Penguin, Incorporated, has balance sheet equity of $5.8 million. At the same time, the income statement shows net income of $864,200. The company paid

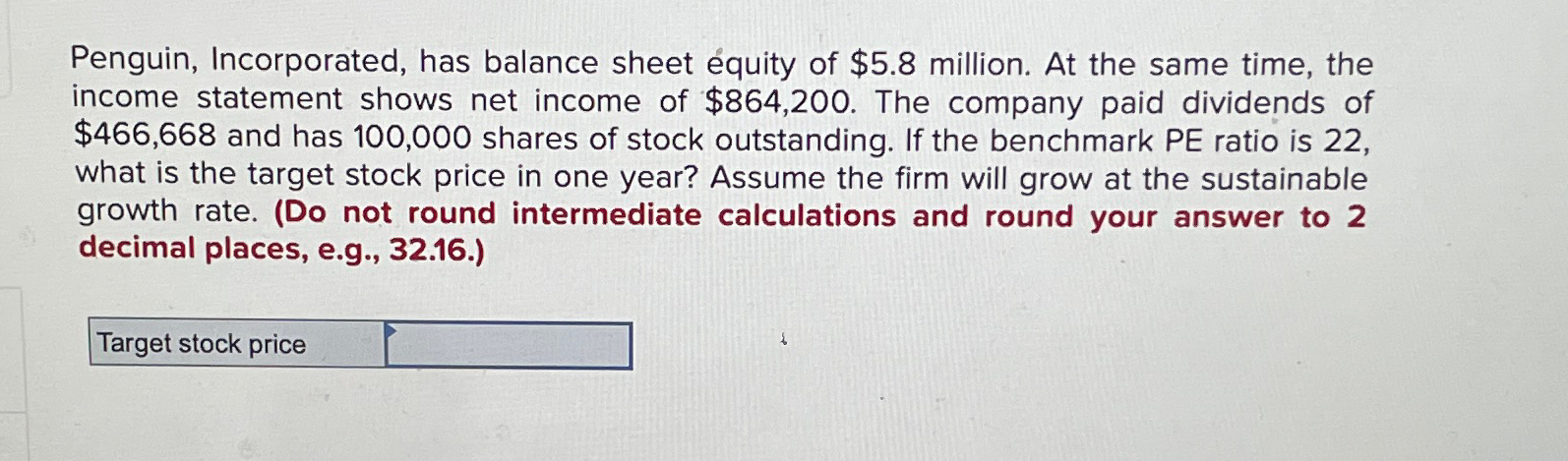

Penguin, Incorporated, has balance sheet equity of $5.8 million. At the same time, the income statement shows net income of $864,200. The company paid dividends of $466,668 and has 100,000 shares of stock outstanding. If the benchmark PE ratio is 22, what is the target stock price in one year? Assume the firm will grow at the sustainable growth rate. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Target stock price

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the target stock price in one year using ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

13th Edition

1265553602, 978-1265553609

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App