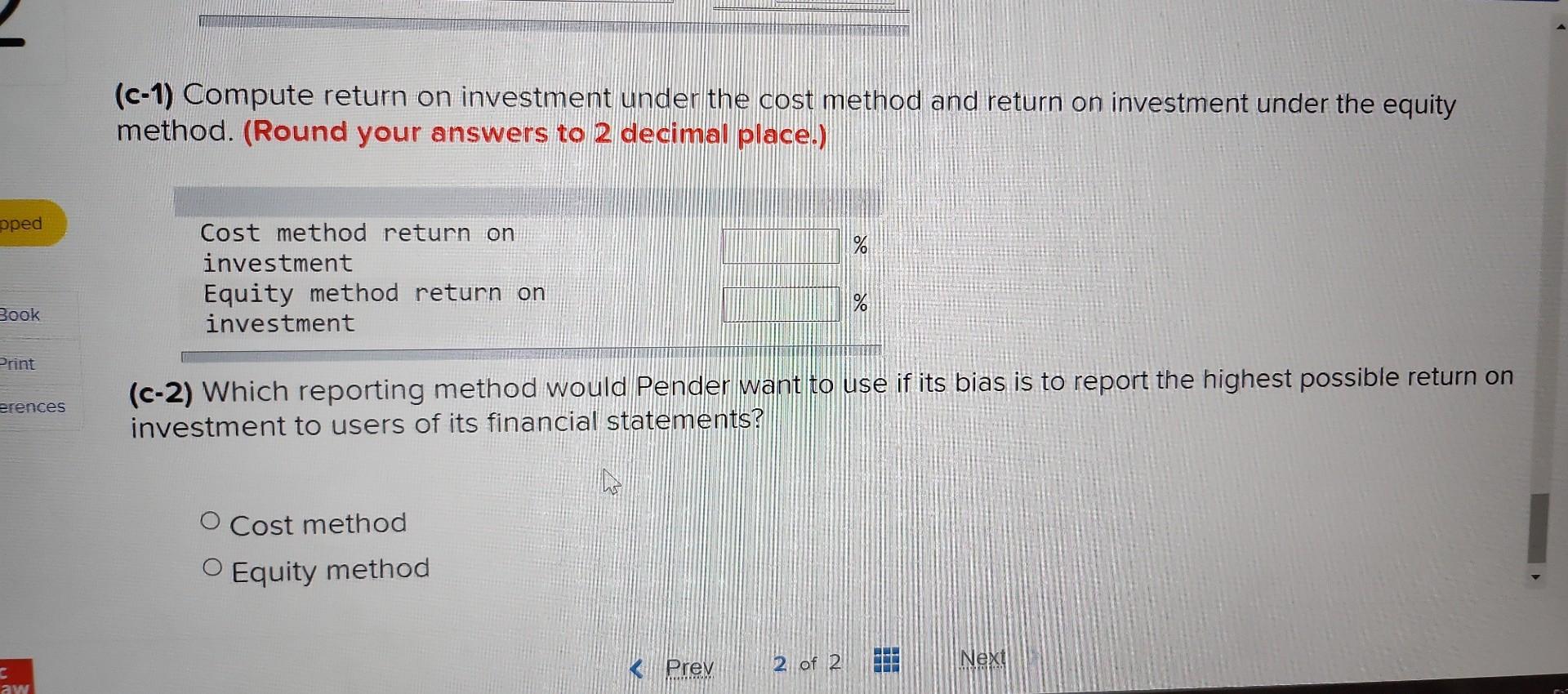

Pender Corp. paid $285,000 for a 30% interest in Saltspring Limited on January 1, Year 6 . During Year 6 , Saltspring paid dividends of $110,000 and reported profit as follows: Pender's profit for Year 6 is calculated on $990,000 in sales, expenses of $110,000, income tax expense of $352,000, and its investment income from Saltspring. Both companies have an income tax rate of 40%. Required: (a) Assume that Pender reports its investment using the equity method. (i) Prepare all journal entries necessary to account for Pender's investment for Year 6 . (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account fleld.) (iii) Prepare an income statement for Pender for Year 6 . (Negative amounts and deductibles should be indicated by a minus sign. Omit $ sign in your response.) (b) Assume that Pender uses the cost method. (i) Prepare all journal entries necessary to account for Pender's investment for Year 6 . (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account fleld.) Journal entry worksheet (ii) Determine the correct balance in Pender's investment account at December 31 , Year 6. Balance in Pender's investment account \$ (iii) Prepare an income statement for Pender for Year 6 . (Negative amounts and deductibles should be indicated by a minus sign. Omit $ sign in your response.) c-1) Compute return on investment under the cost method and return on investment under the equity nethod. (Round your answers to 2 decimal place.) (c-2) Which reporting method would Pender want to use if its bias is to report the highest possible return or investment to users of its financial statements? Cost method Equity method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started