Answered step by step

Verified Expert Solution

Question

1 Approved Answer

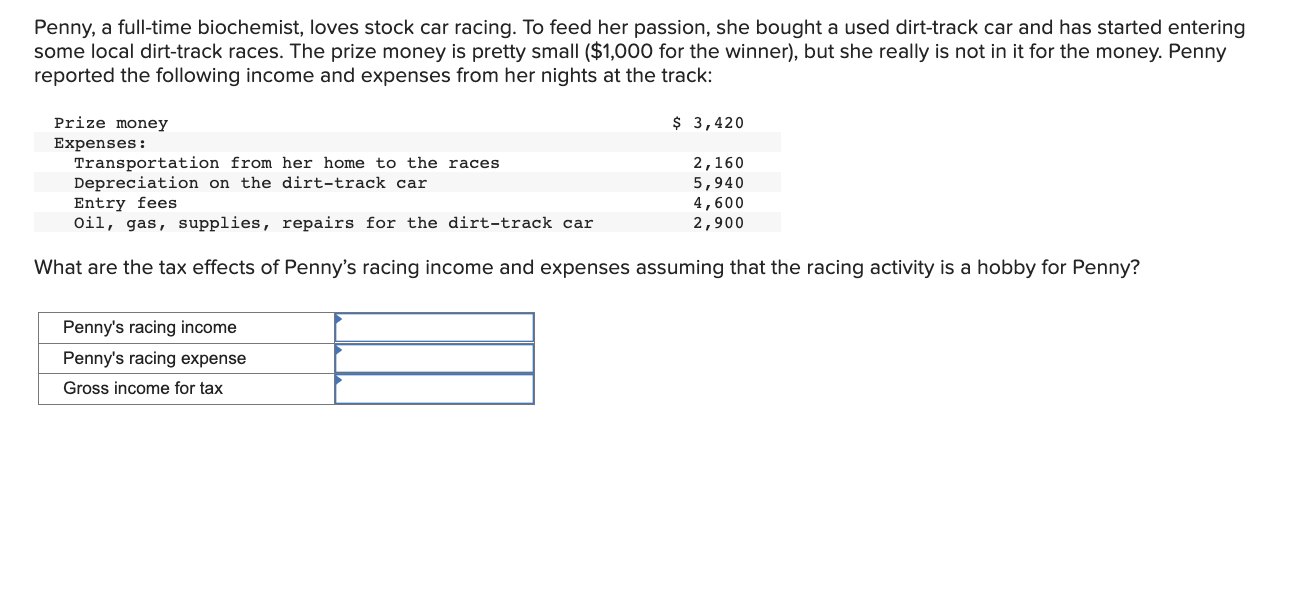

Penny, a full-time biochemist, loves stock car racing. To feed her passion, she bought a used dirt-track car and has started entering some local

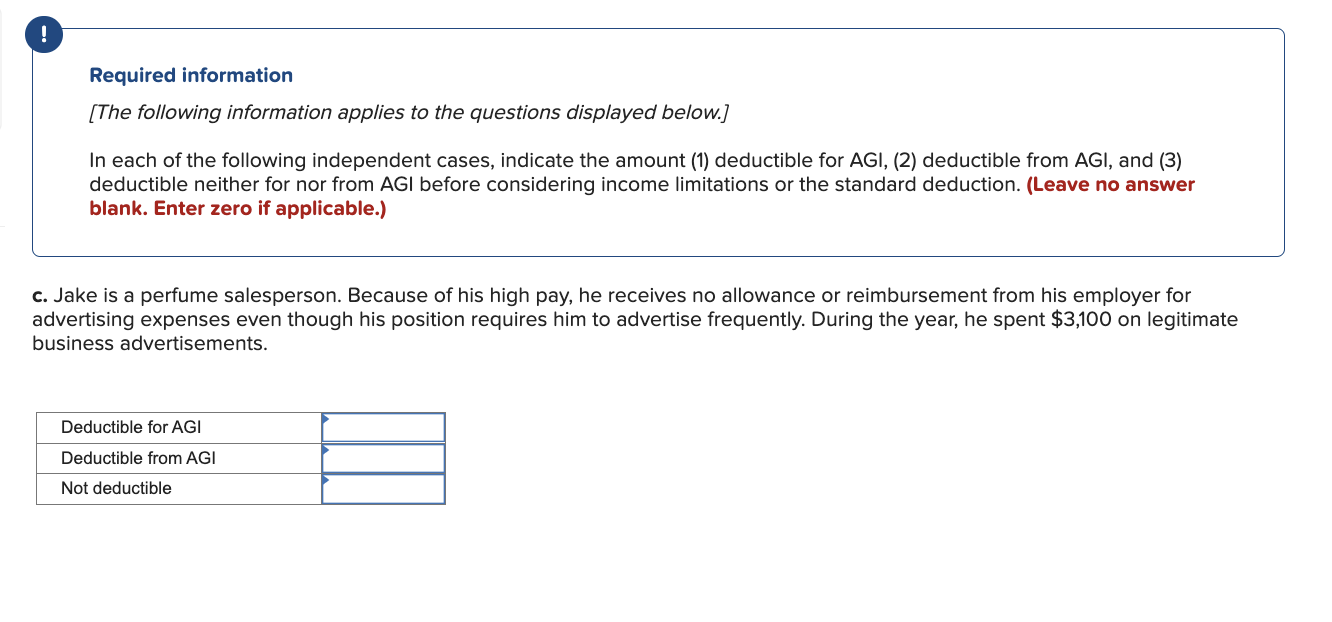

Penny, a full-time biochemist, loves stock car racing. To feed her passion, she bought a used dirt-track car and has started entering some local dirt-track races. The prize money is pretty small ($1,000 for the winner), but she really is not in it for the money. Penny reported the following income and expenses from her nights at the track: Prize money $ 3,420 Expenses: Transportation from her home to the races Depreciation on the dirt-track car 2,160 5,940 4,600 2,900 Entry fees Oil, gas, supplies, repairs for the dirt-track car What are the tax effects of Penny's racing income and expenses assuming that the racing activity is a hobby for Penny? Penny's racing income Penny's racing expense Gross income for tax ! Required information [The following information applies to the questions displayed below.] In each of the following independent cases, indicate the amount (1) deductible for AGI, (2) deductible from AGI, and (3) deductible neither for nor from AGI before considering income limitations or the standard deduction. (Leave no answer blank. Enter zero if applicable.) c. Jake is a perfume salesperson. Because of his high pay, he receives no allowance or reimbursement from his employer for advertising expenses even though his position requires him to advertise frequently. During the year, he spent $3,100 on legitimate business advertisements. Deductible for AGI Deductible from AGI Not deductible

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solution Pennys racing income 3920 Pennys racing expense 7840 Gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started