Penny Manufacturing Company acquired 75 percent of Saul Corporation stock at underlying book value. At the date of acquisition, the fair value of the

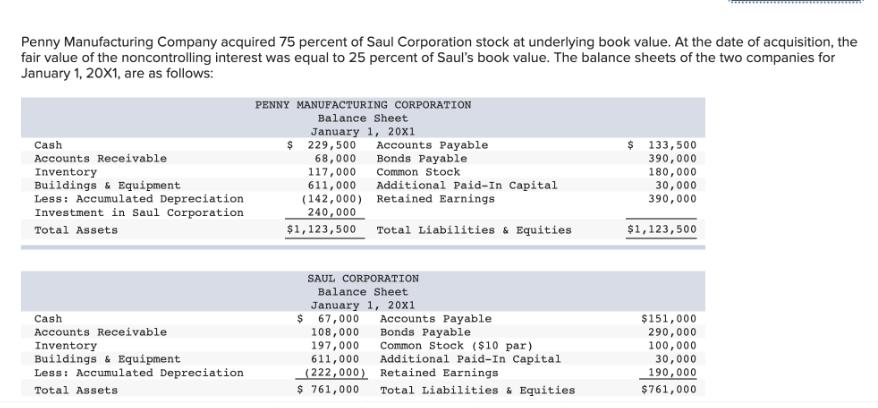

Penny Manufacturing Company acquired 75 percent of Saul Corporation stock at underlying book value. At the date of acquisition, the fair value of the noncontrolling interest was equal to 25 percent of Saul's book value. The balance sheets of the two companies for January 1, 20X1, are as follows: Cash Accounts Receivable Inventory Buildings & Equipment Less: Accumulated Depreciation Investment in Saul Corporation Total Assets Cash Accounts Receivable Inventory Buildings & Equipment Less: Accumulated Depreciation Total Assets PENNY MANUFACTURING CORPORATION Balance Sheet January 1, 20x1 $ 229,500 Accounts Payable Bonds Payable 68,000 Common Stock 117,000 611,000 (142,000) 240,000 $1,123,500 Additional Paid-In Capital Retained Earnings $ 761,000 Total Liabilities & Equities SAUL CORPORATION Balance Sheet January 1, 20x1 $ 67,000 Accounts Payable Bonds Payable 108,000 197,000 611,000 (222,000) Common Stock ($10 par) Additional Paid-In Capital Retained Earnings Total Liabilities & Equities 133,500 390,000 180,000 30,000 390,000 $1,123,500 $ $151,000 290,000 100,000 30,000 190,000 $761,000

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

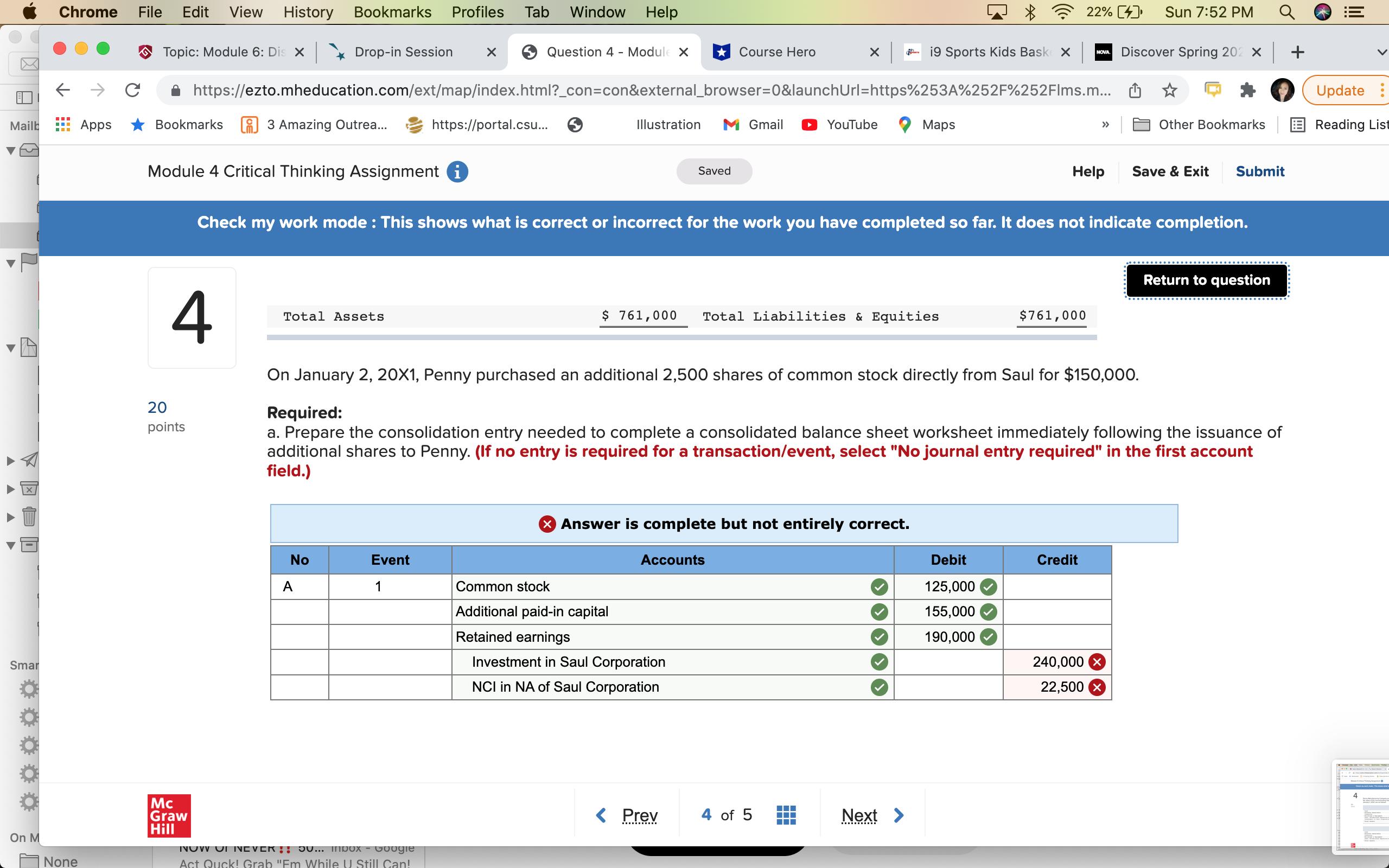

The consolidation entry for the issuance of additional shares would be as follows Debit investment in Saul corporation 150000 Credit cash 150000 To pr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started