Answered step by step

Verified Expert Solution

Question

1 Approved Answer

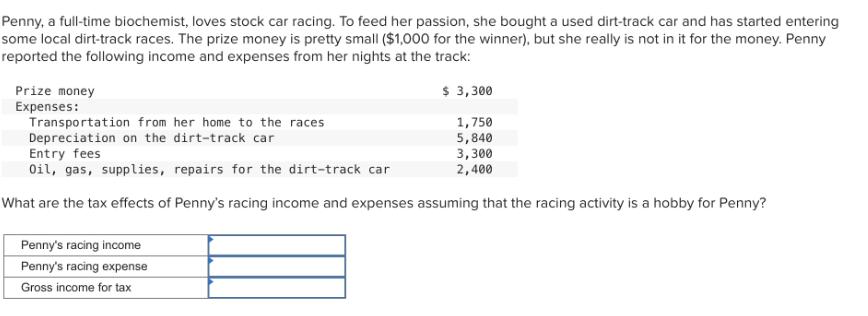

Penny, a full-time biochemist, loves stock car racing. To feed her passion, she bought a used dirt-track car and has started entering some local

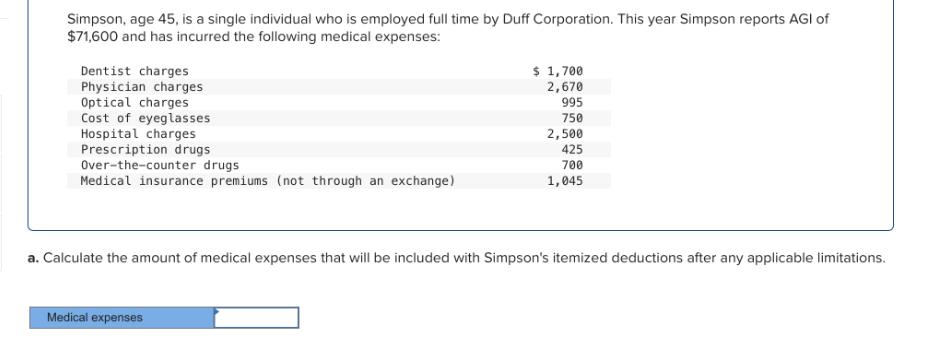

Penny, a full-time biochemist, loves stock car racing. To feed her passion, she bought a used dirt-track car and has started entering some local dirt-track races. The prize money is pretty small ($1,000 for the winner), but she really is not in it for the money. Penny reported the following income and expenses from her nights at the track: $ 3,300 Prize money Expenses: Transportation from her home to the races Depreciation on the dirt-track car 1,750 5,840 3,300 2,400 Entry fees Oil, gas, supplies, repairs for the dirt-track car What are the tax effects of Penny's racing income and expenses assuming that the racing activity is a hobby for Penny? Penny's racing income Penny's racing expense Gross income for tax Simpson, age 45, is a single individual who is employed full time by Duff Corporation. This year Simpson reports AGI of $71,600 and has incurred the following medical expenses: Dentist charges Physician charges Optical charges Cost of eyeglasses Hospital charges Prescription drugs Over-the-counter drugs Medical insurance premiums (not through an exchange) $ 1,700 2,670 995 750 2,500 425 700 1,045 a. Calculate the amount of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations. Medical expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets start with Pennys racing income and expenses Pennys Racing Income Prize Money 3300 Pennys Racin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started