Answered step by step

Verified Expert Solution

Question

1 Approved Answer

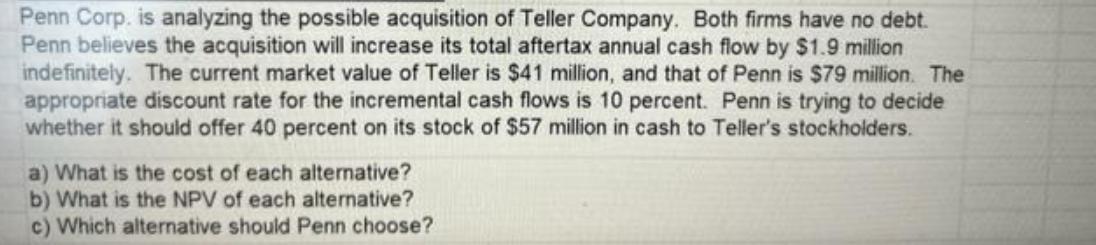

Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total aftertax

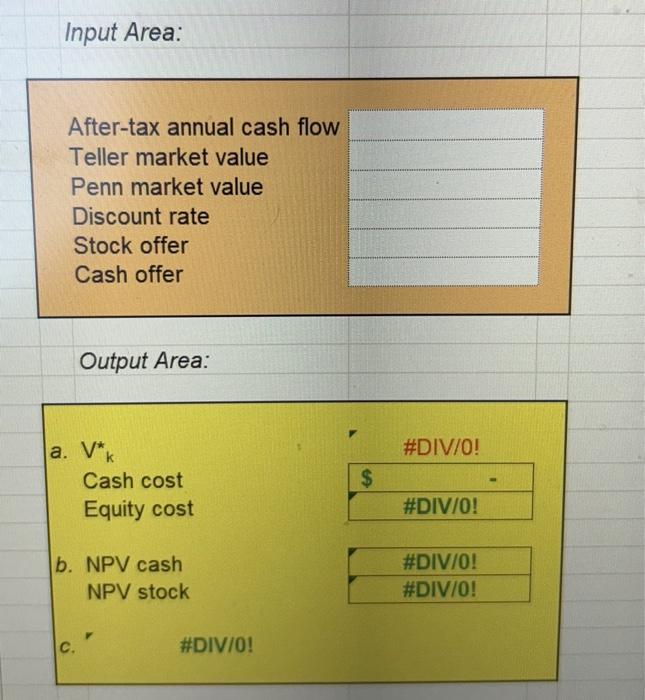

Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total aftertax annual cash flow by $1.9 million indefinitely. The current market value of Teller is $41 million, and that of Penn is $79 million. The appropriate discount rate for the incremental cash flows is 10 percent. Penn is trying to decide whether it should offer 40 percent on its stock of $57 million in cash to Teller's stockholders. a) What is the cost of each alternative? b) What is the NPV of each alternative? c) Which alternative should Penn choose? Input Area: After-tax annual cash flow Teller market value Penn market value Discount rate Stock offer Cash offer Output Area: |a. V*k #DIV/0! Cash cost $ Equity cost #DIV/0! b. NPV cash NPV stock #DIV/0! #DIV/0! C. #DIV/0!

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the cost and NPV of each alternative for Penn Corps possible acquisition of Teller Comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started